If you find our work valuable, please like, subscribe and share. We rely on that to grow our subscriber base. This is real analysis by real analysts. Enjoy!

Please Note: there will be no weekly next week but Charts of the Week will still be published and subscribers will receive an update on our thoughts on Uber

In this week’s KnowHow:

The bigger picture earnings trends

The lessons from Q1

Do earnings really matter?

Stocks most at risk

Stocks that could surprise positively

The good and bad thing about earnings season is that there are no shortage of views. Whether that is about the earnings or stock price reaction for individual companies or just an overall view on whether earnings even matter… rest assured, you will be hearing plenty of opinions over the coming weeks. It is important during earnings to take in the bigger picture trends both from a macro and company level perspective but also to dial back the noise. The John Bogle saying comes to mind, “the market is often stupid but you can’t focus on that. Focus on the underlying value of the dividends and earnings”. Still, portfolio volatility during earnings season is par for the course and understanding the risks and earnings dynamics are important during this period.

The bigger picture earnings trends

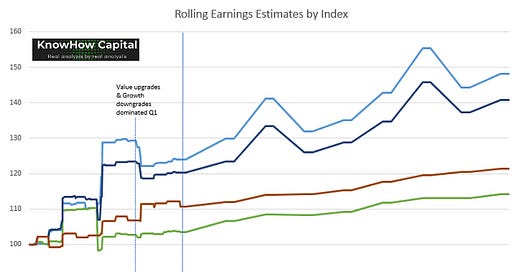

We’ll start with a top-down perspective of where the market is today. If you look at the below chart, you’ll see that we are getting towards peak earnings and sales estimates for the S&P. The picture for the Dow Jones is not dissimilar and in fact earnings trends are weaker in Q2 given the risk of margin pressure from input cost inflation. From a broader market perspective, this earnings season is critical for equities to keep pushing higher from current levels in our view. We need to see companies deliver and drive renewed earnings momentum.

The KnowHow Capital Portfolio is now live. Subscriber access only below.

The lessons from Q1

At the same time, we see a lot of similarities between the upcoming Q2 earnings trends and what we saw in the previous quarter. Prior to Q1, expectations had become elevated for tech and digital businesses that had benefited from the pandemic. Those expectations saw a hard reset when companies actually reported earnings and provided 2021 guidance. On the other hand, more cyclical businesses generally surprised more positively.

In the below chart, we have shown rolling earnings estimates for the key growth and value indices. You will see the trend we describe above through the Q1 earnings period with both Nasdaq and S&P Growth estimates being rebased. Looking ahead to Q2, the chart suggests a similar earnings set-up though less pronounced in our view.

What’s driving M&A and where are the upcoming opportunities? Subscriber access only below

Do earnings really matter?

So, given that top-down perspective, our conclusion is that you should expect another volatile earnings season with set-ups for many stocks looking not dissimilar to what we have already seen earlier in the year. However, something we have been looking closely at this week is how stocks respond in the period after earnings ie. does it make sense to react in the short-term?

A few charts here, but a word of warning… the data points are tricky to see on Substack. We would suggest clicking on the charts to view or accessing them on our Twitter handle.

