The Daily KnowHow is free and we want to keep it that way. If you find our work valuable, please subscribe and share. This is real analysis by real analysts. Enjoy!

In today’s KnowHow…

Keep your eyes on the VIX

How Juul came up against an army of rich parents

China clamping down on iron ore

The billionaire boom

What happened overnight…

As the US returns to ‘normal’, with fully vaccinated people not needing to wear masks, markets have also normalised for different reasons. We have seen commodity prices temper overnight (more below) that have allayed concerns about inflation risks resulting in more orderly markets this morning. US equity futures signalling a market recovery that was gaining momentum after a bruising week. Gains in Europe were led by banks, while miners fell amid a retreat in raw-material prices. Outside this, treasuries recovered from the prior session’s weakness, as the 10yr shaved two basis points to 1.63%.

Chart of the Day

We skipped inflation chat yesterday in the Chart of the Day. So, how could we not go back to it today!? Honestly, we wouldn’t but this is an important survey from Reuters. It shows what economists think would be viewed as a tolerable level of Personal Consumer Expenditure (PCE) inflation before they start to twitch around rates and tapering. Our view is that we’ll see elevated numbers through Q2, well above 3% due to base effects before falling back in Q4. Tapering is probably an August conversation in that scenario.

Analysis

Keep your eyes on the VIX

We’re pretty chilled out folks here at KnowHow, but there’s few things more irritating than someone pointing out that its “time in the market, not timing the market” when your portfolio is losing money. Can we just stop that pls!? It makes us feel like this…

How you’re feeling about the stock market price action is dependent on so many things: your risk tolerance, personal circumstances, experience. And, human psychology is such that we want to look at our portfolios regularly and that leads to complacency at the peaks and fear/uncertainty at the lows. Understanding your risk-reward and the macro paradigm at different points in the cycle are therefore important.

We use the Vix, volatility index, as one of our sentiment indicators. If you’re in this, you should be looking at it closely. Below is the weekly relationship between the Vix and the S&P 500 over the last 40 years (Bloomberg). Vix goes up, S&P goes down and vice versa.

If you’re a trader, you’re probably watching the VIX everyday. But, does it matter if you’re thinking longer-term? Come on, would we mention it if it didn’t!?

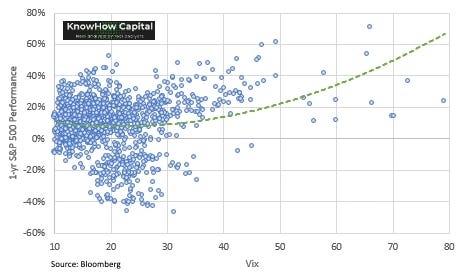

The chart below shows you the 1yr performance of the S&P at different Vix levels. Again, this is 40 years worth of data. A VIX above 30 starts to substantially increase your investing risk-reward.

But, the relationship isn’t that straight forward. A high VIX has a very high probability of success but a low VIX also does as we show in the chart below. In fact, if you remove the 2007 sub-prime volatility, a VIX below 20 would have similar risk-reward to a VIX above 30. The problem is that uncertainty corridor between 20-30 where volatility is rising but the market is still hedging its bets. The risk-reward falls considerably. This week we have been hovering around those levels rather like Feb and March. This is not the time to get trigger happy.

What we’re reading

How Juul came up against an army of rich parents

This is a longer read but a fascinating insight into how Juul lost its way having been a Silicon Valley darling. At one-point (chart below) Juul was the largest haul by a U.S venture capital-backed company in Silicon Valley history, eclipsing deals done by Uber, We Work and Space X. Altria, the US listed tobacco company, invested $12.8bn in December 2018 for a 35% stake in the company. With the company, blighted by health issues, including a mysterious outbreak of acute lung injuries, a group of powerful parents put pressure on the FDA to turn up the heat on the company. The real worry was that their children and their friends were part of a group of millions of middle school and high school students that were vaping; a jarring public-health setback after two decades of declines in youth tobacco. Altria now values its 35% stake in Juul at $1.5bn, which would imply a total valuation of below $5bn.

China cracking down on iron ore

It has taken government intervention to stop the surge but Iron ore’s slump from a record accelerated as China ramps up efforts to control a dizzying surge in prices. Futures in Dalian dropped the daily limit, while prices in Singapore tumbled 11% as the world’s biggest iron ore buyer rolled out more measures to temper recent gains. Tangshan city banned steelmakers from fabricating or spreading price-hike information, the latest in a list of measures targeting the hub, after Premier Li Keqiang earlier this week urged China to deal with surging prices. The surge across commodities helped push the country’s factory-gate prices up by the most since 2017, and inflation concerns, which we have banged on about a lot recently, are intensifying around the world amid a broad economic recovery and vast stimulus programs. China is a massive commodity importer, they aren’t going to just sit back and watch prices surge.

The billionaire boom

Something a little more left field for a Friday. If you, like us, are thinking about what the billionaire’s club looks like when we join it (a couple of years at this run rate baby!) then look no further. On the 2021 Forbes list, which runs to April 6, billionaire numbers rose nearly 700 to a record total of more than 2,700. The biggest surge came in China, which added 238 billionaires, one every 36 hours, for a total of 626. None of this will probably come as no surprise to hear and while we don’t have many conclusions to take form this, the chart below highlights the scale of this increase in wealth.