In today’s KnowHow…

When the herd exits…

Yellen’s switcheroo

Food delivery competition on the rise

The reinvention of London

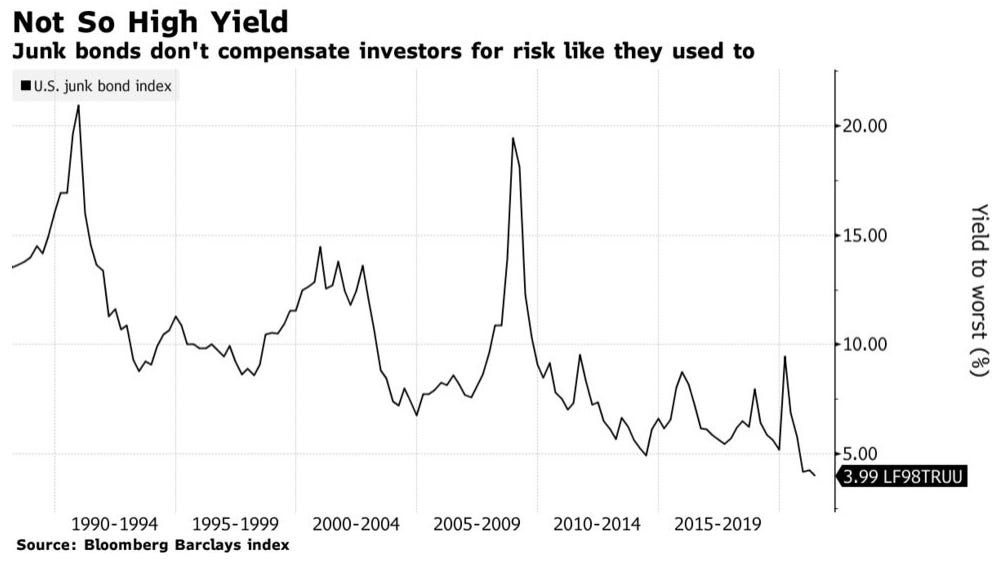

Junk bonds headed for ‘shakeout’

What happened overnight…

Janet Yellen threw a little fuel to a fire that was already getting slightly out of hand yesterday before pulling that fire extinguisher out immediately after… the damage, though, was already done (more below). Today is a different story as European stocks and US futures rebound with the focus turning to positive earnings and signs of economic recovery from the pandemic. Miners and travel stocks are driving the European outperformance with tech rebounding to. Outside equities and commodities continued their phenomenal run while the USD rose and treasuries remained steady.

Chart of the Day

With the EU outlining its own semiconductor plan today, have a look at this excellent chart from the Semiconductor Industry Association. They expect around $1tr in investment in localisation of production. And, they estimate prices will rise up to 65% as the world fights it out for control of the “oil of tech”.

Analysis

When the herd exits…

A question that got quite a lot of attention yesterday, not only on Twitter (courtesy of @BahamaBen9) but also the wider market, was the extent to which retail investor activity and potential switching into crypto was driving the recent sell-off in growth stocks. The chart below suggests there is some logic to that argument.

Crypto is very much outside of our pay grade but we have some good ideas on how to measure retail investor activity in stocks. There are lots of data-points that have been getting much attention recently.

The below chart of FINRA’s Margin Debt vs S&P 500 is being cited by a number of market bears.

The story goes that retail investors have increasingly levered up to invest in the stock market and this is increasingly turning into a speculative bubble. Well, you could have made that argument from 2013 all the way to 2019 and you would have been wrong.

What this analysis misses is the assets side of the balance sheet. Retail investors are using more margin to invest in stocks but how does that measure up versus income, cash and overall net worth? The below chart shows the bigger picture. Household Debt in the US isn’t really a concern. The retail investor is good for that leverage.

Our preferred gauge of speculative activity is to look at the derivative market and smaller contract option activity or overall option activity. Have a look at the below chart from GS at this time last year. It clearly demonstrates a trend of rising retail investor participation that has accelerated post-pandemic.

We flagged the below chart a few weeks ago around total US call option activity with the caption, “The Herd is Exiting”. The data is volatile so we wouldn’t focus on yesterday’s specific data point but that exit is clearly accelerating.

As we launch our Equity and Portfolio Strategy product over the coming days (please note, this will only be for paid members), one area we are spending a lot of time on is retail activity within individual stocks. The heightened volatility in this market means understanding sentiment and positioning in individual stocks is a crucial factor in deciding when to invest. This is particularly true lower down the market cap spectrum.

Teladoc has been a FinTwit favourite post-pandemic with a high and rising level of call option activity. We think this has contributed to a high degree of volatility and some brutal price action since February.

A more recent FinTwit favourite is Palantir, set to report earnings next week. Once again, we see a very similar pattern of rising call option activity.

What we’re reading

Yellen’s switcheroo

Janet Yellen got herself and the market into a bit of a tizz yesterday after saying rate hikes may be needed to stop the economy overheating. She then quickly back-tracked reverting to the Fed and KnowHow mantra… inflation is transitory. Yes it is… BUT, as poor Janet’s comments yesterday show, policy makers and analysts will be getting drawn into the inflation debate increasingly over the coming months. Rates are low currently vs where we would expect them to be and a rapid spike in yields could easily exacerbate the current tech/growth unwind. We like this WSJ article also on Yellen’s Interest-Rate Comment.

Food delivery competition on the rise

Investors recently have poured $14bn into the emerging instant grocery delivery sector. The new apps, which include GoPuff, Getir, Gorillas, Weezy and Dija, are using their war chests to offer heavy discounts as they target market share. VCs are particularly keen on apps that promise to deliver groceries in as little as 10 minutes, thanks to a network of “dark stores” across urban centres in London, Berlin and beyond. Uber’s delivery chief, Pierre-Dimitri Gore-Coty, has compared the funding frenzy to the spending spree around electric bike and scooter rental services such as Bird, Lime, Voi and Tier.

We still like Uber (see analysis here). The company has made wide-ranging partnerships including the recent GoPuff deal. And, as we commented on Twitter last week, more entrants will add competition but the winner will be the operator with the largest logistics scale. Uber wins in our view.

The reinvention of London

London may get viewed by Brits as privileged and shielded from the worst social and economic shocks but it has been more devastated by the pandemic than other parts of the country.

It has also seen more deaths and more jobs lost along with a silent exodus of migrants (may be as high as 8% of the capital’s population). But, this is a story of many major cities all across the world including New York. Can London recover its 30-year trajectory? Well worth a read in the FT.

Junk Bonds Headed for ‘Shakeout’

Randy Brown, chief investment officer of Canadian insurer Sun Life, believes “There is a shakeout to come in the lower tiers of credit, but not the upper tiers… That’s not near term. I think we probably have a couple years of runway”. We have spoken at length about rising rates and the Yellen comments yesterday also make this point but risks to lower-rated credit include the Fed tightening monetary policy sooner than expected, or at least being perceived by the market to be considering a change. When you’re looking at equity risk parameters, high yield is worth paying attention to.