If you find our work valuable, please like, subscribe and share. We rely on that to grow our subscriber base. This is real analysis by real analysts. Enjoy!

In today’s KnowHow…

Some weed for that portfolio

Cathie Wood’s bigger picture

Cashing out of crypto

Yuan tolerance

JD.com Logistics shares fizzle post initial surge

What happened overnight…

Strong data from the US and some more positive Biden rhetoric have spurred markets once again this morning. US Jobless claims fell to fresh pandemic lows and Joe is reportedly set to unveil a budget that would take federal spending to $6 trillion in the coming fiscal year (much of this we believe to be priced in though). Over in Europe and the Stoxx 600 is set for its second week of gains, led by the insurers this morning. Over in Asia and the big news was the JD.com Logistics opened up 18% but gave back most of these gains to finish up 3.3% (more below). Outside this, not a huge amount to report on the yields or dollar side.

Chart of the Day

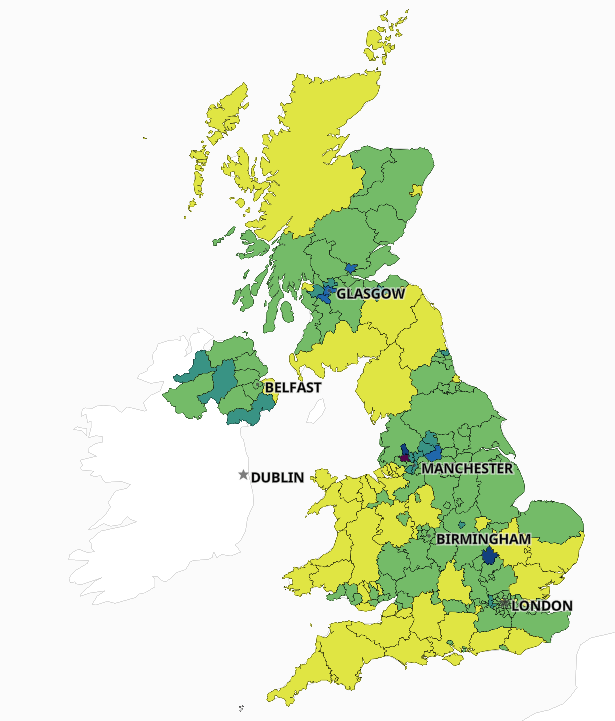

The UK’s uptick in coronavirus cases in the past few days is starting to put the government and Europe on edge. Almost 50% of people in the UK have now received a second vaccine dose and from mid-May, the country is largely out of lockdown. But, there are pockets of the Indian variant now starting to emerge around Glasgow, Manchester and Birmingham. Worrying? Yes. But, ahead of the winter, this will also be a test case for whether vaccines are successfully breaking the cases to hospitalisation chain that has been the biggest concern through this pandemic.

Analysis

Some weed for that portfolio

We first started doing some work on the cannabis space at the end of 2017. The story is a simple one… governments around the world are legalising recreational use while a host of medical applications are also being developed. The legal marijuana market is around $20bn globally at the moment but most research groups are forecasting a 5x increased to c.$100bn by 2026. Boom! But, investing has not been for the faint-hearted. The excitement around the stocks has consistently led to an unsustainable exuberance in the sector followed by a substantial pullback. Weed has become the stock market’s crypto.

Volumes have normalised

Yesterday, we discussed the factors worth considering to assess a bubble (more here from yesterday). Well, there are a lot of things about cannabis stocks that would make you think it is exactly that, particularly since the start of this year. However, in recent weeks, volumes have stabilised and enthusiasm has tempered.

Given the above, we thought it was worth a revisit. So, why the hype?

1. Legalisation is set continue:

Recent polls (May 25th poll here) have started to highlight the bipartisan support for federal cannabis legislation. Back in February, Majority Leader Chuck Schumer announced that his Senate would do what no other Senate has done and introduce and pass legislation reforming federal marijuana policy. Yes state action is continuing and is supportive, but federal legislation is the big development.

Outside this, states continue to support the growth of cannabis. In the past 6 months alone, cannabis-related ballot measures put to voters last November passed, including those in conservative Mississippi, Montana and South Dakota. State legislatures in New York, New Mexico, and Virginia have approved bills to legalise cannabis for recreational use also.

What is interesting is that at current levels, even without legalisation occurring anywhere else in the world the growth we are set to see in the US alone is significant. The below chart shows that from 2020, the size of the market is set to double in legal US states alone.

2. M&A will continue with consumer interest growing

The recent 10th May announcement that Trulieve is looking to acquire Harvest Health & Recreation for $2.1bn may be an indicator that big marijuana mergers are making a return. This came just after the finalisation of the GW Pharmaceuticals acquisition by Jazz Pharmaceuticals for $7.2bn.

On top of this, we expect to see a further shift towards consumer product companies partnering with traditional cannabis providers to take advantage of markets opening up around the world (reminder Constellation Brands increased its stake in Canopy Growth to 38.6% in 2020). The quote below from Tim Seymour, founder of Seymour Asset Management in New York and portfolio manager of the Amplify Seymour Cannabis ETF supports this view:

Investors want to be invested in cannabis just because it's an exciting social consumption growth story, but also because this massive market will also have the same exposures to software, technology, e-commerce, logistics, big data – all trends that are a major part of investing in consumer trends outside of cannabis.

