If you find our work valuable, please like, subscribe and share. We rely on that to grow our subscriber base. This is real analysis by real analysts. Enjoy!

In this week’s KnowHow:

Are Chinese ADRs now good value?

How big a problem is China for US businesses?

Which businesses are at risk?

The China Golden Dragon index, which includes US listed Chinese equities, has had a torrid time since March, down almost 50%, when the Chinese government began its crackdown of its digital businesses. In the last few days, there have been suggestions that the Chinese Communist Party’s elite Politburo may be looking to appease investor concerns regarding international listing amongst other issues. We are by no means China political experts, but Friday’s Politburo meetings do suggest that the path for many of these Chinese businesses will remain murky over the second half of the year at least.

Naturally, anything that falls 50% and offers the scale of growth opportunity that China does is going to attract a host of value hunters, not least of all, Charlie Munger who highlighted his own investment in AliBaba in April. We flagged our views on this in a recent Tweet below.

Are Chinese ADRs now good value?

There is however, also a top-down valuation argument that is worth appreciating. Despite the Golden Dragon index almost halving over a few months, as we show in the below chart, valuation versus the Nasdaq Comp still doesn’t scream cheap in our view particularly given the risks still involved. The index is now trading at a 5% discount to the Nasdaq Comp on a 1yr forward PE basis which is hardly attractive given recent history. We would not be surprised to see that discount continue widening over the coming months.

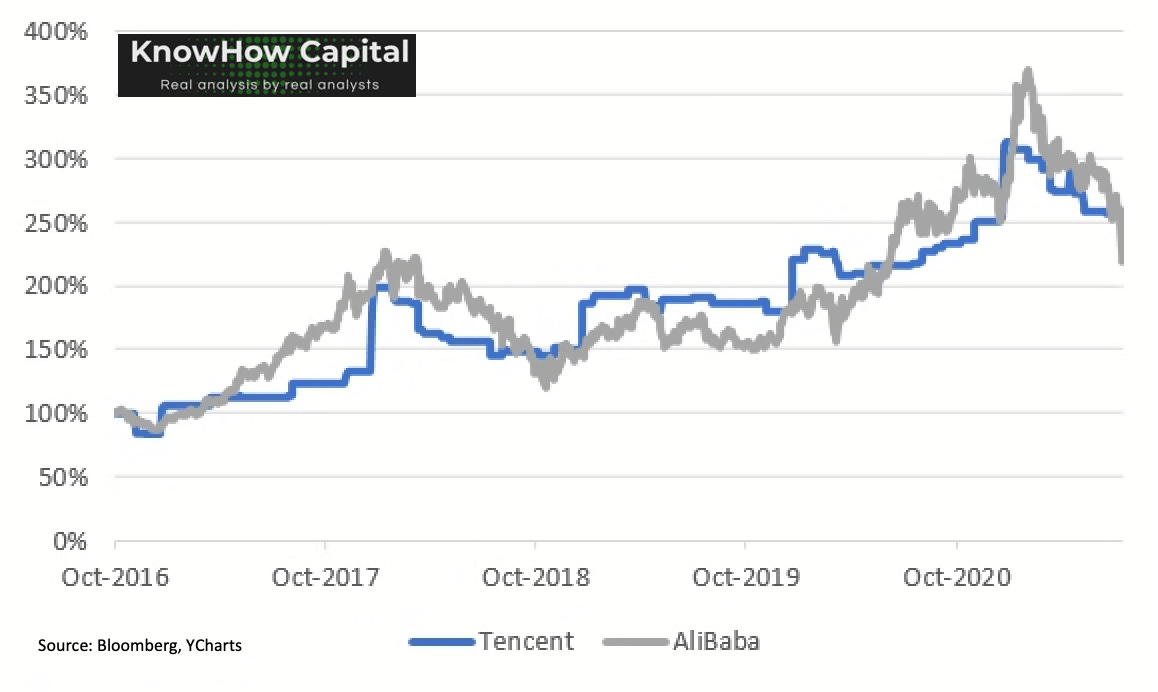

The risk remains that even if noise around recent antitrust and digital security measures in China starts to die down, there are still revenue and profitability ramifications that will take time to become apparent. The chart below shows 1yr forward rolling earnings estimates for both Tencent and Alibaba. As analysts work through the potential impact of the Chinese government’s crackdown, they have cut estimates by anywhere between 20-50% over the coming years for companies in the Golden Dragon index.

How big a problem is China for US businesses?

A separate discussion, and one that is getting an increasing amount of attention from investors, is the potential impact on US companies that have large businesses or ambitions to build large businesses in China. To what extent is the market discounting China risks through these businesses? This is a complicated question not least because the immediate issue relates to digital security and antitrust in China. Most US businesses are not directly exposed to those risks. However, as US-China tensions continue to rise, it is a risk that investors need to understand fully.

