In case you missed some of our work this week, here’s a quick recap:

Tail risks…

Investing is getting harder than you think

The bubbles are making a comeback

Some weed for that portfolio

Bitcoin, Ark and Gamestop

Tail risks…

There is a tendency amongst some investors, particularly growth investors, to argue that “tail risks” don’t matter if you keep investing in quality companies. To a degree, that is true. You can find various bits of analysis that show you that holding for long periods of time leads to performance. But, we’ve said this before and we’ll say it again… your average investor, or portfolio manager for that matter, is unlikely to be able to sit through big drawdowns and not react. Understanding your tail risks is therefore important.

A few years ago, PIMCO published a report arguing that excess liquidity and the interconnectedness of financial markets and global value chains meant that tail risks were fatter than normal i.e. higher standard deviation events were occurring with greater frequency than at other times during history. This feeds into some of the volatility analysis we have done in recent Daily KnowHows. An investor today has to accept greater volatility in their portfolio.

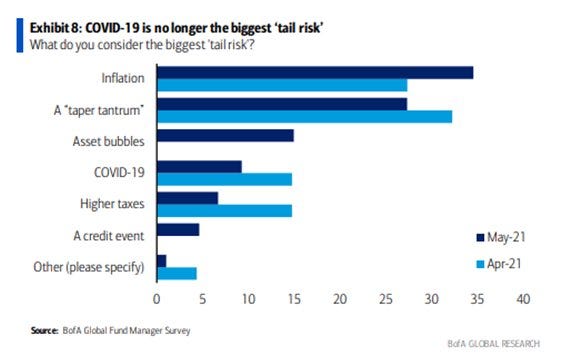

The team at Bank of America run a monthly survey asking their investors to highlight what they believe is the biggest “tail risk” for markets. This month’s survey is below. Concerns around inflation, asset bubbles and a potential credit event have risen versus April. Inflation and a potential “taper tantrum” as we approach H2 are the biggest tail risks.

But, we’ve been giving this some thought. Are these really “tail risks”? We know inflation volatility is a thing, we’ve experienced it through Q1/Q2 this year. And, much of the market is sitting back waiting for the “taper tantrum”. They are risks for sure and will drive volatility but thing like recent events in Belarus, or the ongoing risks around Taiwan-China, another pandemic, even the Colonial Pipeline etc are the risks that could really surprise the market.

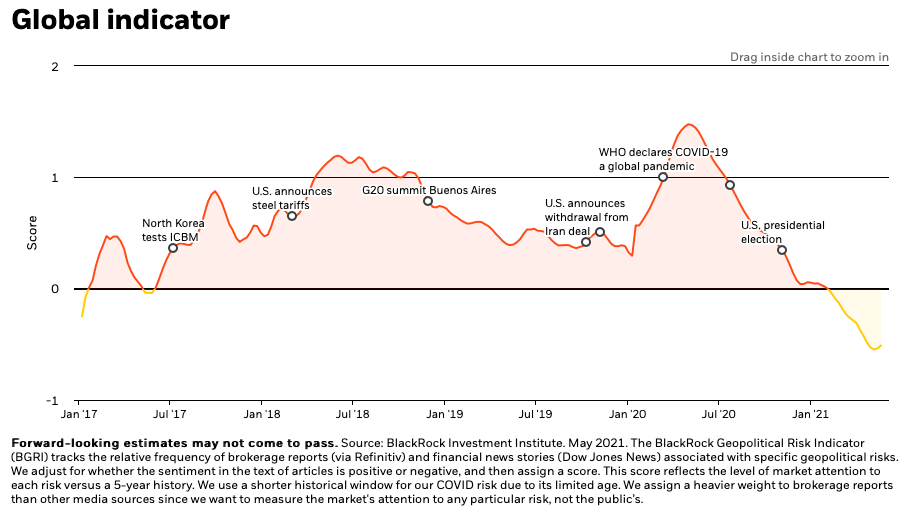

In their recently refreshed Global Risk Indicator, BlackRock have 10 tail risks which they believe could catch markets by surprise. These include technology decoupling, COVID-19 resurgence, cyberattacks and US-China tensions. They then use a combination of words analysis in company and brokers reports along with news articles to assess the extent to which the market is paying attention to them. All pretty clever really. Their chart below would suggest a high degree of complacency around tail risks.

