More than just "bunny-hugging" | We love Snap BUT... | the Biden market jitters

Your Daily KnowHow

In today’s KnowHow…

More than just “bunny-hugging” at World Earth Day summit

We love Snap but…

The Great U.S. Inflation Head Fake

Biden’s capital gains tax jitters

What happened overnight…

Tax was the name of the day yesterday with Biden proposing a large capital-gains tax hike on high earners which seemed to disappointed many from a business and personal stand-point… Reports suggested that he could even double the rate. Equities did rally off lows in the US with jobless claims hitting their lowest level since March 2020. In Europe, equities have dropped slightly with investors pointing to mixed earnings on Friday morning. Moncler is leading the way, down 7% after Q1 results. Looking ahead and US futures are posting modest gains post the selloff yesterday while Bitcoin is heading for its worst week in more than a year (below $50,000) as the proposed capital gains tax in the US worries investors.

Chart of the Day

The news yesterday of the US Tax rate increases reminded us of some analysis we saw a few years ago. Very little has changed since then and we can point to many charts that say similar on corporate tax rate too

Analysis

More than just “bunny-hugging”

We said yesterday that the World Earth Summit was the tee-off for a big year for climate change with the COP26 summit in Glasgow in November. Don’t get distracted by the dire recent performance of some of the clean energy ETF’s, inflows remain strong and as we see a host of announcements from governments through to banks and investment firms, this will inevitably continue.

Doubling up and down

Yesterday’s headlines were dominated by the US plan to cut emissions by 50-52% from 2005 levels by 2030. The US also announced a doubling, by 2024, of its annual public climate finance to developing countries, and an increase in its efforts to mobilise private finance to help the cause. But there was also more from other countries: Japan will target a 46% cut to emission and Canada 40-45% by 2030. UK’s “bunny-hugging” PM committed to a 78% cut by 2035 vs 1990 levels.

More needed from China & India but…

Skeptics will argue that with China and India still aloof, progress will always be hard. But, there’s also more going on beneath the surface here. Concerns about climate change have been increasing steadily over the past few years, with research from Pew in Summer 2020 showing that (a median of) 70% of respondents across 14 countries saw it as a “major” domestic threat. Even in the middle of the Covid-19 pandemic, in many nations threat levels were considered to be higher than infectious diseases (see chart below).

Consumers are driving change

Consumers are also taking action via their personal behaviours, and the Covid-19 pandemic has sped-up this trend considerably. Research by McKinsey in April 2020 shows that, since its onset, over half of UK and German consumers had made significant lifestyle changes to lessen their environmental impact, such as recycling more and buying products with sustainable packaging. Brands will now need to do even more to win their loyalty and purse strings. Such steps will begin to feed through into countries that are the bigger emitters too, we think. In the words of the British PM, this is all far more than just “bunny-hugging”.

We love Snap but…

If you want to gain an understanding of what it takes for a business to “own” it’s customer base and keep them constantly engaged, there are few better case studies than Snap. Their rate of innovation in their niche is truly outstanding.

An advertisers dream…

And, in turn, that has driven an enviable level of penetration in the younger demographic at 70%+ of 13-34 year olds in countries comprising over half the world’s digital ad spend. The ARPU run way is huge. We love that as we have highlighted with Pinterest.

Last night’s results were solid enough and after an initial whoops, the shares reacted well. There are probably also few social media plays that could actually benefit from a re-opening. Have a look at this comment from CEO, Evan Spiegel, on last night’s call.

“During the pandemic, a lot of folks sort of shrunk their social graph. They started talking more to their family members or really close friends. And what we're seeing now in the United States, which is really exciting is that people are going out more. And they're seeing more friends or they're returning to school or work. And so, their social graph and the people they're interacting with on a regular basis is starting to expand. And that sort of communication with that wider social graph drives a lot of the frequency of use of Snapchat.”

So, what’s the but…

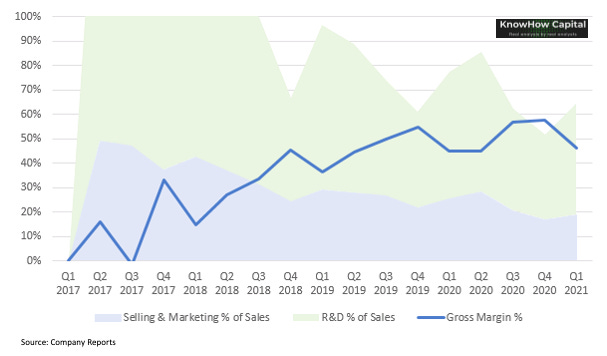

Below, we have broken out Snap’s gross margin as well as R&D and Selling & Marketing Expenses as a % of sales. As user bases mature, we want to see growth at stable gross margins and falling R&D and selling costs as a % of sales. That effectively is the path to profitability for a platform business. For Snap, gross margins have improved but other costs remain high and the company itself recognises the need to keep spending on further innovation, including AR hardware, and international sales.