Conclusion

A number of recent events have brought the sector back into focus. Enthusiasm has tempered, M&A activity is picking up and federal legislation is on the agenda. If you fancy some weed in your portfolio, we would suggest using an ETF approach. We’ve been looking at the Cannabis X ETF.

What we’re reading

Yuan tolerance

The Chinese Yuan has now hit its highest level since 2016, a level that in the past has led to Chinese authorities stepping in and devaluing their currency. A few things are driving this: i) China’s economic resilience through the pandemic, ii) Chinese authorities have been keen to push the Yuan as a means for foreign exchange and reserves, while funds have also been playing ball leading to significant inflows, iii) the continued de-basement of competing currencies in the dollar, sterling, euro and yen. Last year, Morgan Stanley economists suggested the Yuan could become the third largest reserve currency by 2030, surpassing the yen and sterling. Of course, that’s also a trend that has been highlighted by many dollar bears recently. However, whether that actually plays out and on what scale is a different thing. First of all, China is still primarily a net exporter. A stronger Yuan today helps with commodity imports but also makes China’s exports more expensive. Secondly, China has kept a tight grip on capital flows. Despite recent willingness to allow local funds to invest in foreign assets, if anything, President Xi has shown even less willingness to allow big outflows. The Yuan has historically struggled to gain international appeal, how the authorities react to this appreciation is a significant step in whether or not it can gain appeal in the future.

Cashing out of crypto

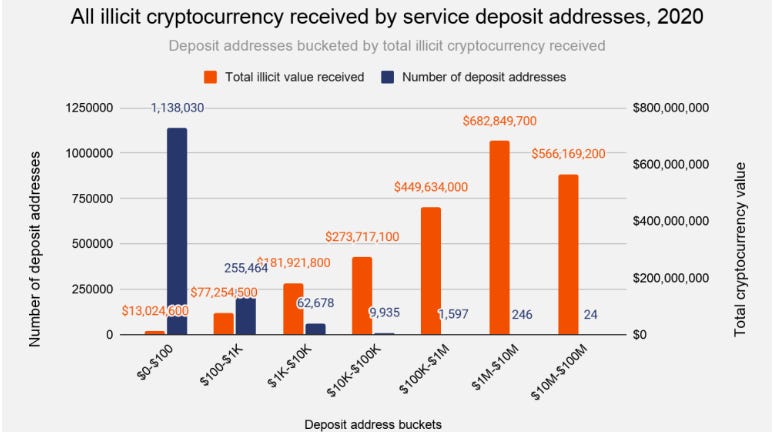

Even if you’re a big time crypto bull, there is a dark side to it that you need to acknowledge. The holdings of the largest crypto assets remain very concentrated and while the exact extent of the issue is hard to ascertain, it is clear that a significant amount of transactions are being used for money laundering to benefit a few. To be clear, money laundering is also a significant issue in the cash economy. That is one of the primary reasons why there is strong appeal from central banks to issue their own digital currencies. The issue with crypto is the current concentration of holdings and appeal for illicit activity. This morning, the FT has a great report on some of the ways anonymous crypto owners are cashing out through the Russian-language Hydra platform on the dark web. Last year, more than $350m in crypto ransoms were paid out to online hackers a la Darkside, the group that hacked the Colonial Pipeline a few weeks ago. But, authorities are cracking down hard and regulation is only going one way.

Cathie Wood’s big picture

Cathie Wood’s strategy has a lot of doubters. But regardless of how you feel about her investing approach, the journey is remarkable. As we discover in Bloomberg’s write-up, she has gone from awkward child to an ETF revolutionary and thematic superstar investor with her ARKK main fund up 150% in 2020 and a further 26% in the New Year. Critics have enjoyed the recent hammering the fund has taken with a number of skeptic crowns getting louder in recent weeks. The recent analysis and price target update for Tesla, with a 2025 “base case” of $3,000 a share, has also added to the angst and questioned the quality of the research team that Cathie prides herself on. But, a lot of this misses the point. The performance over a long period of time now is outstanding and even if you are skeptical, she has nailed the tech acceleration.

JD.com Logistics shares fizzle post initial surge

In a time when Chinese scrutiny of the tech sector is stepping up, we have been closely following the JD.com Logistics IPO to get a sense of sentiment in the space. It was very positive early on with the shares trading up 18% initially, however they pulled back to finish the day up a mere 3.3%, giving the company a market cap of $33bn. As a bit of background, JD Logistics is a spin-off similar to US tech group Amazon’s logistics arm. The company delivers 90 per cent of packages on the same or next day for parent JD.com, its largest customer, but it is increasingly focusing on providing delivery and logistics services to third-party customers. The IPO had already fallen short of initial expectations when the company first submitted listing materials a few months ago and it also came just after JD.com had pulled the proposed IPO of its finch arm amid the regulatory clampdown. For us the reaction suggests investors like the company and believe it came at an attractive valuation, however, the subsequent move once again highlights the cautious stance investors have on the space at the moment