If you find our work valuable, please like, subscribe and share. We rely on that to grow our subscriber base. This is real analysis by real analysts. Enjoy!

In today’s KnowHow…

These are the data points to watch

The UK’s third wave?

Private equity groups on diverging paths

U.K. House Prices Continue to Boom

What happened overnight…

Markets have kicked off June on the front foot post strong data coming out of Europe (more below). The Stoxx Europe 600 is up over 1%, as cyclicals outperformed while S&P and Nasdaq futures are both in the green following the US holiday. Looking ahead and US manufacturing data for May will likely provide further clues on the state of the recovery, as will the NFP’s at the end of the week (more below). Outside equities, commodities and oil have both jumped driven by increased optimism around the recovery. WTI crude futures have now risen to their highest in more than two years.

Chart of the Day

Given it’s a big macro week and the inflation debate will no doubt be getting many of us excited, we thought this chart from the FT brilliantly captured what has been getting so many of the hawks anxious in recent weeks. The cost of their breakfast…

Analysis

These are the data points to watch

As we head into June, the rhetoric of ‘Sell in May and Go Away’ could not be more relevant with most global markets up over 10% already year-to-date. While we remain wary given the speed of the rally this year, a few data points in the next week or so will give us a sense of where the markets will go from here over the summer.

PMIs are strong but are they peaking?

We have had a whole lot of manufacturing PMI data out overnight and we’ve been digging into the releases of some of the key manufacturing economies: China, Japan, Taiwan, Germany. When we’re thinking about transitory inflation, one of the key areas we are following is the inventory build being reported in PMIs. If inventory pressures start to ease, then the rate of manufacturing recovery should slow and subsequently, we should see demand pressures ease across the whole value chain including commodities. This recovery has played out at a much faster pace than any recovery in history. Instinctively, we therefore also expect it to reach maturity faster. There are signs in today’s PMI data that we are nearing that point though, it is worth noting that in Europe activity levels remain very high. The message from most of the PMIs this morning is fairly consistent: i) manufacturing demand remains strong though in most cases, it is stable or slightly softer vs April, ii) supply chain disruptions, particularly in Germany and Taiwan, are weighing on the level of activity, and iii) pricing pressures keep coming through.

According to IHS Markit this morning, purchasing activity rose at the fastest pace in nearly a quarter of a century, manufacturers ran down inventories of finished goods to the sharpest degree recorded since November 2009. On top of this, factories lifted their prices by the most in more than 18 years of survey data as they took advantage of the tight market to pass on higher costs to customers. This, in our opinion will continue to fuel the debate around inflation over the coming weeks and whether the recovery in Europe will be strong enough on its own or whether the ECB needs further support.