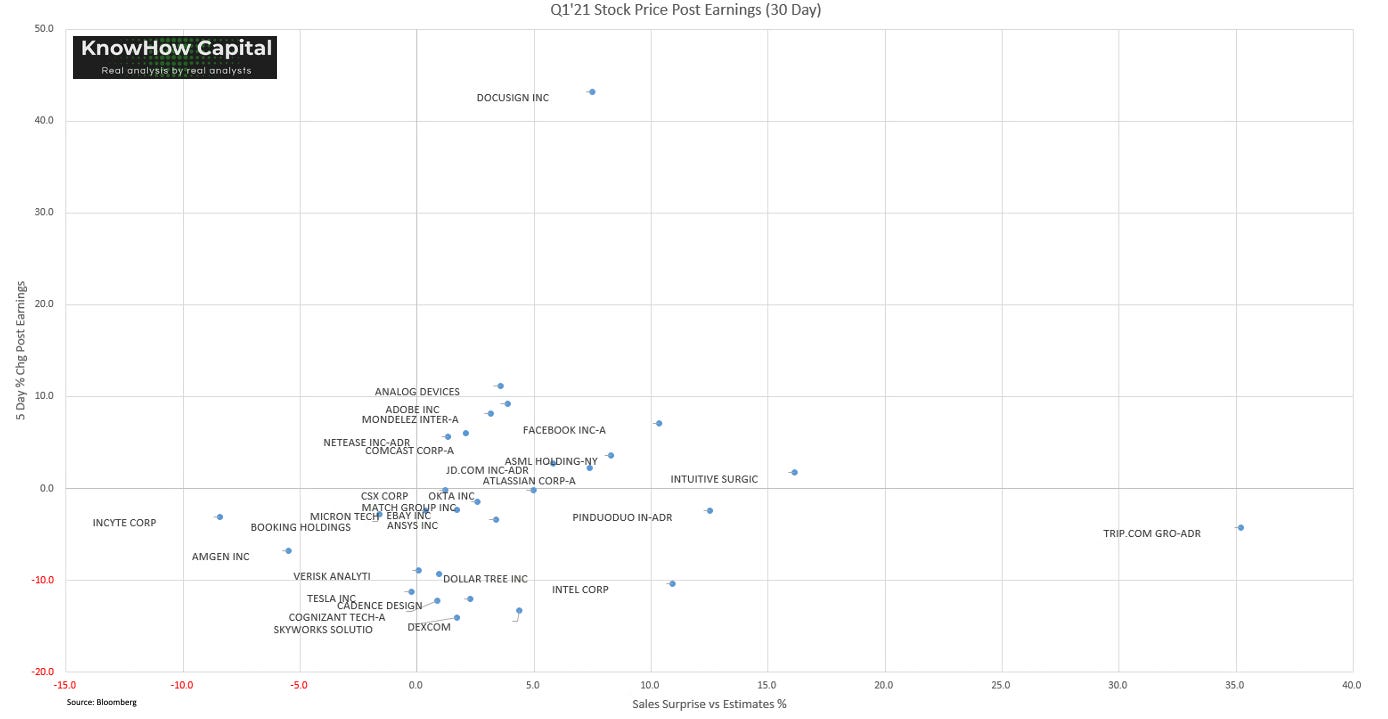

The first chart below looks at the day 1 share price reaction of all the Nasdaq 100 constituents on their earnings in Q1. You will see standout names like Docusign and then Okta on the other end of the spectrum.

By Day 5 post earnings, that spread of winners and losers remained and in many cases actually became more extended as investors absorbed the earnings results. For example, Okta had kept drifting lower and Docusign had kept pushing a little higher.

However, interestingly when we looked at the price performance of stocks 30 days after earnings, the picture was different. Many of the best performers had started to give back their earnings gains. Meanwhile, some of the worst performers, Okta in particular, had started to recover.

When we dig into some of these trends on a company level, we found a few interesting things:

1) misses or beats on the quarter lead to very short dated price action provided the underlying trends have remained. That was the lesson from Okta.

2) upgrades/downgrades on guidance lead to more sustained price action

3) continued out/underperformance occurs when there is a break/inflection in trend a la Docusign.

Of course, to seasoned investment analysts, some of this should be pretty obvious. But, even then it is worth a refresh and tells you that importance of understanding the real drivers of the company you’re invested in.

Another factor that is important to understand is positioning into earnings. As we are seeing currently in the case of many high growth stocks, positioning before earnings will often dictate price action on the day and also prior to the release. We look at positioning in two different ways:

1) KnowHow Positioning Score: our proprietary positioning score incorporates a number of different data points including fund holding data, short interest, options data and price action

2) Price vs Earnings Momentum: comparing recent price action with direction of earnings

Both of the above tend to give us a good indication of whether or not stocks are likely to disappoint at earnings. Below we have shares two sets of stock screens that highlight stocks that potentially are at risk ahead of earnings and those that could positively surprise.

Our analysis of Nike, Adidas and Lululemon’s social question is one of our most read reports this year. Subscriber access below.