The Daily KnowHow is free and we want to keep it that way. If you find our work valuable, please subscribe and share. This is real analysis by real analysts. Enjoy!

In today’s KnowHow…

Bitcoin, Ark and Gamestop

Apple & autos… will they or won’t they?

Iron Ore hit once again…

Star technology investor James Anderson takes parting shot at his rivals

Secretive Hedge Fund Ends Long Silence to Take On Japan Icon

What happened overnight…

After a mixed session on Friday, global indices are in the green as we start the week. Both Nasdaq and S&P futures are positive as investors maintained their confidence that the Fed will keep the taps running. Over in Europe and volumes are pretty light as Germany, Denmark, Norway and Switzerland are all shut. In Asia, China once again cracked down on commodities speculation (more below) with steel and iron ore prices both tumbling off the back of this. Finally, the dollar and treasuries remained steady in early Monday trading.

Chart of the Day

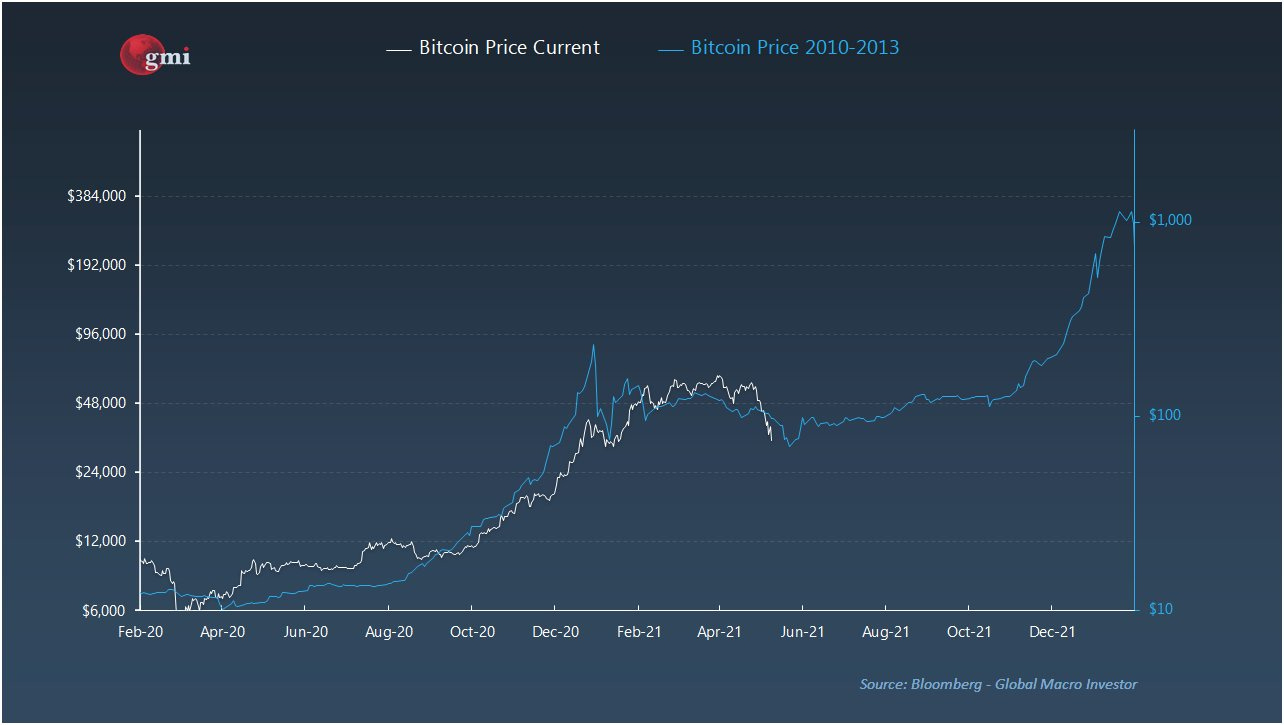

Courtesy of Global Macro Investor. There have been a few of these going around over the past week… looking at the recent correction in parallel with the previous bull run in Bitcoin. Likewise, looking at recent price vs stock-to-flow models. Bitcoin bears will of course be skeptical but they make for interesting analysis and thought nonetheless.

Analysis

Bitcoin, Ark and Gamestop

We have already written a lot on the potential retail unwind as it continues to play out across markets. But, the gist is basically this… even if you take the view that retail participation in markets will be structurally higher than pre-pandemic, there are still a large number of people that are unlikely to be able to commit the same amount of time and funds to investing/trading post re-opening. That unwind is 100% healthy for markets but also brings volatility. Our list of stocks most exposed is here.

We did some correlation work last week looking at growth stocks. A little more today but this time looking at the bloodbath that is crypto at the moment. The big three retail trades over the past 18 months have been: crypto, growth stocks and meme stocks. These have all been avenues for retail investors to chase volatile but rapid returns.

Below is the a chart of Google Search trends across the three. For most of last year, they co-existed as part of the same trade. This year, as stocks have been weaker, that has changed.

If you then look at the correlation of Bitcoin vs growth, we’ve used Ark Innovation ETF in the below chart as a proxy, you see that much of that strong relationship over the past year has started to ease. In fact, despite this weekend’s cryptoland volatility, Nasdaq futures are indicated up.

Some will say, including us, that Gamestop and other meme stocks continue to trade at excessive levels. But again, looking at the daily option volume, a fair chunk has unwound.

Through much of last week’s crypto sell-off, smaller exchanges were pointing out that they continued to see a leverage unwind which was largely done late in the week. This weekend’s activity would suggest that’s far from being the case.

