If you value our work, please help us grow further by subscribing, sharing and Tweeting.

The Weekly KnowHow is sponsored by new company modelling platform Stellar Fusion. Dynamic company models built by real analysts to help you invest with knowledge. Sign up to get access on launch. Coming Soon!

1. Amazon R&D spend: Great chart from @stellarfusiong - If you had bought $AMZN when it was just an online book store and AWS was hidden optionality, you would have found yourself a 10 bagger.

2. Disney playing catch-up: While the debate about subscription price across different countries may continue, it is interesting to see how quickly Disney is catching up with Netflix.

3. Tech margins 2x the S&P: While we are wary of the market given the lack of breadth, it is interesting to see that since 2000, we have seen a sustained increase in tech margins.

4. European valuations looking more attractive: While there are many other ways to highlight the markets exuberance at the moment, this simple chart does suggest that, despite the share price move, the European market still remains attractively valued.

5. US savings: Not necessarily that surprising but it is interesting to see the scale of the inequality gap in the US and how quickly it is increasing.

6. S&P Concentration: Even post the recent pullback, the S&P remains very concentrated. Facebook, Apple, Amazon, MicroSoft and Google account for 22% of S&P 500 market cap while contributing only 16% of the earnings.

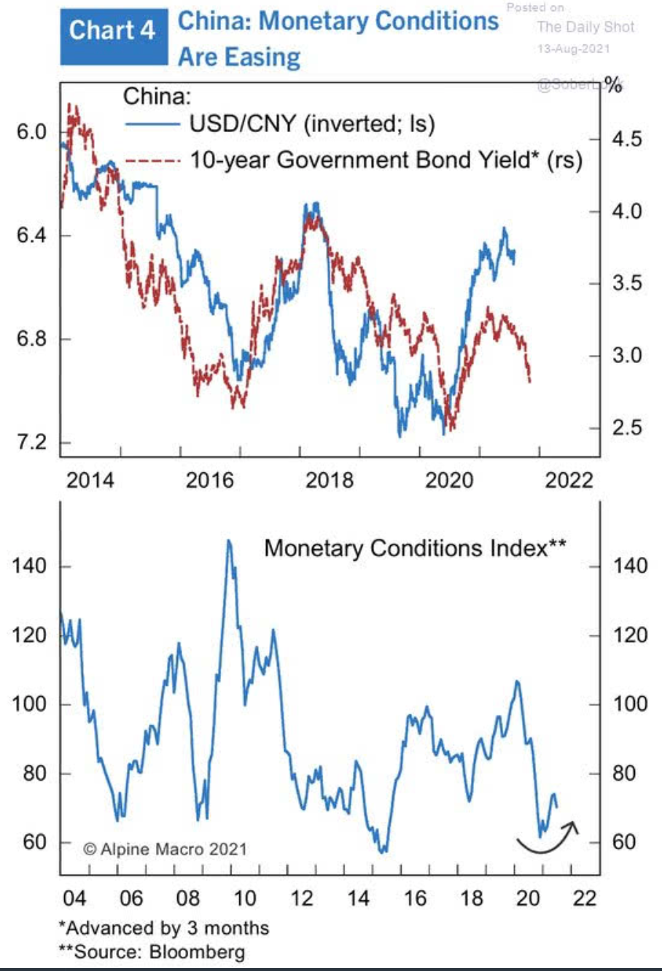

7. Chinese 10-year leadership: Another very interesting chart from the Daily Shot. The Chinese 10-year government bond yield tends to lead USD/CNY by 3 months

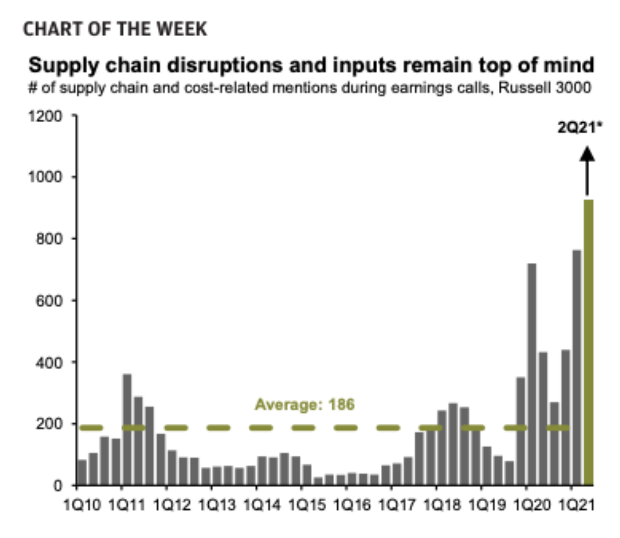

8. Supply chain disruptions: We have previously spoken about the scale of the supply chain disruption and this great chart from @FiduciaInvest highlights it very well.

9. Hedge Fund revival? For anyone interested in the space, this is a pretty interesting article from the FT looking at Hedge Fund performance in recent years and how the industry returned 11.8 per cent last year, according to data group HFR — the best year since the aftermath of the financial crisis in 2009.

10. Carbon prices continue to soar: Carbon prices could reach 100 euros as soon as 2025, according to Bank of America Corp. At that level, it’s more economical long-term for some sectors using natural gas to capture their emissions rather than paying for permits to release them.