If you find our work valuable, please like, subscribe and share. We rely on that to grow our subscriber base. This is real analysis by real analysts. Enjoy!

In today’s KnowHow…

Calling the top in equities…

Don’t be fooled by corporate losses

Is it time to revisit some of the events names?

More Evidence of How Frothy SPACs Can Be

What happened overnight…

Uncle Joe turned up the heat on China overnight, unveiling plans to amend a US ban on investments in companies linked to the Chinese military, which may expand scrutiny to a wider set of enterprises. As a result, equities have drifted lower of the back of this with the Stoxx 600 slipping for the first time in three days, driven by miners and real estate firms. Treasuries treaded water around 1.6% while the dollar rose slightly. Outside this, Philly Fed President Patrick Harker said that it may be soon to think about tapering bond-buying but when the time comes to pare asset-buying, it will be done ‘carefully and methodically’ as the economy strengthens. Two other things of note for us. Firstly, Larry Fink, Blackrock CEO, said yesterday that investors may be underestimating the potential for a spike in inflation. Secondly, the retail frenzy continues with AMC leading the way as Reddit’s retail frenzy reaches new highs…

Chart of the Day

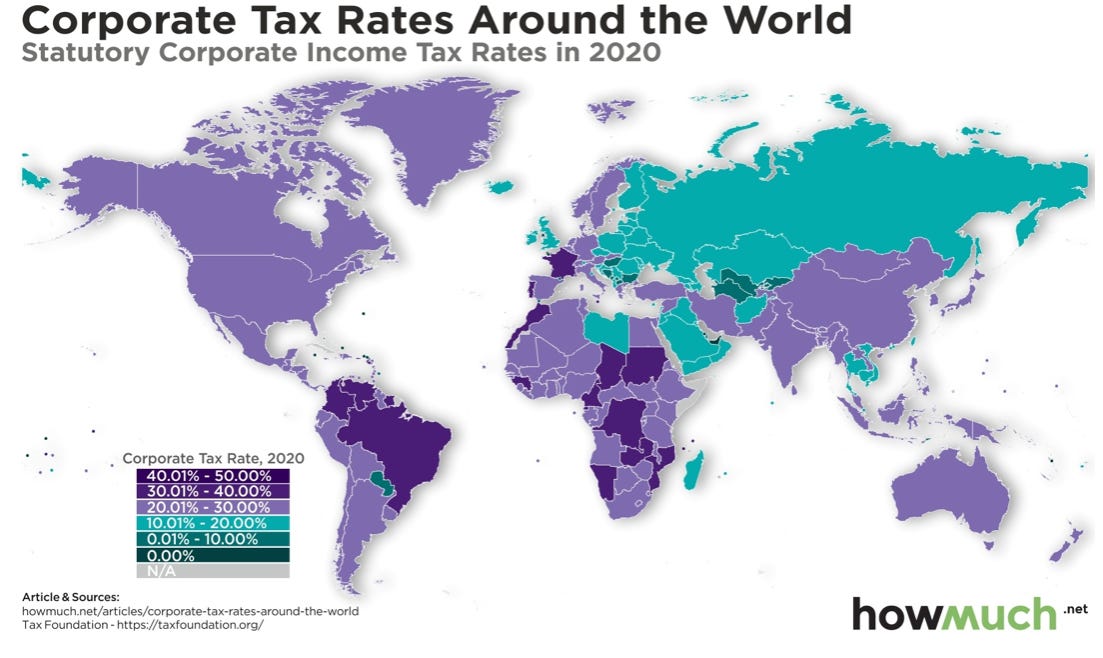

The UK, Austria, India, Italy, Spain and Turkey are coming in for a bit of strife from the US over their digital tax plans. Tax is all the rage ahead of next week’s G7 summit in the UK but also following the US’ recent proposals to the OECD. Well, here’s a bit of context for you.

Equity Market Indicators: May 21

Our Equity Market Indicators publication is a monthly chart-book aiming to capture the key data points we believe are impacting the broader market sentiment. We use the below framework to identify data points. It is available for paid subscribers now. Click below to subscribe.

