The real inflation winners | the problem with carbon taxes | keeping up with the growth-value rotation PLUS Ford & Big Tech

Your Daily KnowHow

In today’s KnowHow…

The real inflation winners

Carbon pricing hitting EU industry hard

Keeping up with the growth-value rotation

Big Tech shows its quality…

Ford plans to manufacture own batteries for EVs

What happened overnight…

We had blowout earnings from big tech, JPow is telling us tapering is still a while away and even President Biden is chipping in with some fiscal spending. How could it possibly be anything other than a green day after all that? Futures are up this morning also despite treasury yields pushing on. The 10-year has gone through 1.65% and Dr Copper (must mean inflation is on tear, god forbid) $10,000/tn this morning, its highest level in 10 years! The US GDP print will be out shortly consensus expecting the US to have grown at 6.6% in Q1.

Chart of the Day

Just like Alphabet the night before, Facebook kicked off its 2021 reporting with a 40% beat of analysts estimates driven by a huge uplift in advertising spend. Now, the company has suggested that will continue into Q2 before slowing down in Q3 and Q4… that seems reasonable. Plus, the new Apple privacy policy will also start to have an impact. Marketers will want to reassess their marketing returns. However, remember our Google comment from yesterday. Digital vs offline advertising spend is still not that dissimilar in size. While Google and Facebook represent nearly 50% of digital spend, we believe the offline to digital process is accelerating post-COVID. We prefer Facebook on valuation grounds.

Analysis

The real inflation winners

Over the past few days, there has been a definite willingness for the market to again flirt with the value rotation. There are a couple of reasons for this:

yields have started to edge back up in anticipation of the American Families Plan and some of the recent US data, including consumer confidence has been robust. You can see this in the recent US 10yr move

commodity prices continue to rise driven by tightness in supply. The chart below has been cited by a few economists in the past few days

No structural inflation until the job market is repaired: Fed

Yesterday, the key message from the Fed was acknowledging that inflation had started to pick up. However, in the same breadth they pointed out that this would prove to be only temporary. Jay Powell’s post-statement presser made clear that in their view, structural inflation would be driven by a healthier jobs market and real wage inflation. That bears out in the data, see the chart below.

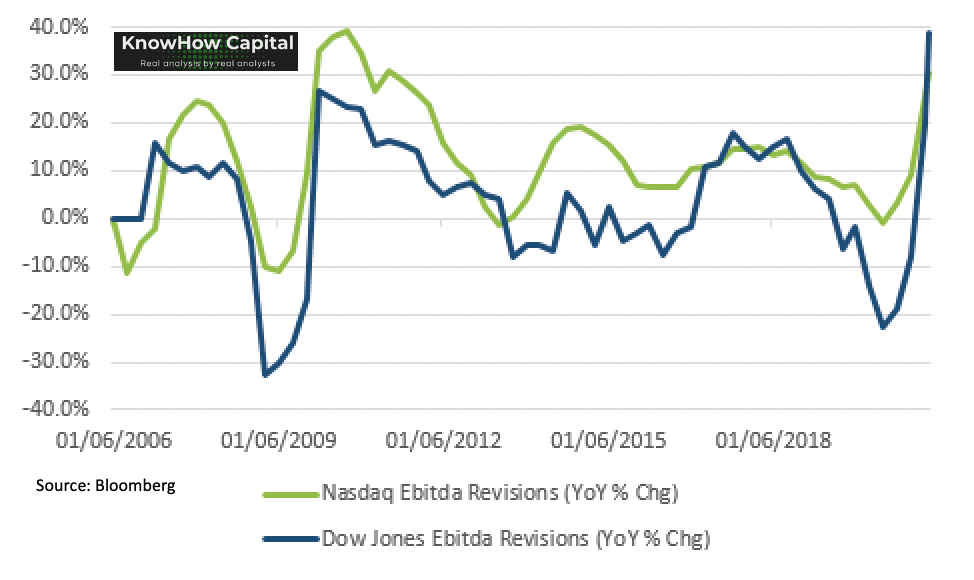

Short-term Ebitda revisions have driven the value rotation

But, what does it mean for the value rotation? There are essentially two drivers of the value rotation: i) an initial greater cadence of positive earnings revisions for cyclical stocks as we come out of a recession, and ii) a higher multiple re-rating as the market anticipates a more sustained cyclical recovery. The market wants to flirt with ii) but in reality, all we have seen to date is i). See chart below.

