The Daily KnowHow is free and we want to keep it that way. If you find our work valuable, please subscribe and share. This is real analysis by real analysts. Enjoy!

In today’s KnowHow…

Can Amazon disrupt the grocery market?

How many units did Tesla actually ship?

Peak inflation expectations?

Qantas pushing out inflation flights

What happened overnight…

Hold on to your hats. At 830am EST today, we’re getting the inflation print. And, there’s nothing in macro land right now that excites the bulls and bears as much as a totally meaningless inflation print riddled with base effects. Oh… yeah we said it! Anyway, ignore the headline number and focus on the Core CPI Ex-Food & Energy. Economists are looking for 2.3%. Have a read of our comment below for some deets. Yesterday’s tech enthusiasm in the US hasn't fed into Europe this morning where resources continue to trade well despite the IEA cutting its oil demand forecast. Lockdown concerns have also re-emerged in both Japan and Taiwan.

Chart of the Day

Yesterday’s US JOLTS report has added to the debate around why job take-up in April was low when job openings are through the roof. Are people just getting paid too much to sit at home or is there a lack of training for the jobs that are needed? The chart below shows the four sectors with the biggest hiring demand and suggests both are contributing factors.

Analysis

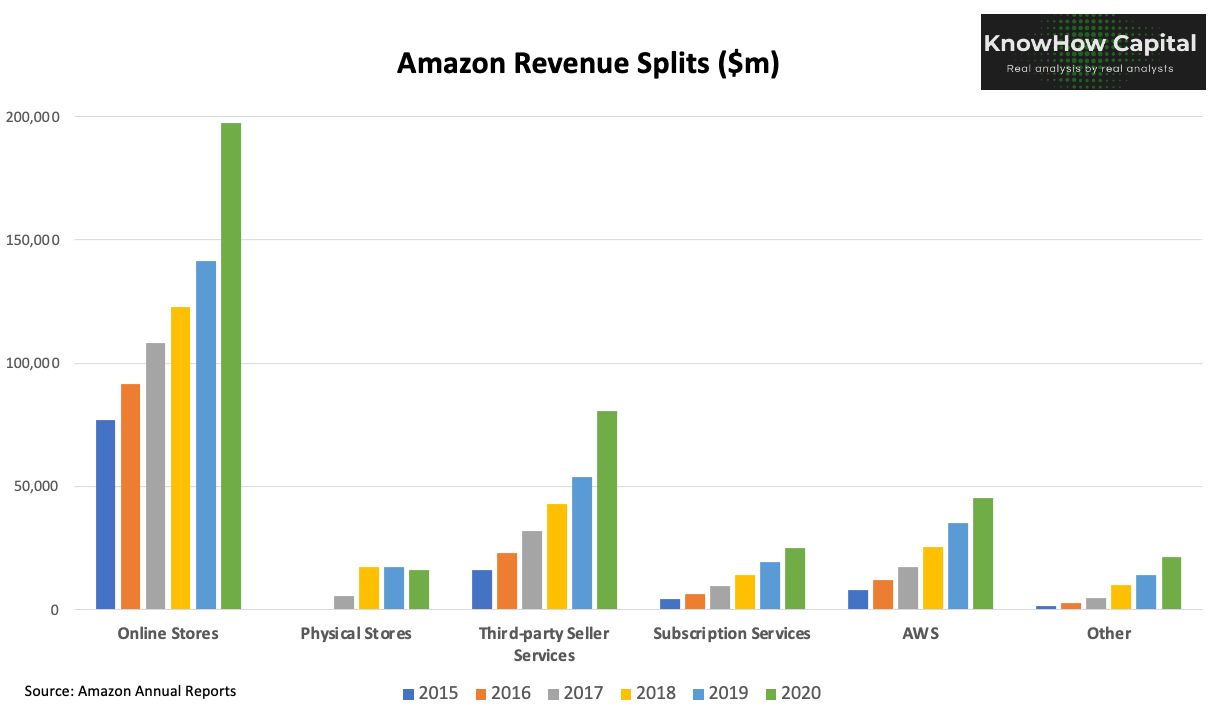

Amazon does it cheaper

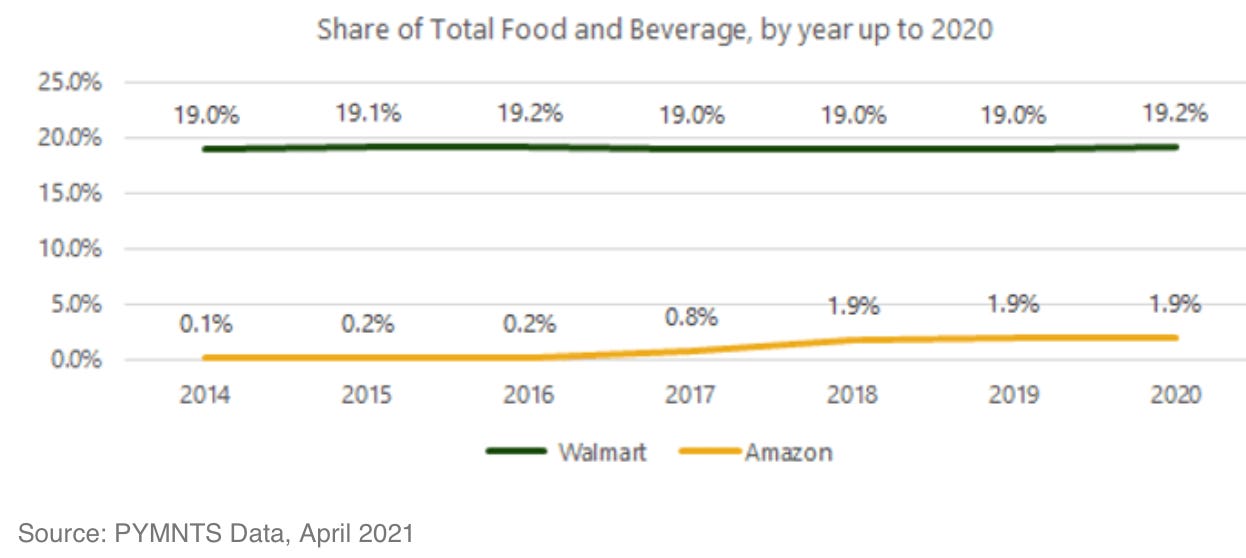

It is no lie that the grocery sector is huge and ripe for disruption after years of technological stagnation. The US grocery market stands at $1.3trn alone, with the global market worth over $12trn. Amazon’s purchase of Whole Foods in 2017 signalled the company was willing to venture into the sector and the recent ramp up in Amazon Fresh and more recently Amazon Go in the UK has signalled that the company is making a real push to disrupt the space. To be clear, there is a long way way to go before this has any sort of impact on its financials (see chart below), but we’re also intrigued by what the potential could be.

Context