Now compare this to Pinterest. Gross margins have been stable at a higher base for a couple of years and R&D & selling costs as a % of sales are now starting to fall.

Why the difference? We think that the demographic and nature of a Snap customer demands more investment and new product innovation. That makes them inherently more expensive to acquire and potentially lower return. Then, bring this back to valuation. Snap trades on 41x EV/Gross Profit 2021 vs Pinterest on 23x. We love Snap but we can’t justify the valuation and believe the investment thesis versus Pinterest is incomparable.

What we’re reading

The Great U.S. Inflation Head Fake

We have spoken at length over the last few weeks about the risks inflation may pose to the market. With that in mind, it is worth reading this Q&A from PIMCO where they assess investors’ inflation concerns and outline reasons that near-term price adjustments are unlikely to lead to longer-term inflation. The key conclusions they state are three-fold:

Despite inflation concerns and the potential for multi-month price level adjustments, we believe year-over-year inflation will be contained in the second half of 2021.

The markets appear to be pricing in a chance that the Fed will be more aggressive with interest rates than it is currently telegraphing.

We expect price pressures to normalize later in 2021 as vaccination rates increase, shipping and supply bottlenecks clear, and durable goods purchases ease.

Within the paper they attempt to answer the questions below:

1. Why are your inflation forecasts lower than the Fed’s?

2. How are supply chain disruptions affecting U.S. inflation?

3. What about the semiconductor shortage?

4. Housing prices are rising at the fastest rate in 15 years. What does that mean for rental inflation?

5. Does PIMCO’s forecast incorporate normalizing airfares and lodging prices as a greater portion of the population starts traveling?

6. Won’t pent-up demand and excess savings contribute to higher inflation?

7. What about the Fed’s preferred measure, PCE inflation?

The bottom line

Over the next several months, we expect to witness a multi-month price level adjustment in the U.S., which will feel a lot like a shift higher in inflation. The March CPI report released this week confirmed the first month of this multi-month price level adjustment, with core inflation up 0.3% m/m, and we could get similar readings in April and May. However, over the second half of 2021, as the economy further normalizes, we expect sequential growth in real economic activity and prices to slow, moderating the y/y pace of inflation.

Biden’s capital gains tax jitters

If you like your news a few months late, you would certainly have enjoyed all the hysteria around the Biden tax plans yesterday… which, have actually been speculated in almost the exact same format since September last year. In terms of what you need to know:

What is the plan?

President Joe Biden will propose almost doubling the capital gains tax rate for wealthy individuals to 39.6% to help pay for a raft of social spending that addresses long-standing inequality, according to people familiar with the proposal.

For those earning $1 million or more, the new top rate, coupled with an existing surtax on investment income, means that federal tax rates for wealthy investors could be as high as 43.4%. The new marginal 39.6% rate would be an increase from the current base rate of 20%, the people said on the condition of anonymity because the plan is not yet public.

Other measures that the administration has discussed in recent weeks include enhancing the estate tax for the wealthy. Biden has warned that those earning over $400,000 can expect to pay more in taxes. The White House has already rolled out plans for corporate tax hikes, which go to fund the $2.25 trillion infrastructure-focused “American Jobs Plan.”

Outside this, Biden will detail the American Families Plan in a joint address to Congress on April 28. It is set to include a wave of new spending on children and education, including a temporary extension of an expanded child tax credit that would give parents up to $300 a month for young children or $250 for those six and older.

For $1 million earners in high-tax states, rates on capital gains could be above 50%. For New Yorkers, the combined state and federal capital gains rate could be as high as 52.22%. For Californians, it could be 56.7%.

This though, is not new. We have highlighted the res before and if you see in the link here, back in October 2020 a detailed assessment of Biden’s plans and what impact they would have on the economy was published by the Tax Foundation. The charts below are perhaps the best way to highlight the impact on what different policies have on GDP and tax revenues: