If you value our work, please help us grow further by subscribing, sharing and Tweeting.

The Weekly KnowHow is sponsored by new company modelling platform Stellar Fusion. Dynamic company models built by real analysts to help you invest with knowledge. Sign up to get access on launch. Coming Soon!

1. The Pret Index: We have mentioned this before, but the Pret Index is a great way to track how many people are going back to work and therefore the knock-on effect to those stocks hampered by the virus and those stocks positively impacted from WFH. The next few weeks here will be very interesting to track this.

2. CO2 Emissions as a share of the global total: This chart does not tell the whole story as you also need to compare the CO2 emissions per capita but the speed of the growth in China is striking.

3. Energy Price Pressure: With inflation still the key threat to markets, this chart highlights very well the pressure energy inflation is currently having on the G-7 economies.

4. Event Risk: We have spoken a few times in the past about the options market and in particular expiries and the effect they have on markets and this chart illustrates the point quite well here.

5. Music Industry Revenues: This is a great chart highlights by @mukund earlier this week. Streaming music will grow 2020 - 2030 but money paid to artists is decreasing. Artists get $0.00348 per stream on Spotify.

6. Ethereum vs Bitcoin: Thanks to @TimmerFidelity for this. Some people think of Ethereum as Bitcoin back in the earlier days (2017). The analog chart below shows that it’s easy to see why. He simply pushed Ethereum’s price history back four years (same price scale).

7. GlobalShipping Costs: We have spoken about the pressures in shipping prices before (and the positive impact this has on the likes of $DSV or $HLAG) and this chart highlights it well. Baltic Dry is up 10x off the lows

8. Semiconductor Market Share: While in Europe we are big fans of $ASML, in the semi space, the chart below highlights the commanding position $TSMC hold in the global market.

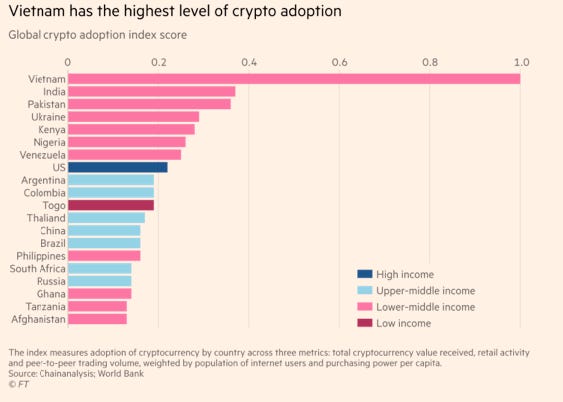

9. Crypto adoption: While still very small, it is interesting to see that Vietnam leads the way by some margin in crypto adoption. It is also worth noting how many developing countries are leading the way.

10. HF’s dumping exposure to US stocks that count on China: Companies with elevated sales from China were dumped as fund managers cut their net holdings by 26% over the month through late August to the lowest level since April 2020, client data from Goldman show.