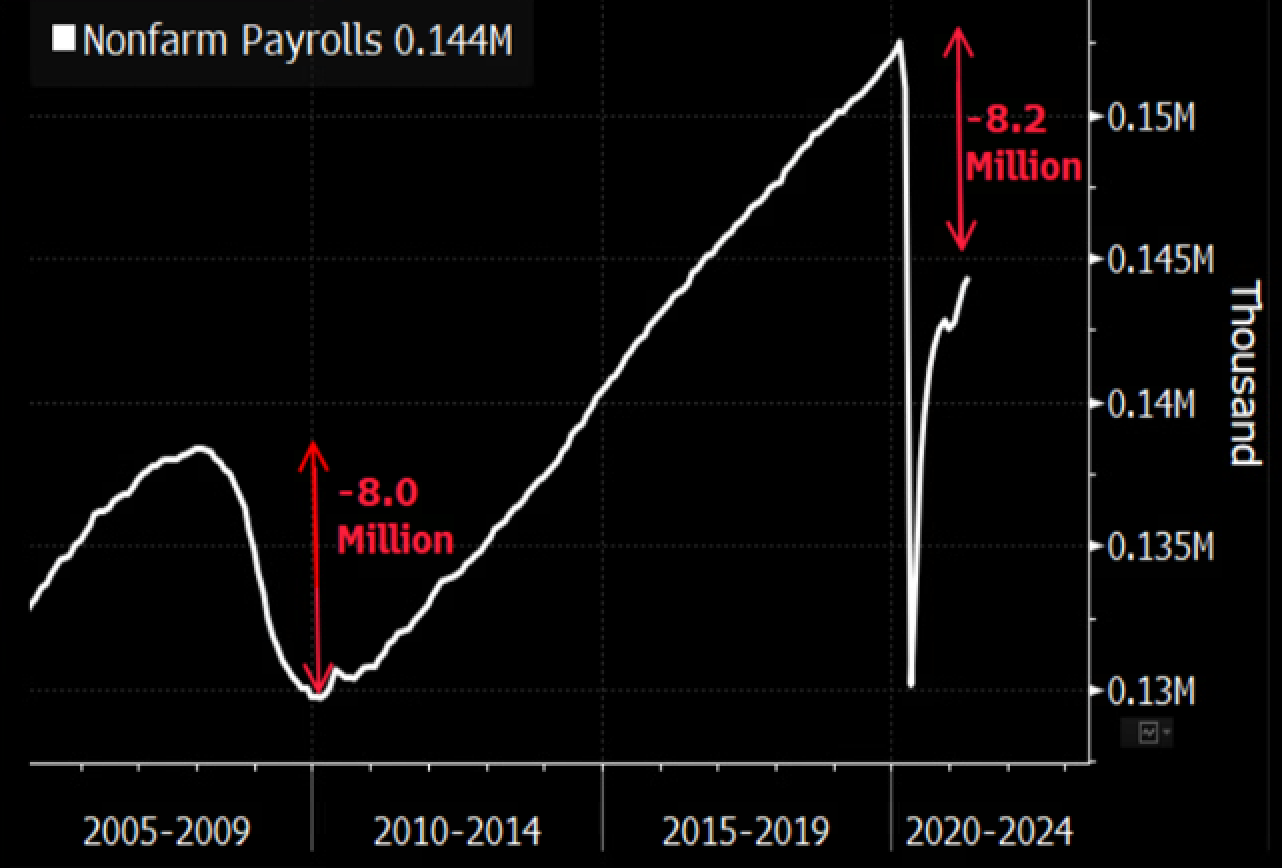

What to expect from the NFP’s?

For the Fed, unemployment will dictate policy direction even more so than manufacturing activity and some of the inflationary pressures we have touched on above. The big miss in NFPs in April has been chalked down as a one-off by many market participants. As a result the NFP’s print on Friday will be very important for many in determining what message the Fed may give over the summer and as we head into Jackson Hole in the Autumn. Consensus expectations for May are at 663k with some estimates higher at 850k post the 266k. A strong print will likely increase the debate around whether this value rotation still has legs in the near-term.

What to expect from the ECB?

The ECB’s job is a little tougher than that of the Fed’s in our view. The speed of the recovery in Europe is still very much unknown given the slower vaccine rollout and with European economies all experiencing different speeds of recovery, the post-pandemic support from the ECB will be very important. Without further support, we think Europe alone will not have enough momentum to recover to pre-pandemic levels with genuine reflation unlikely.

As a result, at the end of next week, the ECB needs to come out with further support to close the large demand gap and bring inflation back to the ECB objective in the medium-term. It is the endpoint for the recovery that should matter for the ECB rather than the journey of how we get there. Inflation over the summer will likely overshoot but without further ECB support, we remain wary over the full scale of a European recovery.

Conclusion:

Post the strong prints today, the events above will be very important for the recovery. A strong NFP print on Friday followed by a supportive tone from the ECB will likely do enough to drive the markets higher in our opinion, however we remain wary of both coming through.

What we’re reading

The UK’s third wave?

There has been a ton of speculation in the press over the long weekend around what appears to be a third coronavirus wave in the UK driven by the recent Indian variant, or delta as the WHO has named it this morning. Last week, we highlighted a map of the UK in our Chart of the Day series showing how new cases of the Indian variant had started to rise rapidly in pockets around Glasgow, Manchester and Birmingham. Over the weekend, government adviser, Prof Ravi Gupta has suggested the government delay its full economy reopening, planned for 21-Jun, by a few weeks. There’s a couple of things to consider here… i) cases are rising in the UK but considering most scientists would suggest the Indian variant is even more contagious than the December UK variant, overall case growth is hardly alarming. Clearly, there is a vaccine and summer effect at play here, ii) the UK government has been bruised by the recent Dominic Cummings affair. The former head adviser to the PM has nothing short of accused him of causing thousands of unnecessary deaths. On the data as it stands, the politics will likely have a bigger sway on any potential re-opening delay than the actual case numbers.

Private equity groups on diverging paths with post-pandemic bets

It has already been a very big year for PE companies and the deals don’t look likely to slow down anytime soon. This article in the FT though is an interesting look at how the PE groups have built up sharply different portfolios before and during the pandemic. Apollo used its $323bn credit division to plough billions of dollars into the travel industry last year, throwing a lifeline to online travel agent Expedia, helping Mexico’s national airline Aeroméxico look for a way out of bankruptcy. Other investors have staked their cash on spotting long-term changes accelerated by Covid-19 that they believe will reshape life for years to come. In particular, Carlyle is helping to finance a transition to telemedicine, via companies such as One Medical, which provides doctor consultations and other medical services to employees at more than 8,000 companies and received investment from Carlyle in 2018.

At Blackstone, lockdown tested the survival prospects of some of its live entertainment assets, which include the Bellagio casino in Las Vegas, the Great Wolf Resorts chain of indoor water parks, and Legoland owner Merlin Entertainments, which also operates dozens of Madame Tussauds wax museums and Sea Life aquariums. Blackstone is also putting money behind transitions that have been hastened by the pandemic, including physical assets whose value has grown along with consumers’ increasing time spent online. “We bought $100bn worth of warehouses, what we call the last mile” for ecommerce logistics, said Gray. “We love [media] content, so . . . in the physical world buying studio space.”

U.K. House Prices Continue to Boom

U.K. house prices recorded double-digit growth for the first time since 2014 last month, as the nation’s booming market showed no signs of cooling. Prices climbed 10.9% from a year earlier, Nationwide Building Society said Tuesday, with the lender saying the increase has been driven by buyers shifting their preferences in the wake of the pandemic. On the month, prices rose 1.8%, double the pace economists had expected. In an interview with the Guardian Tuesday, Bank of England Deputy Governor Dave Ramsden said the institution is carefully monitoring the U.K.’s booming housing market as it weighs the possibility that a rapid recovery from the pandemic will lead to sustained inflation. He said “There is a risk that demand gets ahead of supply and that will lead to a more generalized pick-up in inflationary pressure. That’s something we are absolutely going to guard against.”