Investing is getting harder than you think

We’ve had a couple of goes recently at smashing down some favourite investor misconceptions. What particularly irks us is this idea that you can ignore all around you as well as valuation and if you hold certain stocks for long enough, you will have made a fortune. The theory is very nice but in practise there are so many factors that come into play not least of all, your own personal situation or remit. Plus, picking winners is not easy.

Here is what’s in our pipeline for paid members. Don’t miss out. Subscribe Now

The next take-out candidates

Stock screens for a growth bounce

Pinterest: evaluating the bear case

The Social in Sport: Nike, Adidas and Lululemon

60% of stocks have generated negative wealth through history

In 2016, Professor Hendrik Bessembinder wrote a paper for Arizona State University looking at the total wealth creation the stock market had delivered relative to Treasury Bills since 1926. This was his conclusion in his updated paper last year…

“Summing the outcomes across firms indicates that Shareholder Wealth Creation totalled $47.38 trillion as of end of 2019. Of the same firms, 11,036 firms (42.17% of the total) created positive wealth for their shareholders over their full lifetimes, while 15,132 firms (57.83% of the total) reduced shareholder wealth, as compared to the Treasury bill benchmark”

That tells you that for almost 60% of stocks, investors have generated negative returns. But, it gets better. 80% of that wealth creation has been from just 83 stocks. As many losers as there are winners in recent years

The reality is that if you look through history, there have almost always been as many winners in the stock market as there are losers despite short-term periods of stronger breadth.

Profitability being concentrated towards fewer companies

The question is whether the software revolution and technology can drive faster profitability for a greater number of companies as stock price performance post-pandemic would suggest. McKinsey refers to this as “The Great Acceleration” as innovation drives a step change in economic profit. But again, there is a nuance. The winners are winning a greater share of the prize and as scale kicks in there are even less winners than before.

There are of course caveats to this analysis. We are currently seeing record levels of equity issuance. The pool of stock market companies that are at the forefront of innovation in their fields is therefore growing. For those that succeed, the prize is big. But, contrary to the valuation the market is assigning many of these businesses, history would suggest very few will actually be big winners. “Buy and hold” is a nice mantra but picking what you buy is much harder than what those people would tell you.

The bubbles are making a comeback

Defining a bubble is hard. Mainstream media will often pick out any short-term rapid increase in prices and refer to it as a bubble, suggesting that it is now susceptible to a sharp sell-off. If you took that definition, you would have looked at various asset classes or stocks through history and concluded they were bubbles when in fact, they were not. We like the Robert Schiller definition below though clearly that last point on “real value” is a source of much debate.

a situation in which news of price increases spurs investor enthusiasm, which spreads by psychological contagion from person to person, in the process amplifying stories that might justify the price increases and bringing in a larger and larger class of investors … despite doubts about the real value of an investment.

Where are the bubbles today?

In the Fed’s May-21 Financial Stability Report, they argued that despite some concerns around equity market valuations, the current equity risk premium, the return of stocks relative to bonds, suggested that the overall equity market wasn’t particularly expensive. We’ve argued this before… if you think about equity market valuation in the context of other asset classes, particularly bonds, the relative yield remains attractive. That is why we expect to continue seeing equity inflows over the coming months.

