What's Biden smoking? | Pinterest Volume | Tesla and Cinemas

Everything you need to know...

In today’s KnowHow…

Why Biden’s Tobacco plans may signal a renewed focus on other key social issues…

What do we make of Pinterest volume?

Is streaming set to kill off cinemas?What happened overnight…

Texas police going hard on Tesla crash

Key commentary from markets and news flow overnight

Tobacco is getting smoked overnight (excuse the pun) with the news that Biden plans to crack down on the space (thoughts below). Asian markets had little to report in all honesty with the Nikkei under pressure with tech and autos down sharply while Mainland China was the only major market to finish in the green. In Europe, Tobacco is the key story but all sectors are in the red with Travel & Leisure and Banks the biggest under performers. Outside ‘normal’ markets and Dogecoin lovers are celebrating again today. This time they are marking a day known for celebrating pot smoking… In the past week Dogecoin prices are up 400% with the market value of more than $53bn… who said the current times were crazy?

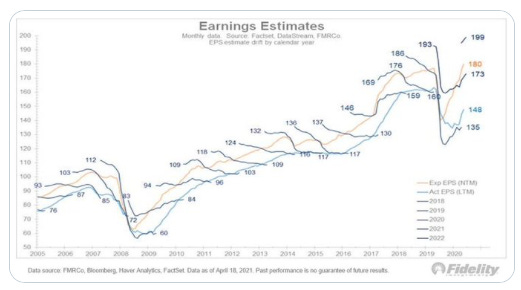

Chart of the Day

As we head into earnings season, we think this chart from Fidelity’s Jurrien Timmer is worth a look. Earnings trajectory typically starts high and rebases lower through the year except when coming out of a recovery. When this year’s trend starts to peak, we will get another headwind for equity markets in the short-term.

Why Biden’s Tobacco plans may signal a renewed focus on other key social issues…

Tobacco stocks have been hit hard this morning as the WSJ suggested that the Biden administration was mulling a rule that would lower nicotine content of cigarettes to a level that’s not addictive while also banning menthol cigarettes entirely. As a result, British America Tobacco and Imperial Brands are both trading down c6% in European while Marlborough owner Altria in the US lost over $6bn in market cap yesterday. We will touch on the direct impacts for Tobacco names below whilst also noting that this move is likely to set the path for the Biden presidency going forward.

Tobacco impacts:

This move has been expected for a number of years now with the industry bracing for nicotine levels to be reduced in cigarettes and further regulation on cigarettes. As a result, investment has been made into ‘next-generation’ products that claim to be only 10% as harmful as normal cigarettes however this does little to protect the industry. Having said this, we note there are two points that suggest Biden’s plans are not as simple as they initially may seem:

(1) This will likely take years to implement: The reality is that there has to be widespread availability on non-addictive cigarette alternatives that have lower risk than normal cigarettes. As mentioned above, there are alternatives with lower risk but there are very few functional products that contain a ‘non-addictive’ level of nicotine.

(2) The impact on jobs and real-world consequences has to be taken into account: Altria said any FDA action “must be based on science and evidence and must consider the real-world consequences of such actions, including the growth of an illicit market and the impact on hundreds of thousands of jobs.”These decisions will not be taken lightly and the knock on effect to jobs, the illegal cigarette trade and tax revenue may not make this policy as likely as initially expected.

What does this signal from Biden elsewhere?

The part that really interests us are the more wide-reaching impacts this may have especially on the Healthcare and ESG spaces. Biden won his presidency on supporting the most economically and socially disadvantaged in the US. On top of this, Biden has promised to combat climate change and expand Obamacare. As a result, we think the moves yesterday will lead to a renewed focus on Biden’s other key socio-economic policies:

(1) Healthcare / Obamacare back in focus: Going into the election, Biden promised to strengthen and expand the Affordable Care Act, known as Obamacare. Around 115 million Americans, those over 65 or on low income, receive their healthcare from the government through the Medicare and Medicaid programmes and Mr Biden, going into the election, wanted to allow people to enrol at 60. The Biden administration has recently released a letter outlining President Joe Biden's request for fiscal year 2022 discretionary funding in advance of Congress's annual appropriations and budget process. While this didn’t signal all of Biden’s plans, it highlighted yet again Biden’s drive to create public health equality. The tobacco news overnight yet again highlights Biden’s plans and, in our opinion, will help drive a renewed focus on Biden’s healthcare plans.