Analysis

Calling the top in equities…

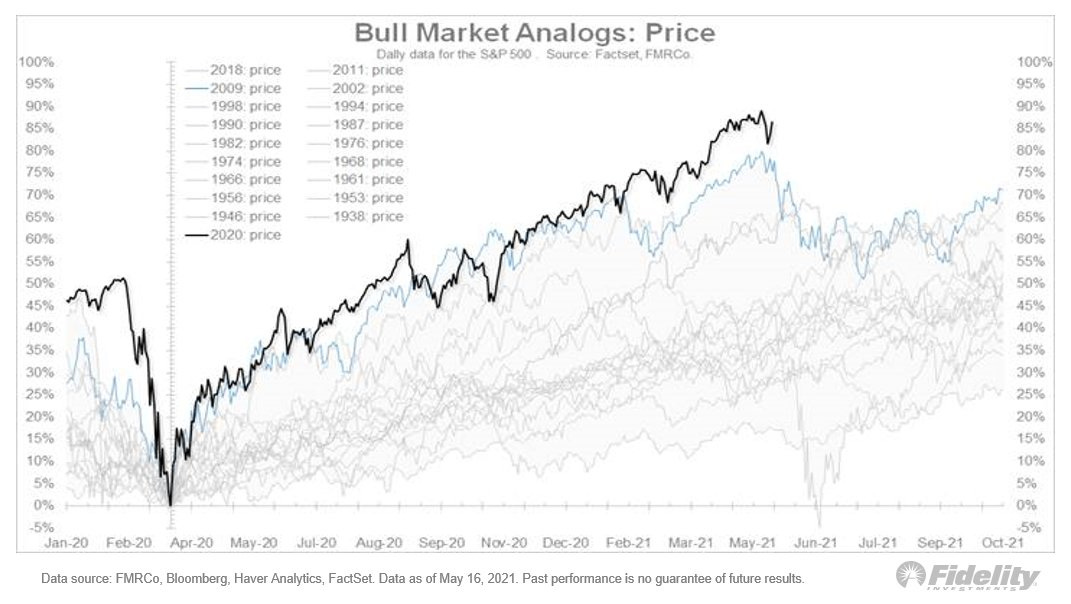

In our Equity Market Indicators report from yesterday we discussed that whilst we remained positive in equities, we were mindful that we were entering the next phase of the rally. Equity market recoveries post-crisis typically follow a very consistent pattern. Below is a chart from the excellent Jurrien Timmer, Fidelity’s Head of Global Macro, that puts the current crisis in context versus previous corrections going back to 1938. It suggests a very similar pattern to what we saw in 2009.

If you breakdown what is happening under the bonnet, there are effectively a few phases of any recovery:

Phase 1 (Apr-Jul 2020): Phase 1 is driven largely by valuation discrepancies in quality growth businesses with good visibility despite the crisis.

Phase 2 (Jul to present): Phase 2 of the recovery sees greater market breadth with investors now anticipating an earnings recovery driven by an improving economic backdrop.

Typically, when economic leading indicators start to peak, particularly manufacturing indicators, we reach a consolidation phase or Phase 3 a couple of months later. As you’ll see from the chart below, this is particularly evident in value or cyclical stocks.

Essentially, the market has to juggle the fact that valuation multiples have already normalised and earnings momentum is now slowing. Plus, from a macro perspective some of the accommodative policy measures should start to be removed. That has repercussions for positioning and areas of the market that have attracted excess liquidity… watch out the memers!

Typically in that phase, value stocks will underperform (spread vs growth stocks below) but tightening of macro policy will also inevitably have an impact on longer duration growth names. Hence, phase 3 ends up with the market struggling to gain momentum and a short-term equity market top. We are not far from that point.

What we’re reading

Don’t be fooled by corporate losses

If you have a spare 20 minutes then we would thoroughly recommend reading this paper from Baruch Lev, Feng Gu and Chenqi Zhu names “All Losses Aren’t Alike”. It is not a new approach but what they have attempted to do is analyse all loss-reporting US companies in the past 25 years, adding back to their earnings (losses) the intangible investments they expensed minus amortisation. The assumption here is that as intangibles are investments, expected to generate future benefits, they should not be treated as regular investments that reduce earnings and often make companies loss making. Take for example Pfizer’s $9.4bn R&D in 2020, this is recorded the same as salaries and commissions. The team undid accountants’ folly by capitalising and amortising the R&D, IT and brand enhancement. The result: a full 40 per cent of loss reporters would have been profitable without the expensing of intangibles. These are termed “accounting losers”, in contrast with “real losers”. They go into more detail in the paper but there were also side benefits for the “accounting losers” such as their employees being more productive and turnover less than those of “real losers”.

Is it time to revisit some of the events names?

Pre-Covid, the events names were some of our top picks given the growth they were seeing; however they have clearly been hit the hardest over this period and with the pace of recovery still very much up for debate, we understand investors reluctance to revisit these names. Having said all this, the confidence from Informa, in Europe, this morning gives us confidence that the space is looking attractive again. The company continued to trade in line with expectations since April results and remains on track to deliver the baseline revenue target for the year of at least £1.7bn. What we found reassuring was that CEO Stephen Carter said, ‘Further strength in Informa’s subscriptions-led businesses and measured confidence in the progressive return of physical events in Mainland China, North America and the Middle East, is delivering further security.’ To put some numbers around the Chinese recovery, some domestic events are now back to pre-Covid levels with 200k attendees at the recent China Beauty Expo in Shanghai. While the recovery is certainly not going to be a fast one (they restarted events in China 12 months ago), the statement today gives us more confidence that it is a matter of time before we reach recovery not if we will reach recovery. The space has underperformed and with consensus still expecting only a partial recovery out to 2023, we think there could be upside risk to numbers here.

More Evidence of How Frothy SPACs Can Be

We have spoken ad nauseum on SPACs for the last few months so we will make this one short but another angle that they will likely receive more scrutiny is on the interest income the companies said they expected to earn on their cash. At least nine SPACs, including some tied to billionaire William P. Foley II and Apollo Global Management, have indicated since April 2020 that they anticipated earning 1% or more on the cash they raised before spending it on acquisitions. That’s roughly 10 times the average yield over the past year on Treasury bills. In the case of Foley Trasimene, one of the largest SPACs that filed 1 %-or-higher rate assumptions in 2020 disclosures after short-term rates had already started plummeting as the Covid-19 pandemic began spreading in March, it earned only $985,318 in a period where they told investors that they were hopeful that they would earn $7.5 million for that period.