In today’s KnowHow…

The pain trade

Apple’s Epic court battle…

The Sage sees inflation and euphoria

The unwind of the SPAC boom

Ethereum just getting started?

What happened overnight…

Yesterday was one of those days that would make many market participants go… huh!?Yields edging lower and growth stocks getting hammered as the market demonstrated its enthusiasm for re-opening again. But then, it was the start of May. It’s also exactly why focusing on daily noise is not our style but we have offered up some thoughts on the Growth-Value trade in our analysis. Today does look like much of the same with tech leading the way down in Europe and the Nasdaq futures trading down in the US. Oh, and then there’s that whole Ethereum situation which hasn’t gone un-noticed.

Chart of the Day

The chart below is from the excellent Callum Thomas at Top Down Charts. There’s a lot written around margin debt and potential leverage of retail investors in equities today. We’re skeptical on many of the data points but this demonstrated it very clearly.

Analysis

The pain trade

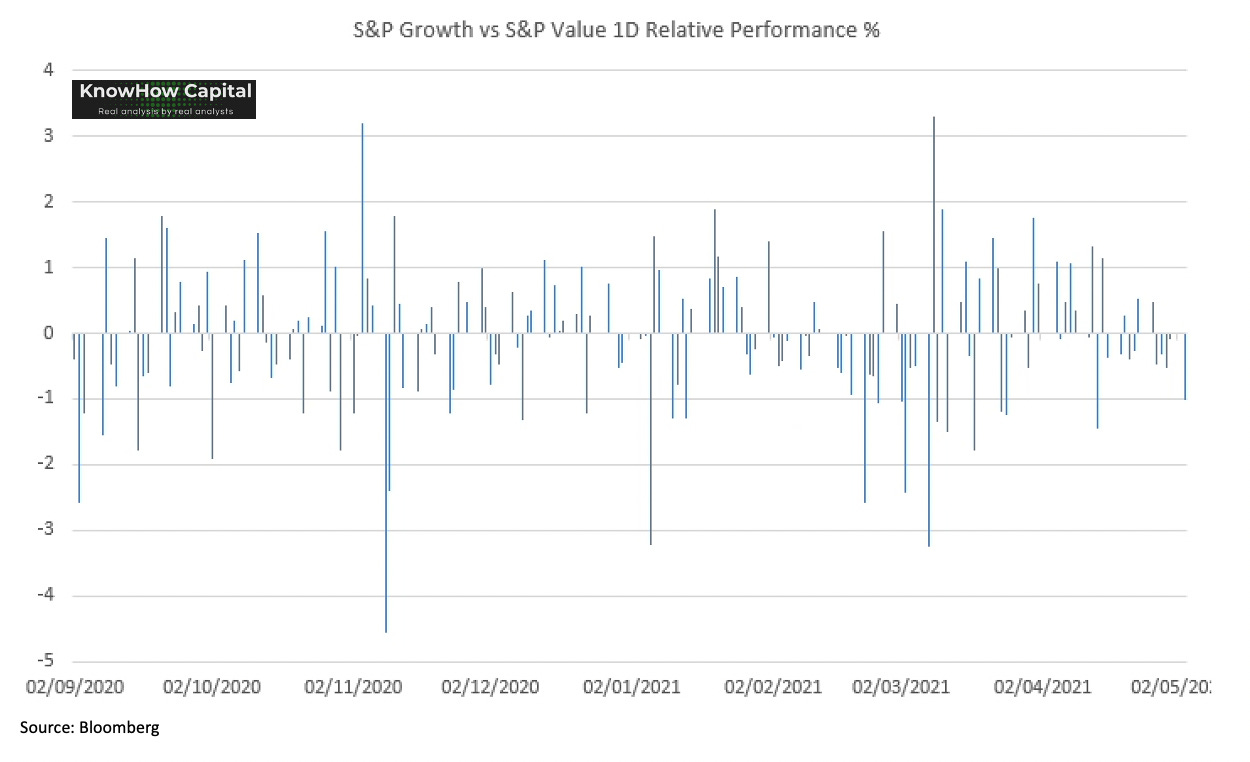

If you like your factoids as much as we do at KnowHow Cap, you’ll appreciate this one. Yesterday’s growth-value “pain trade”, was the 29th time this year that we have seen a more than 1% relative move in either direction for growth stocks or value stocks. Not impressed? Here’s another one. At this point last year, pandemic ‘n all, we had only seen 20 such moves. Tell that to the Vix traders that tell you volatility has gone down this year. No way sir.

