Over the coming weeks, we will be launching our ESG, macro and stock analysis products on Substack. We would love to have you subscribe to those. The Daily KnowHow is free and will remain so. But please, if you value our work, subscribe and share. This is real analysis by real analysts. Enjoy!

In today’s KnowHow…

We are still due a correction

Hydrogen set for take-off

Digging for EV metals

The vaccine effort that went wrong

China continues the crackdown…

What happened overnight…

After a great week of beats for the space, it is the tech sector that’s misbehaving today. Over in Asia and China’s antitrust crackdown weighed on the Asian tech space while Twitter’s 2Q guide led to the stock trading down 12% after-hours and pulling the NASDAQ with it. Clearly not enough of you are retweeting this daily… In Europe, it was reassuring to see that neither the vaccine nor the Alexion deal are holding AstraZeneca back with the stock up 3.5% post results (more below). Finally, while the US 10yr rose slightly, it is still on course for its biggest monthly decline since July.

Chart of the Day

So this is what we think is the Twitter problem. This chart from PRC shows the penetration of each app across US adults. Twitter is a great product for so many that use it… particularly those that have the pleasure of following KnowHow Capital. But, it needs to re-engage with a large part of the opportunity base. New products like Spaces is a start but it also costs costs money.

Analysis

We are still due a correction

A few of our subscribers have been asking for an update of our Market Sentiment Indicators given the reaction to some stocks through earnings. Some of the share price moves have been hairy to say the least but there’s a few points we wanted to share:

We are still due a correction: let’s start with the Market Sentiment Indicators. We had suggested a couple of weeks ago that earnings would add to volatility and the market was due a shakeout. That hasn’t really played out. On the whole, most indices have been able to push through new highs over the past week. Our updated table is below. There is still enough flashing red in our view to remain cautious particularly as volumes start to dry up post earnings season.

Concentration risk is high: have a look at the chart below. There have been some harsh share price reactions to even a sniff of earnings disappointment. But, on the whole, there is still good performance breadth across the market. The volatility in some stocks feels more severe than it actually is. That tells you that positioning has started to become quite concentrated again in recent weeks particularly in growth stocks.

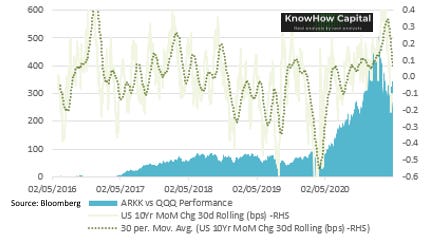

High growth still vulnerable: our playbook through this year is based on continued macro improvement and stock differentiation. We always want to own growth stocks. But, we have to be cognisant that the macro view and valuation backdrop are not currently supportive. In the chart below, we have used the ARK Innovation ETF as a proxy for high growth and the QQQ ETF for Big Tech or quality growth. It’s a complicated chart but the message is a simple one. As rates continue to rise, we believe towards 2%, we expect the QQQ ETF to claw back a decent chunk of the recent underperformance through this year. Earnings from Amazon last night again showed that for the growth these stocks offer, they are far too undervalued vs high growth.

Hydrogen set for take-off…

Hydrogen was the name of the game in 2020 and while many of the pure play names have underperformed this year, we still think the sector remains attractive as long as there is strong policy support and key catalysts coming up. As part of our ESG launch, clean energy analysis will be a big focus for us. So, what came out of the FT Hydrogen Summit on Tuesday. If you have time, have a listen to the recording of the Conference. The full agenda for this event can be found here.

In terms of key takeaways, 3 points were particularly supportive for the Hydrogen space:

(1) Detailed EU Action Plan in June: Policy support is imperative for Hydrogen to become a realistic prospect, so it was very positive to see the EU Energy Commissioner, Kadri Simson making the keynote speech. We first heard from the EU on their longer-term strategy in July 2020 and Simson confirmed that the Commission, in June, will announce a 12-point plan to support a 55% reduction in greenhouse gas emissions by 2030. We note that the catalyst in 2020 drove the Hydrogen stocks share prices and it is expected that more granularity from the EU will also be supportive for these names.

(2) EU Will Offer ‘Unprecedented’ Financial Support: The EU currently has €1.8trn worth of firepower and the Commissioner confirmed that 30% of this €1.8trn will be used to help support the clean energy transition. On top of this and a further 37% of the EU’s Recovery and Resilience facility will also be used to support this transition. We see the share for hydrogen potentially reaching double digits of this funding in order to achieve 40GW by 2030. As you can see by the chart below that shows the announced projects, the EU is still someway off this 40GW target.

(3) UK’s Business Minister confirmed UK will also update plans: With two of the key Hydrogen plays listed in the UK (ITM Power, Ceres Power), it was very interesting to hear the UK Business Minister, Kwasi Kwarteng, confirm that the UK will also follow-up with a more detailed plan before the summer on their Hydrogen commitments.