The first Amazon Fresh store opened last September in Los Angeles, with a further 10 opening in the US since then. On top of this, the first ‘Amazon Go’ opening in the UK a few weeks ago to compliment the 26 ‘Amazon Go’ stores and the 55 ‘Prime Now’ hubs already in the US. There is potential for 2,000 Go stores in the US and a growth of 20 stores per year in the UK according to the company. The shops are high tech with Alexa helping guide you round the shops. With ‘in store’ cameras to track the shopper, Amazon will use ‘Just Walk out’ technology to track what you’ve picked up while shopping. Your Amazon account is then billed after you leave the store. All very efficient.

Why are they doing this? Well, the aim for Amazon is to be far more than just a grocery store. It is aiming to reinvent the grocery business according to a new set of rules. In this model, Amazon will own the relationship with the customer at the front, “ordering” end of the chain, as well as the back, “delivery” end – and be much more flexible about how things are done in the middle. To contextualise this opportunity, if Amazon can increase their ‘Total Food and Bev’ market share to 10% vs the 1.9% in the below chart, the company could add over $100bn in additional sales just in this sector, not including any further cross-sell opportunities. All of a sudden, that does start to make a dent in Amazon’s overall revenues.

Will this be a success?

The first thing to note is that Amazon has owned Whole Foods for over 3 years, so the company already understands the grocery shopping experience. On top of that, there are a number of reasons why we think Amazon should be able to disrupt the market and potentially take share from direct competitors.

1. Pricing: Through a technology led approach, Amazon should be able to drive efficiencies in both costs (e.g improved inventory planning) and revenues (e.g with customised and suggested lists for shoppers and use of the Amazon Dash Button). This should help lead a similar pricing strategy to the e-commerce side of the business and give the company a competitive advantage from its peers. It is interesting to see that initial pricing comparisons from the Edge by Ascential study suggests this is already the case with Amazon prices at least 6.9% cheaper on average than leading UK supermarkets on branded products.