Inevitably, over the coming months as the data continues to improve and we hopefully wrestle back control of this virus on a global basis, there is likely to be continued optimism around a more sustained recovery. We maintain that the short-term path for yields should be closer to 2% on the US 10yr and real rates should continue to head higher too.

But cyclicals will face inflation and supply chain pressures. Big Tech wins.

However, one of the obvious themes coming out of earnings season is input cost inflation and supply/logistics disruptions. Hiring quickly is also proving to be a challenge. This is not surprising. As economies come out of recessions, activity picks up but margin pressures also start to come through without a more complete economic recovery.

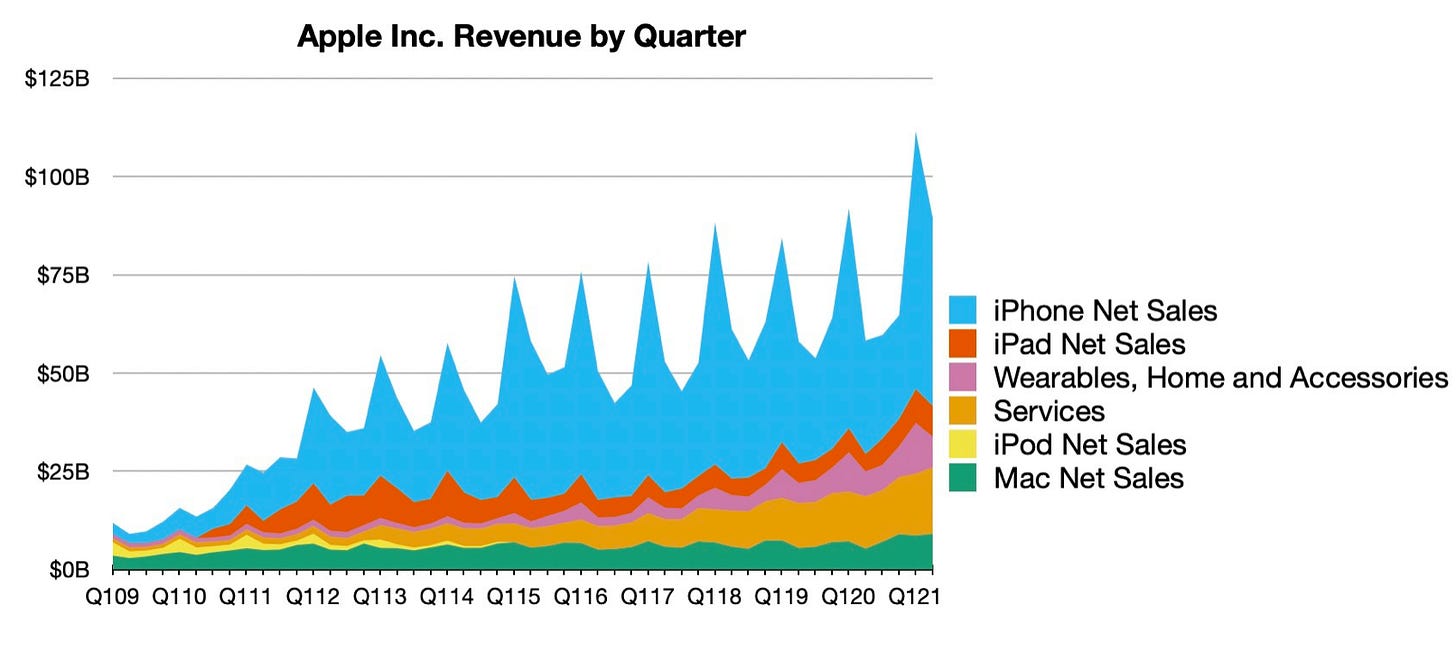

Have a look at the chart below of Ebitda margins plus forecasts for the Nasdaq vs Dow Jones. Essentially, we’re comparing margin profiles of Big Tech vs cyclicals. You’ll see that the cadence of margin improvement is greater for cyclicals post a recession. However, what we have seen through Big Tech reporting is that despite inflation pressures in the wider economy, their margin profiles continue to expand through scale. They are the real inflation winners in our view.

