“Boy, that escalated quickly... I mean, that really got out of hand fast. ”

What is in today’s daily?

We have some thoughts on yesterday’s price action and whether there were signs of Euphoria in the market. Outside this, we note that the backdrop for IT spend is more supportive than the market assumes post recent announcements from SAP, SWI and TEAM. Finally, our chart of the day looks at Coinbase’s valuation compared with Cboe, CME, ICE and Nasdaq which follows on from our analysis last week.

What did you miss overnight?

Asian markets were mixed on Wednesday. The Hang Seng outperformed as the Chinese regulator gave tech companies a month to fix anti-competitive practices. Taiwan was weighed down by the selling in semis. The closely watched US CPI, that we mentioned yesterday, came in hotter than expected but the market seemed to look through this, believing the Fed for now. European markets are trading up small with SAP (thoughts below) and LVMH both posting positive results. In the US, futures are edging higher as the market turns its attention to the US banks reporting today.

What we’re reading…

Quitting QAnon: why it is so difficult to abandon a conspiracy theory

Pfizer CEO says company can deliver 10% more doses to the U.S.

EU Governments to Seek Deal on Controversial Covid Passports

Too far too soon for equities?

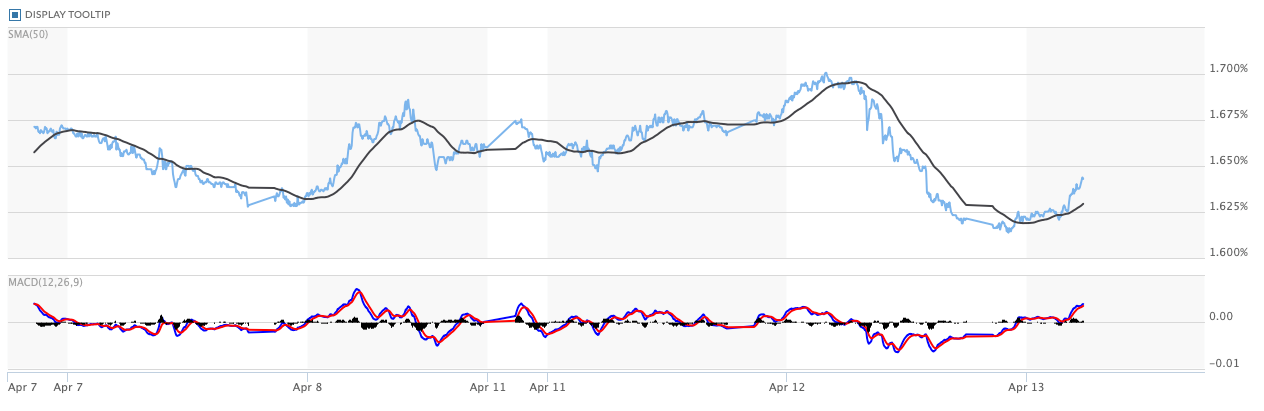

Yesterday’s price action in growth stocks felt somewhat euphoric which in itself should give some cause for concern. We had a US CPI print that was marginally above expectations along with well supported government bond auctions. This was coupled with some concerning news after the CDC and FDA decided to halt the distribution of the J&J vaccine following concerns around blood clots. The result was a near 10bps contraction in the US 10yr yield and outperformance in many of the 2020 growth and “stay-at-home” winners.

Of course, we will now wait to see further news around the J&J vaccine which remains key to accelerating vaccinations in the US but even more importantly, across many emerging economies. Instinctively, we would expect authorities to follow a similar path to the other adenovirus vaccine from AstraZeneca which was reinstated but with some caution around specific groups. We therefore expect the US reopening outlook to be broadly unchanged. Similarly, whilst yesterday’s inflation print was largely meaningless, we continue to expect inflation headlines to be the key driver of volatility through this year and given the amount of stimulus in the system, expect the path for real rates to still be higher.

What does all this mean for markets?

Given futures this morning are mildly positive again on top of the recent price action, we think it’s worth revisiting some of our sentiment indicators.

Two weeks ago, we wrote the below and argued that the rotation into value had run too far. We suggested that growth stocks had bottomed and equities broadly remained supported by fund flows.

“the speed of the value rotation in recent months has been brutal. From a tactical stand point, a lot of the positioning has now unwound which suggests we should see less near-term divergence in growth and value performance until we start to get clearer indications around the nature of the macro recovery.”

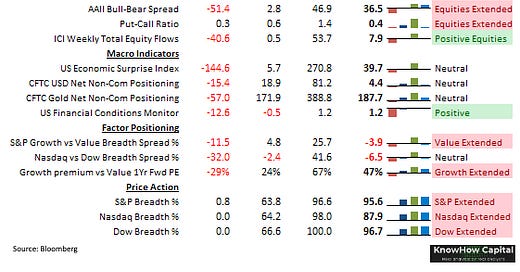

We have included our latest sentiment indicators chart below along with some price action indicators also.

A couple of things have changed vs two weeks ago: i) the AAII Bull-Bear spread has continued to drift higher and the VIX lower, ii) the Put-Call ratio has started to edge back to the lows, see chart below. The combination of the two, along with some of the price action we have seen lately suggests that the market has run too far too soon setting us up for a volatile Q1 reporting season in our view.

IT Spend backdrop better than the market assumes?

We thought it was worth highlighting a few data points over the last few days that suggest the IT spend backdrop is looking increasingly healthy, especially across cloud products. Three points to make:

(1) TEAM, in the US, reported stronger 3Q prelims driven mainly by one-offs in the form of on-premise server products ahead of the February end-of-life licence discontinuation. What is important to note though is that the company pointed out that data centre was also strong and this was partly driven by

(2) SAP, in Europe, pre-reported this morning and much like TEAM, they reported strong numbers whilst revising their outlook at the bottom end of their previous guidance. The beat here was driven by licences but we note that the current cloud backlog was the driver of the FY21 outlook being nudged up. The company now has the highest order entry growth across cloud and software in 5 years. As a result of this, management now expects cloud revenue YoY growth of 14-18% vs previous 13-17%.

(3) SolarWinds traded up over 2% overnight in after-hours trading as the IT management software company said it expects higher than expected revenue for the first quarter. The company guidance was c3% ahead of consensus citing a stronger than expected backdrop. The detail is limited here but this is again supportive for the IT spend outlook.

What does this mean for IT Spend?

Below are the current Gartner IT spends for 2021 and 2022 published on April 7th (more details here). Given the latest reporting figures from the three names above, we feel that these estimates may be on the conservative side and the positive backdrop should be supportive for the cloud software names.