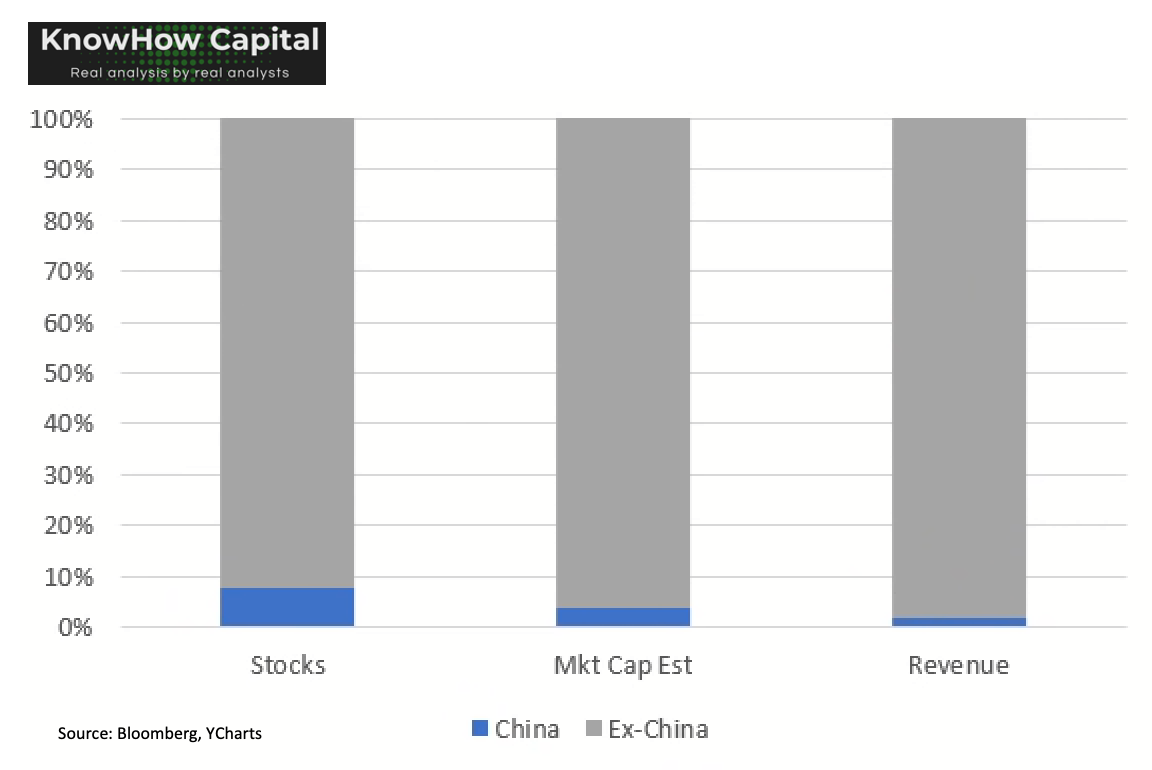

We’ve looked into the China exposure of all US listed companies with a market cap of more than $1bn. Bear in mind, our analysis requires companies to disclose their China exposure which not all do explicitly. Further, there are potential value chain impacts which our analysis will also not capture. Still, there are some pretty clear conclusions. Of the near 2000 companies in our analysis, only 184 disclosed revenues in China. When you pool those revenues together it represents around 2% of overall revenues generated by US companies and an estimated 3% of total US listed market cap. At a top-down level, when considering revenue exposure to China, US investors need not be concerned.

On a sector level, unsurprisingly, that revenue exposure is dominated by semiconductor exposed companies with some of the major operators such as LAM Research (KnowHow Capital holding), NVIDIA, Intel and AMD seeing up to 50% of their revenues generated in China.

So how should investors think about China risks going forward? We think it is too simplistic to assume all China revenues are at risk. In fact, for many US and European businesses and brands, the Chinese consumer still represents the biggest opportunity for growth over the coming years. But it is important to recognise the strategic goals of the Chinese government as laid out in the implementation of the recent 14th 5-yr plan. The below graphic from MERICS shows the key areas highlighted in the plan. We will continue to see a high level of government oversight and control over these strategic areas in our view.

Which businesses are at risk?

We believe, businesses that are at risk are those that: i) produce products or services that can be replicated or substituted by local businesses. And, ii) their products are viewed as key in strategically important sectors/domains by the Chinese government as laid out above. To a degree, we think the below trend in Apple vs Nike sales growth captures this picture well. Both are strong US brands but Apple will always run the risk of encroaching on areas that are strategic for the Chinese government. Over time, this will come through in a more volatile sales growth and profitability trend. Of course, we recognise that the below sales growth has also been impacted by product launches.

In some sectors, particularly in semiconductors and medical supplies, US companies clearly have a high degree of IP that is not easy to replicate. But, the very fact that the Chinese government wants to have significant control of the value chain in those strategic industries poses an obvious long-term risk and means investors should assume a lower valuation multiple on that part of the business. We do this for Danaher which is a large KnowHow Capital holding. Tesla and Unity Software are also two obvious examples of businesses with significant China revenue and ambitions where you should assume low multiples on that growth given the risks. Investors are potentially still under-appreciating some of the longer-term risks in these businesses as seen by recent share price performances and we hope this analysis helps highlight some of the concerns.