Expectations, Expectations, Expectations | Forecasting, Germany's IFO & Meituan

Your Daily KnowHow

In today’s KnowHow…

Expectations, expectations, expectations

When forecasters get it wrong?

Germany’s IFO signalling supply constraints

China Widens Internet Crackdown With Meituan Monopoly Probe

What happened overnight…

A real reflationary feel this morning with US 10yr heading back towards 1.6%, industrial metals driven by copper breaking cycle highs and even Bitcoin bouncing off the recent lows. Easy Fed anyone? Still, Europe hasn’t really got the memo. We’re seeing gains this morning in travel and banks offsetting the loses seen in carmakers and tech companies. In the US, Tesla will kick off a busy week of earnings… hang on to your hats, it’s going to get hairy.

Chart of the Day

The market has come out hard this morning on the “Easy Fed” theme. In reality, we shouldn’t really expect much new from JPow and team. Macro data is largely in line with last month as are inflation expectations. The focus will be on when the Fed will taper. Remember, the taper tantrum of 2018/19? Well, this is one you’ll want to be on top of.

Analysis

Expectations, expectations, expectations

This is the week where so many investors will be obsessing over earnings for their stocks. We will too. But, it’s Monday and we wouldn’t be KnowHow if we didn’t take a slight detour. So, here goes… let’s think bigger picture ahead of earnings.

What drives earnings expectations for the broader stock market?

On a company level, there are of course a number of micro factors and drivers for individual businesses. But, from a stock market perspective, we would break it down into business cycle and consumer expectations.

As we get into this week’s earnings, it is worth appreciating how each of those are tracking. This cycle has often been described by economists as one that is likely to burn shorter but hotter. From a business perspective, we’re not convinced that necessarily translates in the data.

Business conditions suggest recovery will be mixed

While larger manufacturing businesses are indicating a pick up in industrial activity, we see this already in earnings last week, small businesses are far less optimistic as indicated by the NFIB surveys. In fact, at this stage of the recovery post the financial crisis, Small Business - Business Conditions, had already recovered towards pre-crisis highs.

We think there are a few factors at play here but going into this earnings season we are particularly interested in assessing three different factors:

1 - different sector dynamics: various parts of the service industry have been disproportionately impacted through this crisis. Likewise, there is also likely to be a two track recovery across many manufacturing sectors

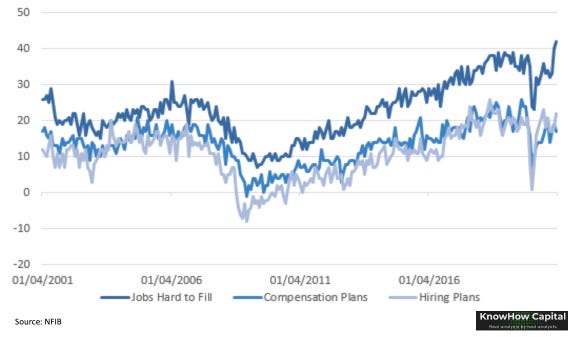

2 - ability to employ: another NFIB chart that we flagged a few weeks ago. Businesses are finding it hard to rehire people. That has potential repercussions for their ability to switch back-on post pandemic

3 - margin pressures: inflation expectations have been rising but not every company will be able to push through pricing.

But the market is far more optimistic

With that backdrop, whilst there are reasons to be optimistic, there is plenty of room for negative surprises driven by a number of unknowns around the re-opening. The below chart tells you that the market is in a very different mood however.

What we’re reading

When forecasters get it wrong?

Stephen Roach is one of the most well-known US and Wall Street economists. His write-up this weekend on what he got wrong in his pandemic analysis is a must read. As with most economists, the view through the middle of the pandemic was that there was a real risk of a double-dip-recession. The likelihood of another shock seemed high and most global economies were still fragile. What changed that was science in the form of vaccines, human nature and most recently Bidenomics. Forecasters often get it wrong but to be a good forecaster you have to accept that will happen.

What’s the German IFO telling us about this recovery?

Germany’s third wave has clearly had an impact on the business environment in the latest IFO survey but overall is still at a level that would suggest continued economic improvement both in the current climate and to a degree in expectations. The sector charts in the survey are perhaps more interesting however from a forecasting perspective.

Two that we would highlight… the blue line is expectations, red is current climate

Unsurprisingly, services which is predominantly travel and leisure businesses have seen a downtick post the third wave. Expectations however, still remain muted similar to what we discussed in the NIFB survey above.

And construction, in many pandemic hit economies, had started to recover well. These are of course very local markets so be careful to read more broadly, but also be mindful of a double dip as sources of materials and supply become constrained. That’s a key theme in this morning’s IFO.

China Widens Internet Crackdown With Meituan Monopoly Probe

For anyone with any interest in the Chinese market, this is certainly worth keeping an eye on as the Chinese government expand their crackdown to outside Alibaba. China’s government has expanded its antitrust crackdown beyond Jack Ma’s technology empire, launching an investigation into suspected monopolistic practices by food-delivery behemoth Meituan.

The antitrust watchdog is looking into alleged abuses including forced exclusivity arrangements known as “pick one of two.” The company said it will actively cooperate with the probe and step up efforts to comply with regulations. Its businesses are currently operating normally, it added in a statement.

The antitrust campaign has gathered pace in recent weeks, as regulators slapped a record fine on Alibaba, instructed affiliate Ant to overhaul its business and ordered 34 of its largest tech companies -- including Meituan -- to rectify any anti-competitive business practices within one month. Following the meeting with SAMR, the Beijing-based firm issued a pledge to abide by antitrust laws, saying it will maintain market order and won’t force merchants to “pick one of two” -- forcing them to select betweens Meituan or a rival -- through unreasonable methods.

The firm, founded by 42-year old billionaire Wang, has long been criticized by rivals and merchants for alleged excesses like forced exclusive arrangements. The firm -- which competes against Alibaba’s Ele.me in food delivery -- had previously been found guilty of unfair competition in at least two legal cases this year and ordered to pay compensation, local media has reported.

Ahead of the probe, Meituan said it will raise $10 billion in a record new share sale by a Hong Kong-listed firm as well as through an offering of convertible bonds. The firm had said it will use the funds to boost investments in new technologies like autonomous delivery as well as for general corporate purposes.

Under antitrust laws, Meituan could face a penalty of as much as 10% of its revenue if it’s found to have violated regulations. Its 2020 revenue was about 114.8 billion yuan ($17.7 billion). In contrast, rival Alibaba was fined $2.8 billion, or about 4% of its 2019 domestic revenues.