“If you owe the bank $100 that’s your problem. If you owe the bank $100 million, that’s the bank’s problem”

What is in today’s daily?

Today we highlight why it is important to appreciate the different make-up of this economic recovery. It means that inflation expectations are far more under-pinned than previously. Plus… Coinbase who? The big US banks are putting down some stellar numbers in the face of some of the new guard.

What did you miss overnight?

Asian markets were mixed on Thursday. The Hang Seng lead China market losses driven by internet names seeing renewed selling. Elsewhere there was little to report in a muted Asian session. Over in Europe and equities climbed as ABB boosted sales guidance, miners rallied and Publicis posted strong results. In the US, futures rose as US banks continues to post very strong results (see below for details). The ruble slid as we await action from the Biden administration against Russia individuals and entities in retaliation for the SolarWinds hack and US election misconduct. In terms of releases, US Jobless claims and retail sales will be closely watched today. Finally, Bitcoin fell back from an overnight record while Coinbase climbed 11% in pre-market trading

Chart of the Day

Thanks to Daniel Lacalle for highlighting this Bloomberg chart on Twitter. It turns out, it’s not just America’s recovery.

This recovery is different

When thinking about the upcoming economic recovery, and any economic recovery for that matter, there is a tendency to reflect on previous recessions as a guide. As a starting point, that is perfectly reasonable. If you do that, you will see that economic recoveries in the US, and developed world, have become shallower and shallower. There have been structural trends driven by demographics, globalisation and technology which have tended to weigh on particularly the consumer part of the economy. When the Fed talks about inflation expectations being anchored, it is this that drives much of their thought process.

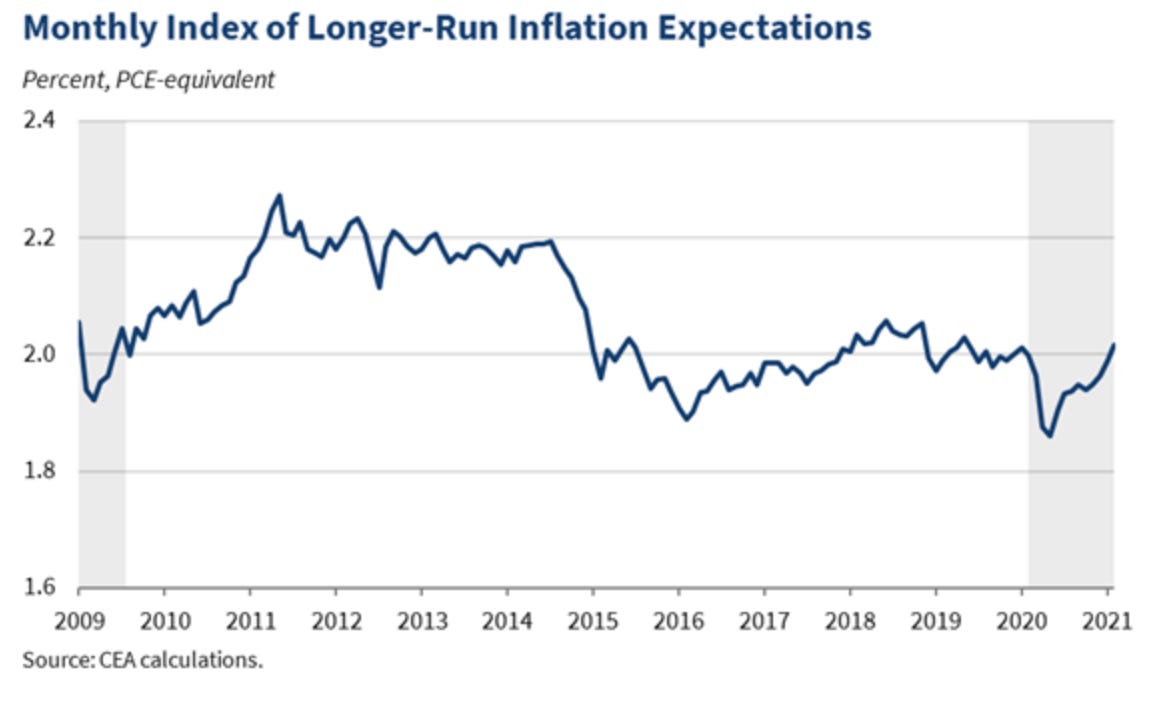

Below is a chart from Jared Bernstein’s inflation blog earlier this week for the White House. Broadly, it suggests long run inflation expectations have returned to pre-pandemic levels. We would suggest that there is a much higher probability today that they rise comfortably above pre-pandemic levels.

As a starting point, we have commented previously on the sheer size and make up of stimulus in the system, see chart below. Unlike post the GFC, we also believe there is greater political appetite to do even more.