What we’re reading

Carbon pricing hitting EU industry hard

Tomorrow, we will write a more thorough note on this week’s FT Hydrogen Summit. But, ahead of that, we’re doing a lot of carbon/energy reading. One of the drivers of making Hydrogen more cost competitive vs other forms of energy is higher carbon prices. Tracking carbon prices is important and given the move we have seen since the pandemic started (up over 100%), we thought this article was interesting.

European industrial groups have stepped up calls for the EU to hasten the introduction of a carbon border tax as record prices for CO2 allowances raise the cost of polluting in the bloc far above any other region. The big issues is that for industries, from cement to petrochemicals, the rally could starve them of funds to invest in decarbonisation.

ArcelorMittal, one of Europe’s largest steel producers, said that without a global carbon price the EU would need to implement a carbon border tax on imports from beyond the bloc if the industry was to remain competitive. Together with a carbon border tax, heavy industry trade associations are urging the EU not to reduce the allocation of allowances for energy-intensive sectors too quickly. “It is a fine line between encouraging investment and stifling it,” said Ineos, the privately owned petrochemicals group.

Keeping up with the growth-value rotation

We have spoken at length about the growth / value debate (the Schroders chart below has the performance since November 2020) so we thought it was interesting to see that investors in a $15bn exchange traded fund are being warned to brace for a major rebalancing at the end of May that could see Amazon, currently one of the top 10 holdings, removed from the index altogether.

The cautionary advice on the iShares MSCI USA Momentum Factor ETF (MTUM) from CFRA, a research consultancy, might not come as a complete surprise to those who have been monitoring the market rotation away from growth to value companies.

MTUM is currently heavily weighted to growth stocks in the broader information technology sector, which accounts for 42 per cent of assets. It has minimal exposure to traditionally value-oriented financials, at 1.5 per cent and no energy sector holdings at all. CFRA expects financials such as Wells Fargo and Capital One to be added in the next rebalancing when it forecasts exposure to financials to rise to the mid-single digits. Other stocks at risk of ejection include Costco Wholesale, Netflix and Nike.

Big Tech shows its quality…

We have been saying for a while that FAAMG’s will continue to outperform and last night highlighted just that.

For Apple, the key is that the company is likely to benefit from a multiyear 5G cycle n accelerating digital transformation driving demand for its products and services, as more people work and learn from home, and eventual new product categories. Apple’s goal to be net cash neutral over time means investors can expect an additional $83 billion in cash to be returned through buybacks and dividends or otherwise strategically deployed.

As we discuss above, it's already been clear in recent weeks that digital-advertising companies are benefiting from a surge in ad spend from marketers. Starting with better-than-expected results from Snap last week and even Pinterest saw ARPU coming in strong. That’s not to say that there aren’t Big Tech headwinds. Along with regulation, global tax regimes and debate around whether advertising spend can be maintained, the new Apple privacy policies will also have an impact . Facebook commented that Apple’s new policy will lead to “ad targeting headwinds” with the changes “to begin having an impact in the second quarter”. We will write more on some of these bear debates over the coming days given we have a more positive view on Big Tech.

Ford plans to manufacture own batteries for EVs

Ford Motor Co. is getting into the battery-making game with plans to invest $185 million to develop its own lithium-ion batteries for electric cars, the latest auto maker to bring the critical technology in-house as the industry rushes to sell more plug-in cars.

Ford’s new facility will not be a full battery cell production facility like Tesla has or General Motors has announced as part of recent $4.6 billion investments in the U.S. However, like many global automakers who have been stung by computer chip and other supply chain shortages, Ford wants to make sure it has enough batteries for what it says is an accelerating transition away from internal combustion engines.