If you value our work, please help us grow further by subscribing, sharing and Tweeting.

The Weekly KnowHow is sponsored by new company modelling platform Stellar Fusion. Dynamic company models built by real analysts to help you invest with knowledge. Sign up to get access on launch. Coming Soon!

1. Cash allocations continue to drop: Great chart from @Callum_Thomas. The August round of the AAII Asset Allocation Survey showed investor portfolio allocations to cash dropping to the 5th lowest reading on record. Part of this is completely natural and to be expected. However, part of it is also a sign of an aging market cycle and gradual but steady shift in the risk vs return outlook.

2. 2021 the year of the capex boom: We missed this back in August, but it is a very interesting chart, nonetheless. S&P’s latest estimates below suggest that non-financial Capex change will surge 13% this year and still grow next year.

3. Inflation is transitory but to remain above pre-pandemic levels: In their monthly, Schroders explain why they believe Core inflation (excluding food and energy) will ease as the jump in prices which has accompanied re-opening fades. However, by the second half of next year the closing of the output gap means that underlying inflation picks up again and core inflation rises more broadly.

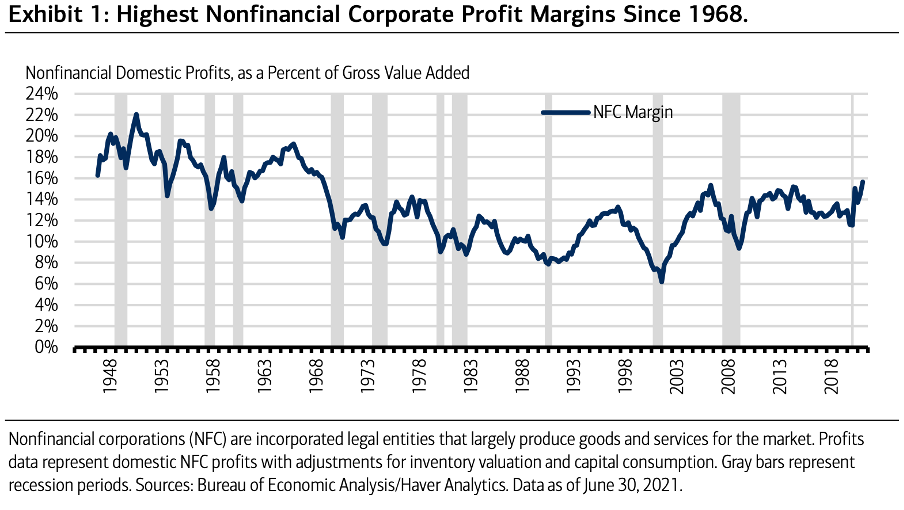

4. Are record-high margins sustainable? Jonathan Kozy from BAML questioned this week how durable these record-high margins are. He suggests the peak in profit margins (to the extent it can be identified in real time) tends to give an advanced warning of a recession and therefore can provide a multiyear runway to begin paring back risk-assets

5. Online adverts by sector/job type: We have all heard about the lorry driver shortage and the subsequent wage inflation and this chart below highlights those sectors that have the most job adverts vs Feb 2020.

6. Wage rises for low-skilled exceed those for high-skilled by most on record: While we are on the jobs debate, the Fed Wage Growth Tracker shows that, for the third month in a row, wages for the low-skilled have risen faster than for the high-skilled. In the previous history of the survey, which now goes back almost 25 years, this had only ever happened in two months, in early 2010.