However, they did go on to highlight pockets of the market that were demonstrating bubble symptoms.

indicators pointing to elevated risk appetite in equity markets in early 2021 include the episodes of high trading volumes and price volatility for so-called meme stocks—stocks that increased in trading volume after going viral on social media. Elevated equity issuance through SPACs also suggests a higher-than-typical appetite for risk among equity investors

In a nutshell, the market overall looks fine but there are clearly concerning pockets in SPACs, meme stocks and we would throw in hyper-growth stocks also where valuations have run well ahead of the wider market.

Unwind or reset?

This chart from Jurrien Timmer, Fidelity’s Head of Global Macro, shows how since late March, a lot of those bubbles have started to unwind as the market has toyed with higher rates expectations and the effects of stimulus cheques starting to fade.

Just in the last few days however, there is a bit of a meme-ish feel returning to this market.

Some weed for that portfolio

We first started doing some work on the cannabis space at the end of 2017. The story is a simple one… governments around the world are legalising recreational use while a host of medical applications are also being developed. The legal marijuana market is around $20bn globally at the moment but most research groups are forecasting a 5x increased to c.$100bn by 2026. Boom! But, investing has not been for the faint-hearted. The excitement around the stocks has consistently led to an unsustainable exuberance in the sector followed by a substantial pullback. Weed has become the stock market’s crypto. However, in recent weeks, volumes have stabilised and enthusiasm has tempered.

Given the above, we thought it was worth a revisit. So, why the hype?

1. Legalisation is set continue:

Recent polls (May 25th poll here) have started to highlight the bipartisan support for federal cannabis legislation. Back in February, Majority Leader Chuck Schumer announced that his Senate would do what no other Senate has done and introduce and pass legislation reforming federal marijuana policy. Yes state action is continuing and is supportive, but federal legislation is the big development.

Outside this, states continue to support the growth of cannabis. In the past 6 months alone, cannabis-related ballot measures put to voters last November passed, including those in conservative Mississippi, Montana and South Dakota. State legislatures in New York, New Mexico, and Virginia have approved bills to legalise cannabis for recreational use also.

What is interesting is that at current levels, even without legalisation occurring anywhere else in the world the growth we are set to see in the US alone is significant with the size of the market is set to double in legal US states alone.

2. M&A will continue with consumer interest growing

The recent 10th May announcement that Trulieve is looking to acquire Harvest Health & Recreation for $2.1bn may be an indicator that big marijuana mergers are making a return. This came just after the finalisation of the GW Pharmaceuticals acquisition by Jazz Pharmaceuticals for $7.2bn.

On top of this, we expect to see a further shift towards consumer product companies partnering with traditional cannabis providers to take advantage of markets opening up around the world (reminder Constellation Brands increased its stake in Canopy Growth to 38.6% in 2020).

Conclusion

A number of recent events have brought the sector back into focus. Enthusiasm has tempered, M&A activity is picking up and federal legislation is on the agenda. If you fancy some weed in your portfolio, we would suggest using an ETF approach. We’ve been looking at the Cannabis X ETF.

Bitcoin, Ark and Gamestop

We have already written a lot on the retail unwind as it continues to play out across markets. But, the gist is basically this… even if you take the view that retail participation in markets will be structurally higher than pre-pandemic, there are still a large number of people that are unlikely to be able to commit the same amount of time and funds to investing/trading post re-opening. That unwind is 100% healthy for markets but also brings volatility. Our list of stocks most exposed is here.

The big three retail trades over the past 18 months have been: crypto, growth stocks and meme stocks. These have all been avenues for retail investors to chase volatile but rapid returns.

Below is the a chart of Google Search trends across the three. For most of last year, they co-existed as part of the same trade. This year, as stocks have been weaker, that has changed.

If you then look at the correlation of Bitcoin vs growth, we’ve used Ark Innovation ETF in the below chart as a proxy, you see that much of that strong relationship over the past year has started to ease.

Some will say, including us, that Gamestop and other meme stocks continue to trade at excessive levels. But again, looking at the daily option volume, a fair chunk has unwound.