(2) Continued focus on Green initiatives: The environment was at the heart of Biden’s election campaignand this week will see exactly how far Joe Biden is willing to go. While his speech at Pittsburgh outlining his Infrastructure plans and the green initiatives was relatively muted, Biden is hosting 40 world leaders for a virtual climate summit on Thursday 22nd and Friday 23rd that includes Putin, Macron and Saudi King Salam. Having gone backwards during the Trump campaign, this week’s summit is expected to signal a renewed US commitment to leading the global fight against climate change. Again, with the world’s eyes on Biden, the tobacco news overnight signals the direction he is likely to take.

Conclusion:

The tobacco news clearly has potentially catastrophic impact on the US tobacco market, however the reality is that this will take some time to play-out. What we think is perhaps more interesting is that it signals Biden’s focus on social issues and in our opinion will refocus the market on the two key drivers of Biden’s plans: Healthcare and Green initiatives.

What do we make of Pinterest volume?

We mentioned yesterday that we would be looking closely at Pinterest’s volume over the next few days after the shares fell nearly 10% on Friday. Yesterday saw further weakness but on much lower volume. Here’s a chart from Bloomberg that shows the spread of volume at different prices over the past week. You have to be careful not to make the narrative fit the story here but we think the lack of activity in the low 70s suggests the selling pressure is more targeted at higher prices and is starting to clear. Remember, Pinterest will report results on 27th April.

What we’re reading

Byron Wien highlights his three troubling issues

The Blackstone Vice Chairman’s Market Insights newsletter is always a must read in our view. In this update, Byron Wien highlights his three concerns for markets:

Risk of higher interest rates and rising inflationary pressures. Key segment in our view is below. This is something we have discussed ourselves at some length

“The output gap—which is the measure of what the economy is producing compared with its potential—is estimated to be $760 billion over the next three years. The new COVID relief package is almost three times that, assuming a money multiplier of 1.0x, and therefore it could be potentially inflationary. If the yield on the 10-year Treasury rises to above 2%, I think there would be a negative market impact, particularly on growth stocks.”Reaching normalcy post vaccination. Though, much of his commentary suggests that he is impressed by the scale of vaccination and optimistic on the return to normalcy

China-US tensions remain a left field risk post Anchorage

His key conclusion… and we like this line a lot as of course we have been advocating exactly this…

“I am more concerned about inflation—and rates—surprising to the upside, and about the potential for U.S.–China relations to move in a direction that would be damaging to global economic prospects. While a strong recovery is unfolding, these are the issues which keep me from being complacent and make the case for strong active management.”

Is streaming set to kill off cinemas?

Few industries have been as disrupted through the pandemic as cinemas and theatres. As we increasingly start to focus on re-opening, it is worth thinking about what the cinema landscape will look like in the years ahead. An article in the New York Times overnight discusses Netflix’s purchase of the “Knives Out” sequels for $450mn. What does this tell us about the streaming battle and outlook for cinemas? A few things:

inevitably, Netflix’s competition is increasing and as streaming platforms compete for content, costs, particularly for franchises are likely to keep going up

directors and actors are increasingly indifferent regarding film/show launches via streaming or through theatres

the returns in streaming and cinemas are now increasingly comparable at least for follow-on films

To compete post pandemic, cinemas will need to evolve significantly and bring in a new level of experience. Worth referring to this chart below… since 1995, tickets sold by US cinemas have been on a downward trajectory with total box office sales largely a function of price increases.

Texas police going hard on Tesla crash

Clearly, Saturday’s Model S crash in which two people lost their lives is clearly getting a lot of press and raises once again concerns around both autonomous and battery safety in cars. Texas police have highlighted that there was nobody in the driver seat in the vehicle which suggests that the Autopilot had been activated. Elon Musk clearly disagree with that and tweeted this overnight.

Now, that’s all well and good but he’s decided to update some bloke on Twitter on his view having looked at the logs when the authorities are trying to contact the company to investigate. Hardly helpful… hmmm.

As an FYI… we found this report of EV battery safety and fires worth reading. Complex but try digging through if you have time. Electric battery safety is a major issue and it does need to be addressed over time. Press like this is unhelpful.