In terms of overall size, looking at the S&P Value vs S&P Growth, the move was barely over 1%, so it was hardly all that dramatic as the below chart shows. However, these moves are becoming more concentrated around positioning as we have highlighted in recent weeks. Hence, they feel more dramatic and painful.

Our view in recent weeks has been that value and cyclical stocks have become extended versus growth stocks in the short-term. Our preferred way of assessing that is to look at breadth of performance across the two sets of factor indices.

There are two things to bear in mind when looking at these charts:

it doesn’t mean growth is due a snapback, merely that the ability for cyclical stocks to keep performing is waning as we saw through much of 2016-18. Some of our trusted cyclical indicators are already suggesting that is the case,

many equity strategists will use market breadth as an indicator for a health equity market with scope to keep performing. That is correct. However, in periods of uncertainty (remember our “uncertainty” comment from last week), we think the current breadth across the market indicates complacency and lack of differentiation. But, that is across the entire market, not just growth stocks.

What we’re reading

Apple’s Epic court battle…

Epic Games, the video-game developer behind the runaway success “Fortnite”, kicked off its case against Apple yesterday. The terms to which developers must agree in order to sell their wares in the App Store on Apple’s iOS devices are a constant source of gripes. Link here to how Apple’s and Epic teed up their arguments yesterday.

In August 2020, Epic enabled “Fortnite” players on iPhones to make cheaper in-game purchases (such as V-Bucks, the game’s internal currency) if they paid directly instead of through Apple’s App Store, which takes a 30% cut. In return, Apple booted “Fortnite” off the store but Fortnite had a lawsuit ready and waiting. The money at stake explains EPIC’s willingness to do battle. “Fortnite” players have spent more than $1.2bn in the App store in the two years since it launched. On top of this, Apple has loosened its grip for other companies. Amazon now do not pay 30% commission on in-app purchases for its Prime Video streaming app.

The case will hinge on how the court defines the relevant market. Apple sees itself as one of many players in the games-distribution market who also charged 30% with some charging more (See below). Epic takes a narrower view, arguing that the App Store has a monopoly on selling iPhone apps.

The Sage sees inflation and euphoria

A few things stood out to us from Berkshire Hathaway’s annual meeting last week. Firstly, Greg Abel is Berkshire’s 58-year-old vice-chair and CNBC confirmed on Monday that Munger’s hint at the meeting was indeed a nod that Abel is next in line to take over. It was already known that a succession plan had been drawn up by the board, but the heir apparent had been kept from the wider world.

Outside the succession plans, Warren Buffett has warned of inflation hitting the US economy amid a “red hot” recovery from the worst of the coronavirus pandemic. Given all the messaging through earnings, no surprises then that his portfolio companies were “seeing very substantial inflation” in a range of sectors amid shortages of raw materials and high savings among those who kept jobs. But, the Sage also took took aim at signs of over-exuberance across the financial markets, with potshots fired at bitcoin, so-called Spac investment vehicles and the share-trading app Robinhood. Full thoughts on all these here.

There has been a lot of shade-throwing at Warren Buffet’s performance in recent years. But, these aren’t normal markets and the real proof of the pudding will be how his performance stacks up once volatility stabilises. It has stood up well in the past.

The unwind of the SPAC boom

We have spoken at length on Spacs in the past so many will already know our thoughts but this long-read in the FT today runs through everything you need to know on Spacs and the current difficult environment. Over the past year, Spacs have raised eye-watering sums of money, creating a $142bn pool of capital looking for merger targets. By setting up as a merger rather than an IPO, the acquired company has a lot more scope to portray its story and future forecasts without the due diligence of the IPO process. But, the appointment of Gary Gensler, the former head of the Commodity Futures Trading Commission, to lead the regulator has rightfully put the market on edge. There’s also a growing number of short-sellers and lawsuits to boot.

April was the slowest month for Spac issuance since June 2020. Two-thirds of blank-cheque companies without an announced deal are now trading below the $10 price at which investors purchase shares during IPOs, in stark contrast to the market’s peak, when Spacs largely traded at premiums.

Ethereum just getting started?

We’re not crypto experts but we’re not shy of dabbling in the odd coin here and there. It’s fair to say that Ethereum’s record-breaking run has even got us on the edge of our seats. The token is up about 1,500% in the past year and hit a new peak of $3,455 on Tuesday. Plenty of bulls out there believe Ether is just undervalued given the development activity on the network through this year. But, on an RSI it certainly looks like it has run pretty far. Where to even begin?!