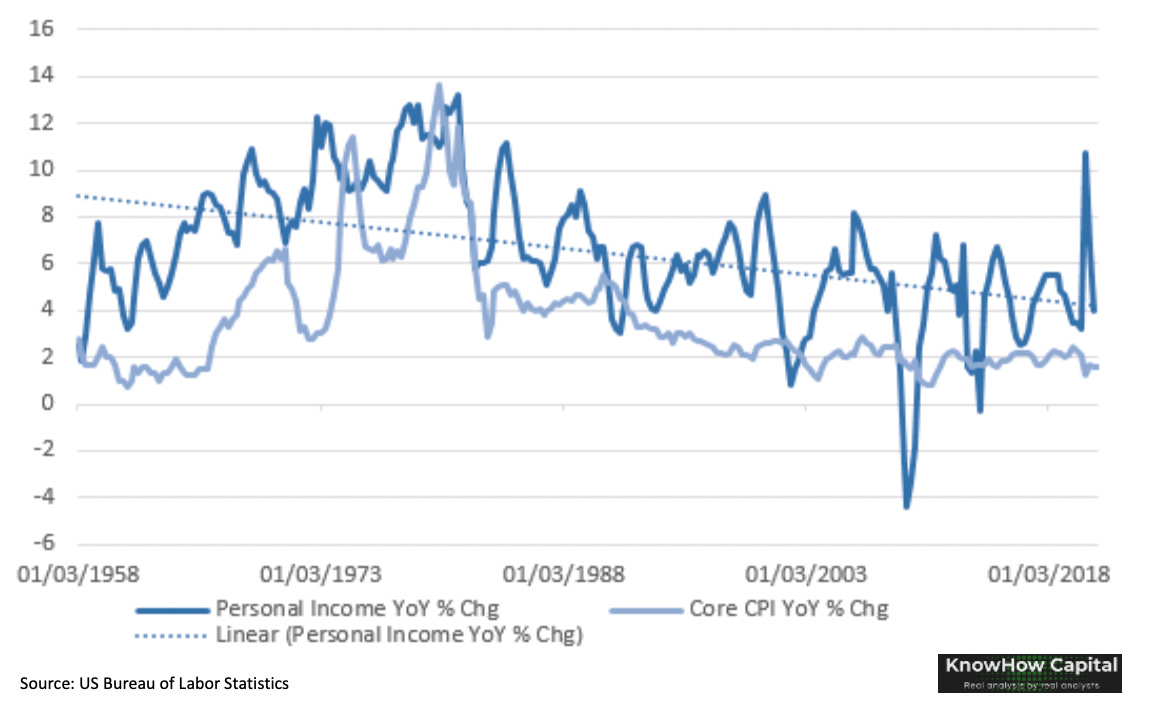

However, the biggest driver of long run core inflation is wage growth which has been structurally in decline in the US for almost 50 yrs.

Many of the headwinds to wage growth, particularly technology, still remain in place of course. But it is important to appreciate that unlike a typical boom-bust or business cycle recession, this recovery is seeing a much more rapid pick-up in hiring activity, expectations and demand. If that sustains, inflation expectations should continue to rise and as we have been pointing out, the equity market will remain choppy.

Forget about Coinbase, here’s some real profits

On a day when all the fuss was about the Coinbase IPO, a couple of little known US banks decided to publish their own first quarter results. From a headline perspective the conclusion was simple: Bank earnings hit record highs in 1Q21. Looking at stock specifics: GS posted records in quarterly revenue and profit, JPM also posted its highest quarterly profit in record, Wells Fargo also enjoyed its best-ever quarterly profit in corporate and investment banking and BoA have continued this theme this morning. And all the while, we thought traditional banking was done!

Outside of the headlines there are a number of other points worth highlighting:

(1) Strong performance set to continue: David Solomon (GS CEO) stated that ‘activity levels continue to be elevated from what I would say was a pre-Covid activity level by a meaningful amount’ pointing to the ‘environment, the monetary fiscal stimulus, and in addition to the economic recovery’ as the drivers of this outperformance.vThe better news for investors is that the core Wall Street businesses do not need to use substantially more capital to generate the type of earnings we are currently seeing. Take for example JPM. The banks corporate and investment banks RoE was 27% in Q1 vs just 14% in 2019.We think the outperformance is likely to continue into 2Q and potentially for the rest of the year.

(2) Consumer sentiment is normalising: another important point to note are the positive comments from the CEOs on the normalising of the consumer environment. Jamie Dimon (JPM CEO) stated that: ‘Consumer sentiment has returned to more normalized levels, reflecting increased optimism. We've seen debit and credit card spend returned to pre-pandemic levels, up 9% year on year and 14% versus 1Q '19, despite T&E remaining significantly lower.’ To us this is very important as it highlights there is considerable pent-up demand in the economy. As travel and entertainment continues to recover, spending will surpass pre-pandemic highs. The chart helps highlight below the consumer spending splits in 2019 for context.

(3) Consumers keep investing: This chart below from BoA this morning was very interesting. It shows that while trends in loans and leases continues to decline (JPM also mentioned this yesterday), consumers have continued investing in assets (bottom right chart). This to us is positive for now although we warn against this growing too fast against average deposits going forward.

(4) Reserves for credit losses released: While this was expected, we got confirmation that banks are releasing reserves they built over the last year in anticipation of potential credit losses. Defaults over the last year haven’t hit anywhere near the levels feared by the street and JPM released $5.2bn worth or reserves in Q1 while Wells Fargo released $1.6bn. BoA have also announced $2.7bn this morning. This again reiterates confidence in the economy going forward and we should see this continue throughout the year in the US and Europe.