PLEASE READ: We have had a lot of feedback from subscribers over the past week and have decided to switch the Daily KnowHow to a free weekly product from next week along with charts of the week. We love writing the DKH but it takes time. We want the depth of our analysis to standout and to be able to showcase our stock and strategy research to our rapidly growing list of paid subscribers.

In today’s KnowHow…

Copper’s Oil Moment Is Near

The Rich Aren’t Paying Tax? Never…

Forced Arbitration Is Gone at Amazon

A Core Skill Every Fund Manager Needs to Learn

What happened overnight…

It is interesting to see treasury yields continue to slide as we head into the CPI print today with the US dollar also slipping. This to us suggests that markets are beginning to agree with central bankers that inflationary is transitory. Outside that, it is a relatively quiet day with Asian and European markets small down while US futures are little changed. In the commodity space, the rally has stalled with the global recovery remaining patchy. See below for out Copper thoughts longer-term though. Over in China and it was also interesting to see that factory-gate inflation for May was at its highest since 2008 but consumer price gains remained subdued.

Chart of the Day

Oil & gas majors are inevitably in the firing line over their carbon reduction plans. This morning, Anglo-Dutch major Shell is getting it from Dutch authorities. The company thought it had put together a credible emissions reduction plan at its Strategy Day recently. Unfortunately, it’s not enough for authorities and they have told them to drive a 45% reduction by 2030. Oil majors will have to make some bold decisions in the coming years.

Analysis

Copper’s oil moment is near

by Lukas Kümmerle

Since the pandemic induced crash in Mar-20, copper has been one of the standout stories with prices more than doubling from the lows and now up 28% YTD. Since hitting the $10,000/tn level in May, some of that enthusiasm has faded. Macro data remains strong but the market appears to be anticipating a peak sometime in Q2/Q3. Still, despite the recent correction, there is a fundamental investment thesis that is well worth exploring.

Infrastructure spending is all the rage

Unlike the Financial Crisis in 2008/9, which resulted in years of austerity, the pandemic has led to many governments, particularly in the developed world, adopting a very different approach. That approach is to spend big and grow your way out of the debt challenge. The Biden administration’s $2tr Infrastructure Bill is the flag bearer for that approach.

Of course, there has been much debate around the make-up of the Biden package. Not enough on the traditional infrastructure projects that would get broader support and have greater copper intensity, and too much on social care and other projects.

However, we believe it is a step in the right direction and the “spend first” approach of the Biden government will lead to continued focus on the infrastructure gap in the US and around the world as the below chart shows.

EVs and climate drive only getting started

As climate focus accelerates in the years to come, copper demand intensity only rises. We are seeing this in electric vehicles where increasing battery capacity will lead to greater copper demand. But, in turn, this will drive significant investment in electric power grids. The IEA estimates that EVs and electricity networks will add a further 2mt to copper demand by 2030 in their base case scenario. That is almost 10% of current supply. In a more accelerated scenario, which we would argue is actually more likely post pandemic, that number grows to 4mt by 2030.

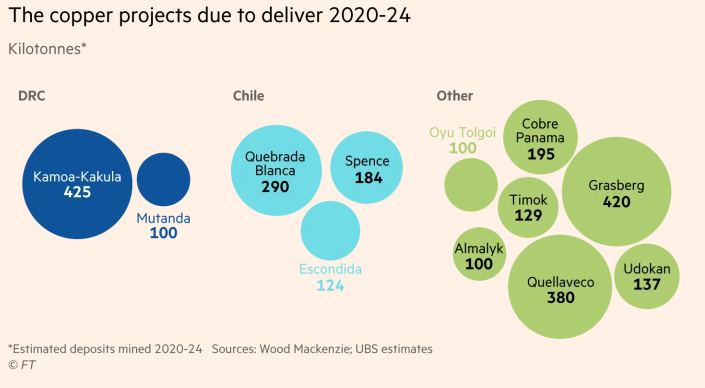

But where is the supply?

In commodities, and any commoditized industry, the saying often goes that “price incentivises supply”. That is of course true if the resources are available. In copper, that has been a challenge for many years. The largest operating mines in Chile are increasingly facing challenges due to falling copper grades. New projects are few and far between. And, where they exist, it is in economies where investing capital is a major risk.

In the short-term, copper prices may have run too far along with the broader cyclicals rally. But, look out further and copper’s oil moment is increasingly near.

Lukas Kümmerle is a macro strategist who specializes in trading commodities. He also writes the weekly newsletter, The Commodity Report. In addition, he shares his thoughts on Twitter.

What else interests us

The Rich Aren’t Paying Tax? Never…

A bit of juice for you on a Wednesday. Details claiming to reveal how little income tax US billionaires pay have been leaked to a news website. ProPublica has obtained a vast cache of IRS information showing how billionaires like Jeff Bezos, Elon Musk and Warren Buffett pay little in income tax compared to their massive wealth — sometimes, even nothing. In 2007, Jeff Bezos, then a multibillionaire and now the world’s richest man, did not pay a penny in federal income taxes. He achieved the feat again in 2011. In 2018, Tesla founder Elon Musk, the second-richest person in the world, also paid no federal income taxes. Michael Bloomberg managed to do the same in recent years. Billionaire investor Carl Icahn did it twice. George Soros paid no federal income tax three years in a row. The article goes into a lot of detail looking at who is paying what and how this compares to the general public and you can also sign up to receive notifications as they release more data.

Forced Arbitration Is Gone at Amazon – The Effects Behind This Move

While this has gone under the radar somewhat, it is still an interesting change of tune from Amazon. The company, quietly, has removed a policy from their Terms of Service that requires all complaints against the company to be sent to arbitrators (this policy meant a complete ban on lawsuits). Even though Amazon had little choice, more on that momentarily, the company’s retreat is a big deal. “Binding arbitration waivers” started out as a way for giant companies going into business with one another to avoid costly litigation by agreeing in advance to have a private arbitrator hear their disputes. The plan worked…until it didn’t. In 2018, 12,500 California Uber drivers filed arbitration claims against the company, putting the company on the hook to find 12,500 arbitrators and pay them $1500 retainers. Uber scrambled to fight the mass arbitration claims, even getting Keller Lenkner, the firm behind the claims, disqualified. It became clear that the point of arbitration wasn’t to create an alternative justice system, but to have no justice system. In Amazon’s case, the costs were running into the tens of millions, due largely to some 75,000 complaints that Amazon’s Echo device retains overheard conversations without user consent. If true, a good reason to complain; but it’s hard to describe the Echo as anything but a luxury good.

A Core Skill Every Fund Manager Needs to Learn

For those of you who have any interest in the fund management space, this interview with the founder and CEO of boutique M&A advisory firm Fenchurch Advisory Partners Ltd., Malik Karim, is well worth a reading. He has been involved in some of the sector’s biggest transactions. His deals include the 2017 merger that created Standard Life Aberdeen Plc and Jupiter Fund Management Plc’s purchase of Merian Global Investors last year. This comes at a time when DWS Group GmbH is “actively thinking” about a transformational deal, Chief Executive Officer Asoka Woehrmann said last week. Credit Suisse Group AG and UBS Group AG are both debating what to do with their fund management businesses. Schroders Plc spent several months contemplating a bid for M&G Plc this year. Further consolidation in Europe’s asset management industry seems inevitable, but it’s been elusive.