2. Multi-product sales: This is key for us. Amazon already has a stranglehold on the non-food retail space and it is interesting to see that many Amazon Fresh customers already add one or two high-margin non-food items to their baskets. This may not sound like much, but it can transform the economics of the order from loss-making to breakeven or even profit-making – giving Amazon a huge advantage over other retailers without this capability.

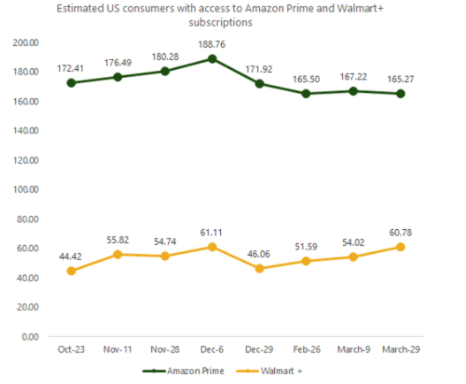

3. Subscription Opportunity: It is no secret that a subscription-based model can help drive revenues higher and the chart below highlights the huge opportunity Amazon has to drive cross-selling from their e-commerce business to the grocery business as the company continues to grow stores.

Conclusion: There is a long way to go for Amazon but they have the technology and ‘KnowHow’ to disrupt the grocery space and take share from the likes of Walmart in the US and Waitrose, Tesco and Sainsbury’s in the UK. It must be noted though (and we have spoken about this a number of times) Walmart and Amazon face other threats in grocery themselves. The like of Instacart, DoorDash and other emerging operators in the booming rapid delivery app sector, which has attracted more than $14bn in venture capital over the past year. But, the runway is long for this 8-headed monster.

What we’re reading

How many units did Tesla actually ship?

For a business where the bulk of the value lies well into the future, the market has a bizarre obsession with monthly deliveries at Tesla. Well, that’s what a hedge fund and retail investor driven market will give you I guess. Still, given Tesla aims to have 40% of its sales coming from China in 2022, sales their matter for the equity story.

So here’s the drama. The China Passenger Car Association published data that appeared to show Tesla local sales of 25,845. On top of that, 14,174 units were exported. If you step back and think about it, that’s a big number from a plant that produces 500uts/yr and had one line shut down for two weeks. Some further digging from a few eagle-eyed reporters and analysts has then led to the conclusion that it was actually 25,845 units produced and 14,174 of those exported. Remember, these are all estimates but our reading suggests that is the more accurate conclusion and gets you to a run-rate as below.

Now, that’s a chart that is more likely to feed Tesla bears. In reality, add back the two week plant line shut down and you’re at the Jan-Feb run rate with a typical late quarter surge in volumes. So, it’s fine. But, this is coming at a time when reports are suggesting Tesla is no longer looking for additional production capacity in Shanghai and Chinese authorities are kicking off about sensitivity of camera data being collected by Tesla cars. That’s the real story in our view.

Peak inflation expectations?

It’s inflation day today. Exciting. We’ll get the US April CPI print at 830am EST and as you can see below, economists are expecting to see a 3.6% CPI number YoY. That would be the biggest headline print since 2011. Yikes, so much for that Fed 2% target hey!?

But, important to realise a few things:

This is base effects. The very fact that inflation was so weak during the pandemic will mean the headline looks so much bigger now. In periods like this, we always prefer to look at 2yr averages. The headline data will likely peak in Q2.

The headline CPI will create a storm. But focus on the ex-Food & Energy number where economists are looking for 2.3% YoY. The Fed will view Food & Energy as largely temporary

the headline is less important than the drivers of the data. We’ve been digging into the France report this morning. Have a look at the table below. Clearly inflation exists in energy and other commodities… we see it on the screens every day. But, high commodity prices also drive a quick supply response. But, what matters is how much of that is feeding into the items you and I purchase every day… clothing, food, manufacturing, services. There are pockets of inflation but nothing alarming.

Qantas pushing out International flights

The Australian national flag carrier is pushing out the start of its International flights from end-October to December after the government suggested it would not reach full vaccination until at least the end of the year. We’ve been of the view for some time that expectations for a recovery in anything other than domestic travel will prove disappointing. There are far too many hurdles to over come: i) vaccination supply still remains an obvious constraint, ii) testing costs are still high and airport hold-ups will create friction. And, iii) the real elephant in the room is how new variants start to impact already vaccinated countries. Neither Japan nor Taiwan have a high vaccination rate, but new variants are accelerating cases in those countries already. Get yourself a motorhome and enjoy the summer…