Conclusion: Going into the summer and the FT Conference confirmed that we will see a number of catalysts that should support the Hydrogen space from the EU and the UK. In addition to this, we have seen further support in recent weeks from across the Atlantic as Biden pushes his Green agenda. Post the relative weakness, the Hydrogen space looks very interesting at the moment.

What we’re reading

Digging for EV metals

Keeping with the ESG theme and if you want to understand better just how reliant the EV space is on a few specific materials, then look no further than the Cobalt price this year. The price has jumped 40% this year driven by persistent demand for EV makers which is unlikely to slow.

While the likes of Tesla and VW have pledged to reduce their cobalt usage in the future given the human rights issues, analysts at RBC say they expect cobalt prices to reach $28.50 a pound this year and rise to $40 in 2024 as alternatives are expected to remain scarce. More than 60 per cent of the world’s cobalt supply comes from the Democratic Republic of Congo, where production is dominated by Chinese companies and London-listed Glencore. Allegations of child labour have deterred car companies from buying cobalt from the DRC, where an estimated 15 per cent of supply is mined by hand, often by children

Tesla’s Model 3 cars produced at its Shanghai factory mostly use the alternative lithium-iron phosphate batteries. BYD, a Chinese automaker, said that all its models would use these batteries and Volkswagen said last month it would use LFP batteries for its entry-level models globally from 2023.

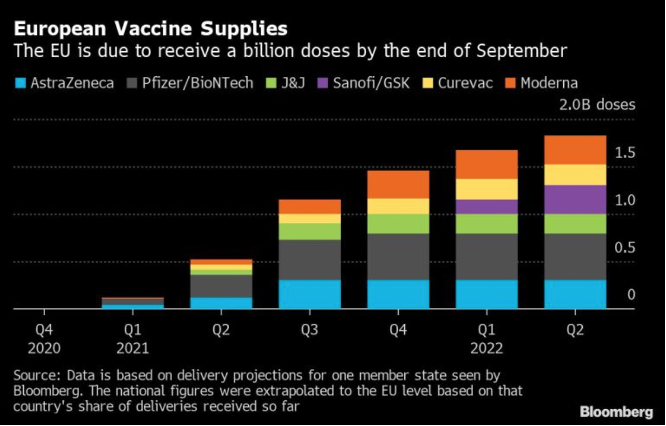

The vaccine effort that went wrong

While Astra have consistently said that they will provide the Vaccine at cost price, it is interesting to see today that sales so far haven’t kept up with its costs, resulting in a hit to earnings and a warning the vaccine effort could continue to affect margins. Most of AstraZeneca’s vaccine sales revenue in the quarter, $224 million, came from Europe, with $43 million in sales to emerging-markets countries. The numbers pale in comparison with multibillion-dollar sales forecasts of other vaccine makers including Pfizer Inc. and Moderna Inc.

For Astra, initially at least, the vaccine effort was a drain on earnings during an otherwise strong quarter. Costs from the efforts shaved 3 cents off its per-share earnings for the quarter. Earnings per share came in at $1.18 for 1Q vs 59 cents in 2020.

Outside the vaccine, AstraZeneca remains one of our preferred names in the space and it was good to see that the rest of the business remained resilient with the drugmaker sticking to its forecast for 2021 on Friday and predicting better times ahead. This guidance does not include any impact from sales of the vaccine and its $39 billion purchase of Alexion, which is expected to close in the third quarter.

China continues the crackdown…

We have spoken a number of times in the past about the recent Chinese crackdown whether it is on Alibaba, Meituan or Tencent. Today we saw a further crackdown as regulators imposed wide-ranging restrictions on the fast-growing financial divisions of 13 companies including Tencent Holdings Ltd. and ByteDance Ltd.

On top of this, the biggest threat to crypto for us is increased regulation which we have also written about. With both of these points in mind, it is also interesting to see that China has ramped up a crackdown on financial scams, from cryptocurrency swindles to bogus patriotic fundraising that capitalizes on the coming 100th birthday of the ruling Communist Party, as new anti-fraud rules take effect on Saturday.

The crackdown is also aimed at ensuring social stability ahead of the July 1 party anniversary, a highly sensitive event, the official said. In Shanghai alone, more than 20 platforms had been crowd-funding for alleged "red" movie and TV programmes dedicated to the political event, which is not allowed without government consent. As bitcoin prices surge, there has been a boom in Filecoin trading in lower-tier cities as investors seek alternative cryptocurrencies to bet on. Some banks have also flagged scams using China's sovereign digital currency, e-CNY, as bait. Other targets of the crackdown include private equity, wealth management, and real estate investment schemes, the banking regulator has said.