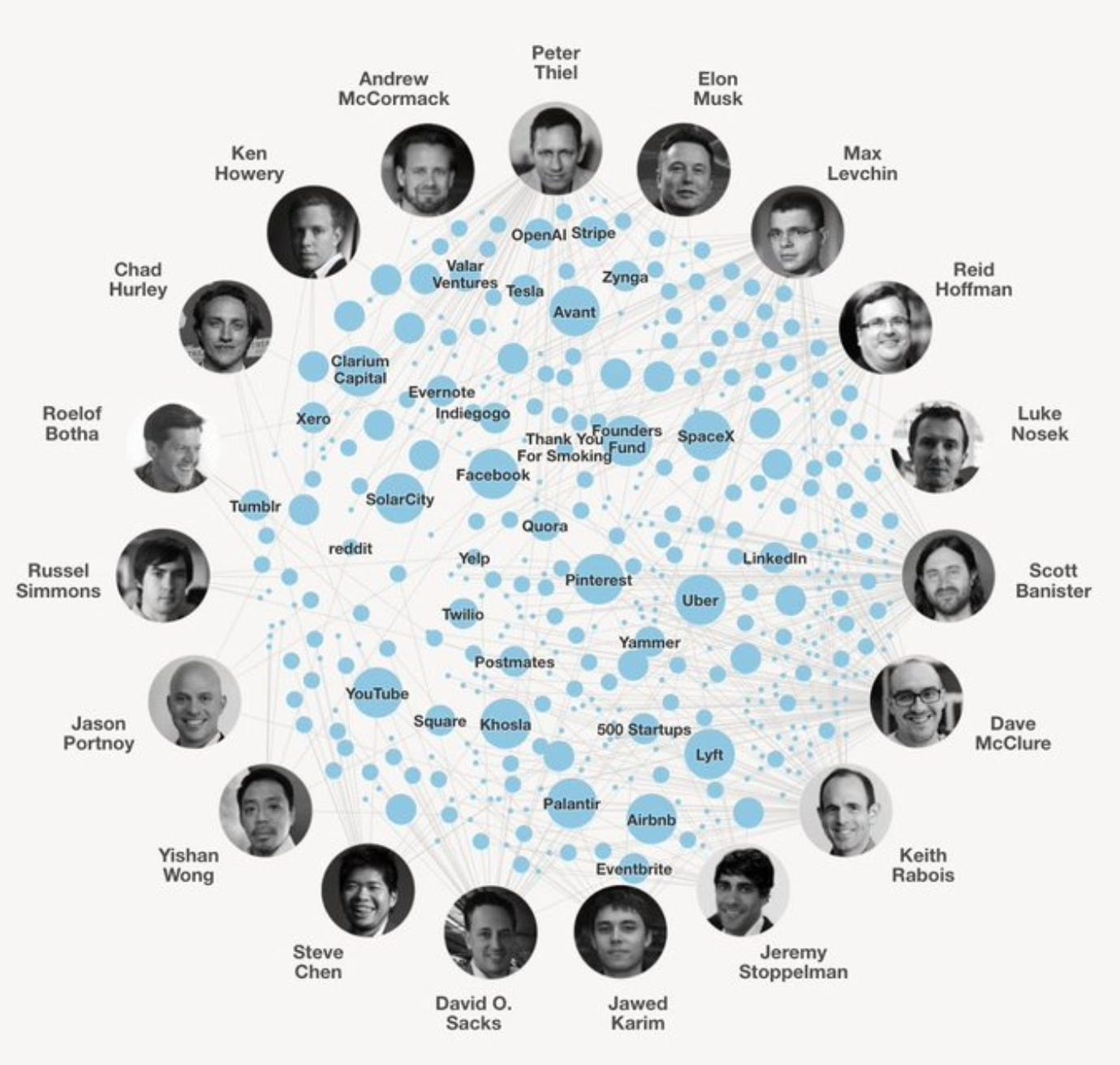

7. ‘Paypal Mafia’ businesses: This is an incredible image from Fleximize.The ‘Paypal Mafia’ are a team of former PayPal employees so prolific that Business Insider labeled them "The Richest Group Of Men In Silicon Valley." After leaving PayPal, many of them went on to build some of the largest companies we now know.

8. Nasdaq Short Interest back to 2008 highs: Thanks to @hedgopia for this. After persisting north of 10bn for 5 straight months, #Nasdaq short interest crosses 11bn at Aug-end. Only the 2nd time this has happened. The last one was mid-Jul '08. Back then, bears were hurting at the beginning but prevailed in the end, as the index unravelled in Sep. $NDX

9. US listed Chinese companies enduring more pain: We have highlighted this chart in the context of the article in the FT looking at how investors divided over Chinese markets. The chart below highlights how US-listed China shares have (perhaps fairly) seen heavier selling than the broader market.

10. ECB staff GDP projections: It would not be the weekly without a mention of the ECB earlier this week. Overall, Euro area real GDP is projected to exceed its pre-crisis level in the fourth quarter of 2021, one quarter earlier than in the June 2021 staff projections and, by the end of 2022, to reach a level only somewhat below that expected before the pandemic.