In today’s KnowHow…

Are we seeing an Ag “supercycle”?

The real risk to markets and the world

Supply chain sourcing stepping up

The patent dilemma for COVID-19 vaccines

What happened overnight…

It’s very much a geopolitics theme in markets today and we’ve tried to follow that in Your Daily KnowHow. Three things to focus on: i) the G7 foreign ministers statement is turning up the temperature on China, ii) big Pharma is being told to give up COVID-19 patents and iii) the EU is laying out it’s strategic Industrial Strategy. Lots of jobs and industrial data coming out through the data and quite a few Fed speakers so expect the market to be wobbly. Still, this morning, futures are up marginally and European markets also in positive territory. It’s very a much a “looking for direction” day.

Chart of the Day

The G7 foreign ministers communique overnight is a reminder of how the world’s views of China have changed post the pandemic. We discuss this in more detail in What we’re reading. This chart is for the US but PEW have done similar analysis for many countries across the world. The theme is generally the same in most developed economies.

Analysis

Are we seeing an Ag “supercycle”?

2021 has been a year of decade long highs in commodities. One space that many investors believe could run even further over the next 6-12 months is in the agricultural space.

Demand will likely continue to outweigh supply as China continues its current import strategy, consumers eat out more after a year of lockdowns while supply is currently impacted by the Brazilian drought. The knock-on effects for a number of companies could be substantial. Key agricultural commodities including grains, oilseeds, sugar and dairy have also jumped, with corn prices above $7 a bushel for the first time in eight years.

Key Developments:

We’re focusing in on Corn but this is equally the case for Soy, oilseeds, sugar and dairy as mentioned above. As you can see in the chart below the price of corn has almost doubled this year. The main driver of this is China after moving to a free market policy a few years ago. In the past, the country has imported c7/8Mt of corn a year. On current estimates we think for the current importing season (ends Sept) China could import over 30Mt, nearly a fourfold increase in imports.

On top of this, we have seen a number of supply issues including storms in the US, droughts in Brazil and for the Safrinha crop. Supply is simply unable to keep up with demand with this theme likely to continue throughout 2021, into 2022.

To contextualise the issue, the tightness is now impacting the wheat market which is a substitute for corn…

Will this continue?

The big question is whether this is the start of a ‘supercycle’ with prices remaining this high for the foreseeable future. While the points made above suggest that the Supply / Demand imbalance will remain and therefore support prices there are a few points to make tactically:

(1) long / short ratios among Hedge Fund managers are around 15x versus the 5 year-range of 2x. This isn’t to say that this cannot increase further but to us, positioning has already become very extended and supported by speculation.

