Please note: this is the last Daily KnowHow. From next week, based on your feedback, we will be switching to a free Weekly KnowHow focused on our equity strategy insights along with a Charts of the Week product. We will be increasing our paid output on macro, equity strategy, ESG and stocks over the coming weeks.

In today’s KnowHow…

So it is “transitory”

Basel Committee offers insight on future of crypto

China’s fertility problem

How will Chinese on-demand trends continue to evolve?

What happened overnight…

It seems as though very little can hold markets back at the moment, even an inflation print that once again was faster than market expectations (more below). With this in mind, global stocks extended a record high while treasuries were steady as investors seem to have growing confidence that inflation is transitory for now. Elsewhere, crude consolidated above $70 amid an improving demand dynamic and bitcoin extended its rebound for the third day, even amidst the Basel white paper suggesting bitcoin should be viewed by banks as similar to the riskiest assets on their balance sheets.

Chart of the Day

The meme stock unwind has started to catch a bit of steam this week. Both AMC and Gamestop are now down around 25% in the last few days.

Analysis

So it is “transitory”

This is the chart that has got all your 1970s inflation junkies in a bit of a tizz…

An above expectations core CPI print of 3.8%, and 5% on headline, should suggest that inflation, even if temporary, is running above market and economist expectations. Inflation expectations therefore, as gauged by the US 10 yr yield, should surely go up but they didn’t. The answer, as always, lies in the detail.

There are clearly elements in that core CPI number that are running hot. The well publicised rise in used car prices was very apparent as was the increase in airfares as the economy re-opens and leisure travel picks up. The Fed is probably correctly willing to bet that used car prices going up 30%/yr is not a sustainable trend.

Meanwhile, inflation in most other high weight categories outside of commodities shouldn’t really give too much cause for concern. However, if you look at food prices and food at home below, the strength in prices we saw this time last year mean comps are actually getting tougher. That’s a high profile inflation item that’s telling you the Fed’s view of these high headline prints being “transitory” is the right one.

What else interests us

Basel Committee offers insight on future of crypto

Yesterday’s Basel Committee publication on how banks should manage any future cryptocurrency exposure should offer crypto bulls some food for thought. Current banking sector exposure to crypto assets is small today. However, as crypto gains broader traction and interest, banks are showing a greater willingness to get involved. The Basel report essentially buckets crypto into two types of assets: Group 1 - effectively currency-backed or stable coins and Group 2 - your traditional Bitcoin, Ethereum and al. The committee is comfortable with banks holding assets in Group 1. But, Group 2 is a big no no. The risk requirement for Group 2 means that for every crypto asset held, banks will have to hold the equivalent in cash. As we think about how crypto finds a place in the real world years from now, the volatility is the real hindering factor when it comes to adoption from a consumer, institutional or transactional perspective. It is why we actually buy the Elon Musk and Stan Druckenmiller argument that while there is a need for digital currencies, it is unlikely that the ones out there today will be the winners of the future.

China’s fertility problem

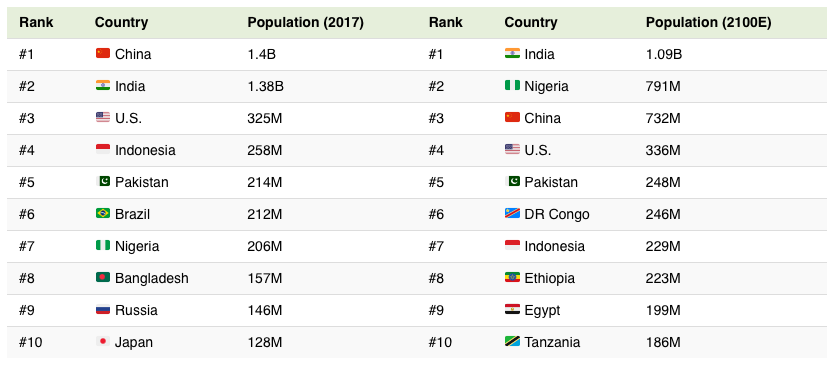

It’s been a few weeks now since the Chinese government announced that it would allow families to have up to three children. A lot has been written about China’s fertility problem which stems from the one-child policy that started to kick in during the early 80s. Demographics and maintaining a stable yet growing population are important for economies to ensure a consistent replacement of its working and productive population. An imbalance will weigh significantly on consumption patterns and economic growth. We are already seeing the peak of China’s population and by some projections, it will almost halve by the end of this century. Incidentally, India has a not dissimilar problem albeit further out. However, what is interesting is that despite adjustments to the one-child policy and the government encouraging Chinese families to have more children, birth rates have continued to fall. Project Syndicate have a very interesting analysis of why that is the case. In urban areas, with the better paying jobs, cost of living is rising rapidly meaning families can’t afford more children. Meanwhile, in rural areas, where there may be greater willingness to have more children, the hukou system restricts movement of population.

How will Chinese on-demand trends continue to evolve?

If you have time over the weekend, then the joint white paper from JD.com and Dada Group looking at Chinese On-Demand Consumption Trends is well worth a read. The report features proprietary insights into the latest on-demand economy trends in China and highlights the key growth opportunities and near-term challenges in China’s rapidly growing on-demand and hyperlocal e-commerce industry. JD.com, is one of China’s leading technology driven e-commerce companies while Dada Group is a leading platform of local on-demand retail and delivery in China who JD.Com has just announced it will increase its stake to 51%. While this report is only Chinese centric, the thematics seen in China are being seen globally, be it the significant rise "Minutes-level" delivery that we have seen throughout the US and Europe or how omnichannel retailing moves to the next level.