The Daily KnowHow is free and we want to keep it that way. If you find our work valuable, please subscribe and share. This is real analysis by real analysts. Enjoy!

In today’s KnowHow…

Assessing earnings momentum

China once again expands its crackdown

Pipeline hack hits day 3 with suppliers growing increasingly nervous

Saturday Night Dive…

What happened overnight…

After a busy April and early part of May, this morning feels a little like we are settling down for the summer. Markets pretty muted but again commodities continuing to push higher. Note, iron ore is up almost 10% overnight in China and other metals are following. Indices otherwise broadly flat as the market looks for direction. We’ll need to see progress on the US infrastructure bill and clearer macro data before we can kick on again realistically. A lot of the press is focusing on what the bond market is telling us vs equities, particularly the bubble in junk bonds. We’ll spend a bit more time on this during the week.

Chart of the Day

This is a chart from Morning Consult and given some of the back and forth around Friday’s jobs data, we think it’s worth looking at. Much of what we have read has dismissed the weak jobs report on the basis that we have a cashed-up consumer willing to wait for work. That makes sense. But the Morning Consult team point out that in their view there is still friction in the jobs market that deteriorated in April. That would suggest the recovery lost steam in April.

Analysis

Assessing earnings momentum

We’ve still got some more earnings to deal with this week but given more than 80% of the US market has now reported, we figured it was worth a little refresh of our earnings momentum charts.

Earnings momentum is the best performing style factor

Stepping back a second… in case you have been sitting back in your cabana, sipping away at your martinis and trying to avoid the noise that is the stock market, it is worth remembering that earnings momentum/surprises have been the no.1 performing investing factor in the past 10 years.

Why? Because in a world where central banks are piling in the liquidity and valuations are expensive across the board, performance is driven predominantly by companies that can keep upgrading earnings and surprising the market. If you think about it, it makes total sense. So, these charts matter.

Let’s get into them.

Earnings recovery is broad

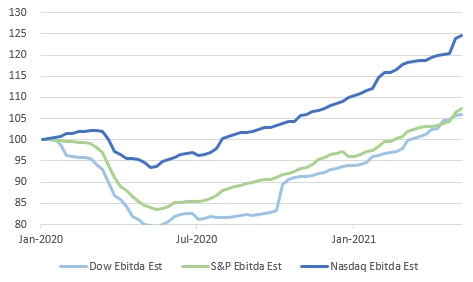

First off, it’s useful to understand the bigger picture trend… where we came from vs where we are today. Below are the Ebitda estimates for the three major indices on a 12mth forward basis indexed to Jan-20 i.e. this is what sell-side analysts are expecting these indices to achieve in 12 mths time. The simple conclusion is that we continue to see positive earnings trajectory across all three indices.

Momentum through Q1 more varied

But, the market cares more about momentum than the actual level… this is where it gets interesting. If you look at the 2021 period in the below chart, you’ll see that Nasdaq revisions have been slowing down through this earnings period whilst the Dow, our proxy for cyclicals, has maintained decent momentum. That changed in the past couple of weeks for the Nasdaq.

In theory, that should suggest earnings momentum is shifting back towards tech and growthier stocks. Not quite. Whilst the cyclicals momentum has been fairly broad through this period, in the Nasdaq, it has been driven predominantly by Big Tech. To some extent, it has been the cyclical element of those businesses, advertising for Facebook and Google, that has driven earnings upgrades. Exclude Big Tech from the growth stocks and it looks like earnings momentum has stalled through Q1.

What we’re reading

China once again expands its crackdown to online tutoring…

We have spoken a number of times in recent weeks about the significant step-up in Chinese regulation that kicked off properly with the regulator focussing on Alibaba’s, now delayed IPO of Ant Group last November. News overnight once again hit the tapes that the Chinese regulator was expanding its far-reaching tech campaign into online education, issuing the maximum penalties to two of the country’s fastest-growing tutoring apps for violating competition and pricing laws.

The State Administration for Market Regulation imposed fines of 2.5 million yuan ($389,000) each on Yuanfudao, backed by Tencent Holdings Ltd., and Zuoyebang, which has received funding from Alibaba Group Holding Ltd., according to a statement Monday. The firms were penalized for making misleading claims about their businesses from falsifying the qualifications of teaching staff to faking user reviews, the antitrust watchdog said.

Pipeline hack hits day 3 with suppliers growing increasingly nervous…

Fuel suppliers are growing increasingly nervous about the possibility of gasoline and diesel shortages across the eastern U.S. almost two days after a cyberattack knocked out the US’s largest pipeline that is a critical source of supply for New York. With the timing far from perfect (summer travel demand and a return of commuting), US gasoline prices have shot up to above $3 a gallon for the first time since October 2014 before pulling back to just below $3.

Daily National Average Gasoline Prices Regular Unleaded

With gasoline inventories ample, the pump price wasn’t expected to tick much higher until Memorial Day at the end of May, which is traditionally viewed as the start of the U.S. summer driving season. If the pipeline doesn’t restart soon it will accelerate the move higher. Our take is that this is most likely a disruption that gets sorted in a few days.

Saturday Night Dive…

I think it is fair to say that expectations were pretty high going into Musk’s SNL appearance with the meme currency, Dogecoin, up a cool 111 per cent last week on expectations meme lord Musk would pump it on television, perhaps bringing a fresh wave of dumbfounded speculators to juice the price further. But, in perhaps the clearest expression of “buy the rumour, sell the news” we’ve ever seen in financial markets, Dogecoin crashed over a third during the show. At pixel time, it’s down 27 per cent from its Saturday highs, to $0.52 (though over the past seven days it’s still up almost 32 per cent).

As to why the appearance precipitated the fall, well despite a rather painful sketch where Musk was referred to as the “Dogefather” (yes, really) he did somewhat let the cat (doge?) out the bag when he referred to the joke coin at the end of the piece as a “hustle”. For those of you a little confused, hopefully this video of their sketch explains it a little better…