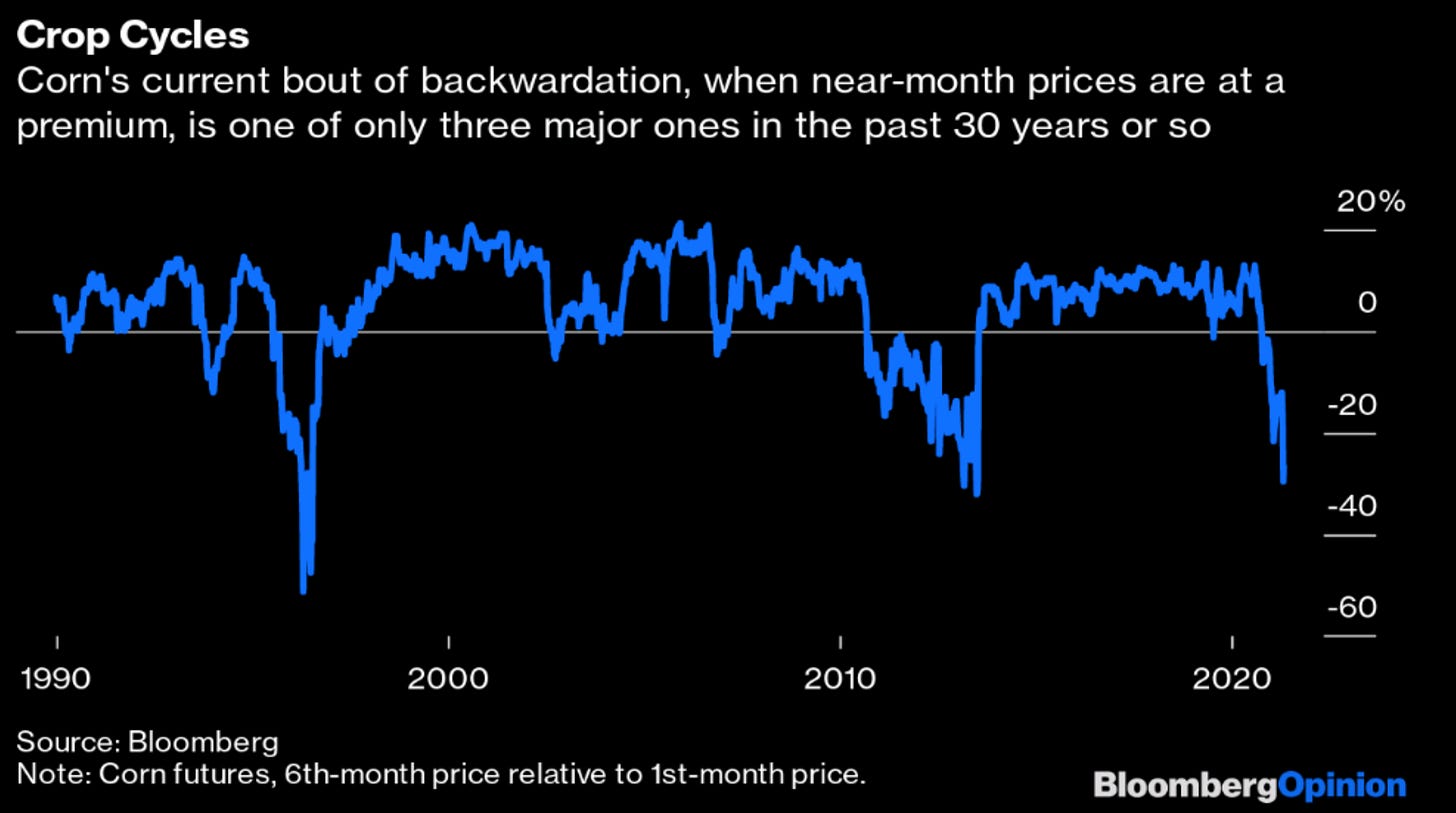

(2) backwardation at these levels have historically reversed in the past: we have used the BBG chart below but in short, time spreads (the difference between the first and sixth futures prices) have widened sharply. The discount on the sixth-month contract is the deepest since 2013 and only one of three such periods of steep backwardation since 1990. In the previous occasions, prices dropped by c1/3 in the proceeding 6 months.

(3) supply coming on? We have recently seen the greatest amount of producer hedging in about 25 years which suggests that plenty of supply is coming our way. While partial hedging is clearly prudent at this time, the scale of hedging suggests that producers don’t see these abnormally high prices as sustainable and want to cash in.

What does this all mean?

While we caution that prices may be at extremes, the structural shift in the market driven by the Chinese free market reforms has raised the floor in Ag prices and in particular corn prices. As a result, we expect prices to remain elevated in the future and farm profitability and investment to see a positive step change. Bearing this in mind, there are a number of ways this can be played either directly through stocks or indirectly through farm machinery manufacturers. It’s a theme we like. Keep your eyes peeled for the Syngenta IPO.

What we’re reading

The real risk to markets and the world

We’ve only commented briefly on the rising tensions with China but last night’s G7 statement from the foreign ministers is a pretty good time to take a look. Much of what was highlighted in the statement isn’t new… they talk about:

a need for China to participate in a “rules-based international system”,

human rights abuses in Xinjiang and the need for open access to the UN

free and open trade policies

Taiwan, although they stop at WHO participation

Hong Kong and the removal of the electoral system

cyber abuse

But, all this sets up a more detailed dialogue ahead of the G7 leaders summit in the UK next month. A lot has been written about these growing tensions. Whether it is China-Australia on COVID-19 investigations and trade tensions. EU-China on industrial IP theft.

As the temperature rises, many of these dialogues and statements will irk Beijing and potentially unravel a more aggressive policy response. And, we have a catalyst… it is Taiwan. The Economist’s edition this week captured this very well. For the world and markets, Taiwan is the most dangerous place on earth.

Supply chain sourcing stepping up

The EU published the update of it’s 2020 Industrial Strategy yesterday, something we had already highlighted in Your Daily KnowHow. The update/new post-pandemic objectives that they highlight are: i) the need to analyse and address strategic dependencies in technology and industry, and, ii) investing more in the green and digital transition.

That agenda is a focus for almost every economy globally after the recent supply-chain disruptions, not just the EU. But these two charts below are interesting and the real focus in our view. If you looked at the EU imports on an overall basis, the chart is below from Trading Economics.

But, in its document, the EU highlights its dependency on 137 core products or essentially raw materials, batteries, chemicals etc. That dependency mix is very different.

It also highlights the complexity of supply chains. And, as governments focus on sourcing and diversifying supply, there will be increased investment and competition for these resources. This is a core investing theme in the years to come in our view.

The patent dilemma for COVID-19 vaccines

Big Pharma has dealt with reputation and public perception issues for years. But, the pandemic was supposed to be the crisis that made the world realise how valuable their intellectual property and investments were. The success and speed of the mRNA vaccines could also be argued as a vindication of the US system… higher drug prices but with greater investment in technology. But, this is all starting to go a little pear-shaped.

Yesterday, the Biden administration announced that it supported a waiver for patent/IP protection for COVID-19 vaccines. This is an issue that was proposed at the recent WTO meeting by both India and South Africa. There is now decent support for it across many countries that are desperate to access the vaccine. But, it also sets a very dangerous precedent as Pfizer CEO, Albert Bouria, is arguing in the WSJ today. Plus, as the EU has been arguing, the IP around the vaccines isn’t really the issue. The bigger problem has been sourcing of raw materials and supplies.

This was supposed to be Pharma’s big comeback. But it is getting messy. Look at the performance below YTD of the Bloomberg Pharma Index vs. S&P.