What we’re reading

Apple & autos… will they or won’t they?

You don’t have to be a detective to work out that Apple have been exploring autos for a number of years now. In recent months, Tim Cook has even been more willing to discuss it. Over the years, it would appear that they have had at least three cycles of recruiting heavily in autos before disbanding the entire team or project. An article in the WSJ this weekend explores where Apple could fit into the autos supply chain. The interesting thing about the electrification of cars is that the Tesla process has effectively shifted the complexity from mechanics to hardware/software. And that is a skillset that Apple has in abundance. Would they therefore accept a role solely as a software or chip supplier in an industry with a massive addressable market? They have never done it in the past and we would be skeptical that they will in the future.

Iron Ore hit once again…

We touched on this last week and once again the price of steelmaking ingredient iron ore fell sharply after China signalled it would focus on efforts to cool soaring prices, warning of “excessive speculation” as concerns grow over rising inflation. The National Development and Reform Commission, China’s economic planning agency, said on Monday it would crack down on monopolies in commodities markets, the spread of false information and hoarding. That message rippled through markets on Monday, with the main futures contract for iron ore dropping 7 per cent on China’s Dalian exchange to Rmb1,049 ($163) a tonne. It has fallen almost 20 per cent since hitting a record high earlier this month. The aluminium futures contract for July delivery dropped 3 per cent on the Shanghai exchange. The Chinese government’s statement reflects its mounting concerns over soaring commodity prices, which have been turbocharged by the country’s industrial recovery from the pandemic. The prospect of a global economic rebound has added more fuel to the rally in prices.

Star technology investor James Anderson takes parting shot at his rivals

It was published a month or so ago but if you haven’t read this report then it is well worth reading. Page 13 is the managers review with James Anderson, his last before leaving the investment trust. Anderson said that his biggest regret was that he had not been radical enough in taking giant bets on companies that he hoped would be tomorrow’s worldbeaters. He also said that his secret was to listen to scientists and other experts, in contrast to other investors who “listen to brokers and the media, besotted as it is by fear-mongering and the many short-sellers.” He has been dismissive of the short-termism of most conventional fund managers. In today’s statement he returned to the attack, saying: “Distraction through seeking minor opportunities in banal companies over short periods is the perennial temptation.” Another new theme is the increased tilting of the portfolio to China, in spite of its cooling relationship with the West. “We added to most of our Chinese positions through the course of the year as well as taking new holdings when we have seen new breakthrough companies emerging,” Tom Slater, co-manager of the trust, said.

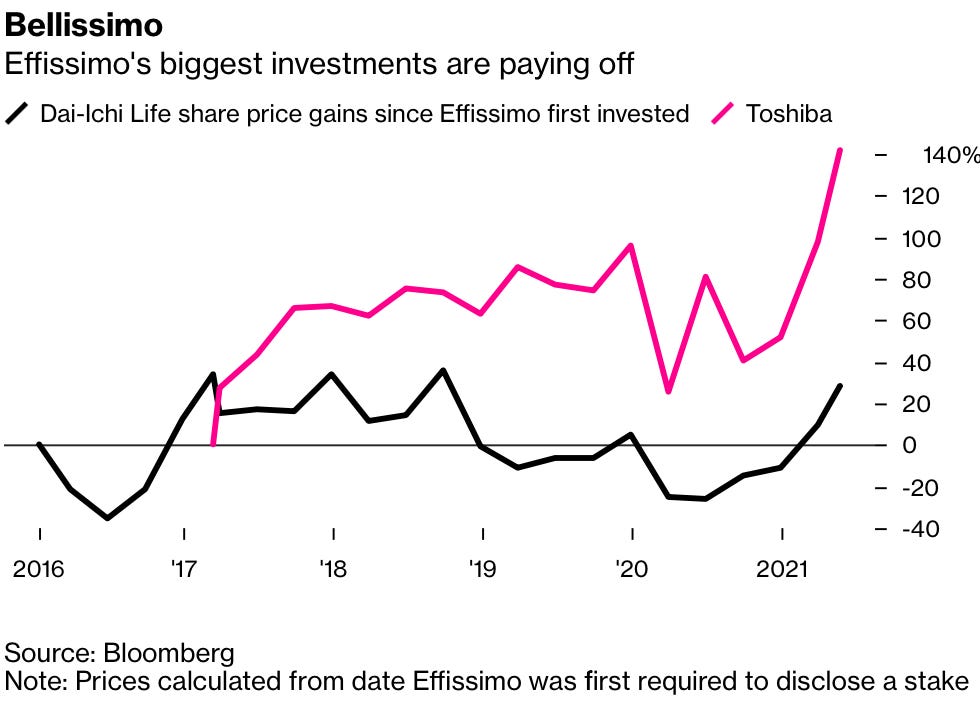

Secretive Hedge Fund Ends Long Silence to Take On Japan Icon

It was the rarest of public appearances. At Toshiba Corp.’s extraordinary general meeting in March, a lawyer, who didn’t give his name, talked for four minutes about why shareholders’ rights should never be infringed. He was speaking on behalf of Effissimo Capital Management Pte, a secretive hedge fund that had avoided the spotlight for almost 15 years. Now it was coming out into the open, if only slightly, to spearhead a campaign to bring change at the conglomerate and by extension corporate Japan. It preceded the resignation of Toshiba’s chief executive officer, turned the iconic manufacturer into a takeover target and caused a surge in the value of Effissimo’s $1.9 billion stake.