If you find our work valuable, please like, subscribe and share. We rely on that to grow our subscriber base. This is real analysis by real analysts. Enjoy!

In this week’s KnowHow:

>100 top funds… we’ve analysed their holdings

Apple, Amazon, Tesla big large cap underweights

Microsoft a huge overweight for tech funds

Niche suppliers and genomics a focus

Adding value but bias still quality growth

One of the key skills in managing a portfolio is understanding the risk profile and nature of the whole portfolio in aggregate. Over the years, we have come across many portfolio managers that may like an idea but won’t necessarily invest. Why? limited capital, opportunity cost, macro view, strategic positioning. The risk for an individual investor is often that they end up with a collection of stocks rather than a portfolio and then struggle to understand the risks they are exposed to in aggregate. Looking at the holdings and weights of large, successful funds is an important exercise and good way to understand portfolio management but also to generate new ideas in our view.

>100 top funds… we’ve analysed their holdings

Given we’ve just got to the end of the first half of the year, we thought it would be a good time to dig into the holdings of some of the largest and best performing funds. To be clear, this is obviously backward looking data and depending on the fund, will have at least a one month delay. What we have done is to separate the funds across large cap focus, mid cap and small cap with a US listed focus. We have also conducted a separate exercise for Global Tech funds. We’ve pooled the main holdings of all the funds across those categories and then analysed them in aggregate against our factor exposures. So… what did we learn? Let’s get into it.

The KnowHow Capital Portfolio is now live for subscribers. We have initiated 11 positions initially with a focus on high quality growth and a valuation underpin but also trying to implement some of our recent macros views. Subscribers can access the portfolio through the link below and will receive analysis on each of the stocks and changes over the coming weeks.

KnowHowCapital Portfolio… NOW LIVE

Apple, Amazon, Tesla big large cap underweights

Digging into the large cap generalist funds, it’s no surprise that big tech makes up almost 50% of the top holdings. We have argued for some time that big tech, despite recent strong performance, remains the best value opportunity in the current equity market. Our own preferred exposures are Amazon and Facebook which make up 31% of our portfolio. However, what is interesting from the analysis below is the extent of the underweight in Apple, Amazon and Tesla. Remember, most generalist funds will look to benchmark against the S&P 500 but they tend to hold far fewer positions and place more concentrated bets. To a degree, we can understand the relative positioning… Apple comes with risks around supply chain, Amazon has e-commerce plus Bezos concerns and Tesla’s is mainly valuation and speed of ramp-up. But, if those concerns ease, there is a lot of capital that needs to be allocated towards those three in the coming quarters.

Microsoft a huge overweight for tech funds

What is interesting is that if we look solely at tech funds, their bias is significantly skewed to Microsoft. Of the 30 tech funds we have included in our analysis, all have Microsoft in their top 10 positions, 80% in their top 3 positions and 50% as their top position. One would assume that the thesis is largely accelerated cloud spending post pandemic, something we are inclined to agree with. But, any hiccups, and there is a lot of capital that needs to come out.

Separately, we find NVIDIA also interesting in the above analysis. Again, bearing in mind that this data is lagged, you can put a significant part of the recent performance down to it being an underweight for active funds in our view. Of the analysed funds, only a third had the stock in their Top 10 holdings and only three had it in their top 5. The stock has almost added $200bn of mkt cap since mid-May, up almost 50%. The flows and our analysis would suggest funds have had to chase a position having been left underweight.

Niche suppliers and genomics a focus

Looking through the holdings of small and midcap funds is a great way to identify holdings that are normally less well covered by sell side analysts and therefore less mainstream. Naturally, fund positions tend to be more diversified but again, you will tend to see some fairly concentrated bets on specific stocks exposed to big themes.

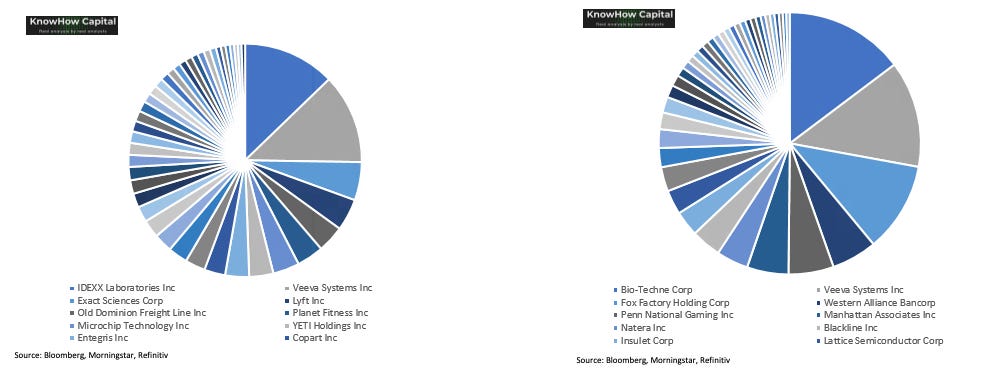

There are a couple of observations around the large holdings of Small (right hand side below) and Midcap (left hands side below) funds:

i) they have exposure to tech businesses but are far less exposed to the big tech themes of cloud, digitalisation and e-commerce. By their nature, those businesses are probably too large for Small & Midcap funds. The obvious exception below is Veeva Systems.

ii) genomics has been leading to a lot of excitement in recent weeks spurring by Cathie Wood’s pitch for her ARKG fund. Almost every fund we looked at has decent sized exposure to genomics amongst their largest holdings. Exact Sciences, Natera and picks and shovels through Bio-Techne were the preferred plays.

iii) there are some excellent businesses with incredibly impressive economics that have exposure to large mega trends. Some of the ones that standout to us are Fox Factory, IDEXX Labs, Entegris, Manhattan Associates.

Small and Midcap funds are an excellent hunting ground for idea generation. We will be making making the full top holdings list with a brief write up on some of the interesting companies available for subscribers next week. You can subscribe below to avoid missing out.

Adding value but bias still quality growth

Bringing this all back to portfolio construction, we think it is important to appreciate the factor exposure for the overall group, bearing in mind that the above holdings make up almost 60% of the weighting in each of their categories. As you will see in the chart below, despite having some very specific thematic exposures, the overall exposure of the funds is broadly balanced across all three of the key factors, quality, growth and value. We ran a similar bit of analysis at the start of the year and again, despite adding more value in recent months, the exposure was largely the same. In our view, the lesson is simple… place your thematic and stock bets but make sure your overall portfolio exposure remains balanced particularly as we enter a period of increasing macro volatility over the coming quarters.