“They say that love is more important than US dollars but have you ever tried to pay your bills with a hug?”

What is in today’s daily?

We’re about to get into the swing of earnings over the coming days, but before we do that, some thoughts on the US dollar. We’ve been pretty constructive lately and highlighted dollar short positioning as a potential tailwind. But, some of last week’s reaction to positive inflationary data leads us to believe that much of that positioning has now unwound short-term. Plus, we like Pinterest… huge user base that continues to grow international, unique customer insights driven by a far healthier user experience than typical social media and a long-run way when it comes to monetisation. But, the shares were down 10% on Friday. Here’s what we think you should do.

What did you miss overnight?

Asian markets traded higher one Monday as Chinese markets outperformed amid easing concerns about the health of the distressed-debt manager China Huarong Asset Management. European markets held steady with little to report while US futures slipped from all time highs as investors wait for the first full week of reporting to commence.

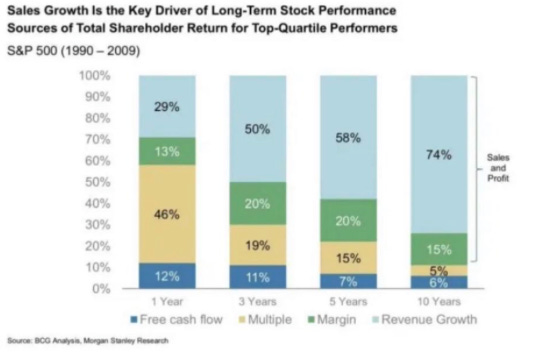

Chart of the Day

This chart from BCG and Morgan Stanley, flagged by @_inpractise on Twitter this morning, is a great reminder of why growth wins long-term. Find companies with long growth run ways and strong execution and invest in them. Just make sure you’re not already paying up too much for the growth. It’s that simple.

Why the USD could weaken further near-term

The move in yields last week to us signalled that the bond trade is exhausted for the time being and spreads for now have likely widened too far. The recent driver for the strength of the US dollar has been driven by two factors: i) the attractiveness of the US bond spreads relative to other developed economies where yield curve control is in full flux, and ii) a large short-base in US dollar positioning as you see from the chart below. Both are now less of a tailwind in our view.

As a result, we believe this will likely lead to a further weakening in the USD in the near-term. What was surprising, was that yields failed to rally (and in fact came off) on stronger jobs data, a better-than-expected CPI print and further positive data points last Thursday in the US. Add in the large buying of bonds from international investors and we see a strong likelihood of yields trading inline, if not lower, in the near-term.

This reason alone will likely lead to pressure on the USD however there are also a number of other points that point to USD weakness in the near-term:

Reopening trade played out? The USD has also seen support this year as the country reopens and vaccinates its population ahead of many other countries, especially in Europe. We believe that this trade has played out and now the focus will be on Europe and parts of Asia playing catch-up. Data this week in Europe (PMI’s) will likely refocus investors on the European recovery.

History suggests yields may weaken in Q2: we thought this was interesting from MUFG. Looking back to the start of 2000, yields have only risen this fast in the first quarter of the year twice.

The bank notes that on the other two occasions; in the second quarter of 2009 and fourth quarter of 2016, yields then retreated in the following quarter. Whilst we all know historical performance is by no means a reliable way of projecting future performance, it is nonetheless worth bearing in mind. Given that the dollar moves have been linked closely with moves in US yields, any decline would, therefore, tend to undermine the US currency

USD weakness may lead to further weakness: One interesting point that must not be ignored is the fact that investors have already taken large MTM losses on Treasuries this year and are therefore more likely to remove any FX risk from their portfolios if they begin to take MTM losses on the USD as well.

Quieter week for data: This week should see a slightly quieter week in terms of data released. The keys will be the April prelim PMI print, jobless claims and home sales. Having already had stimulus checks deposited into accounts, we believe the market has already priced in strong prints, as evidenced by last week’s prints.

Conclusion:

While we remain positive USD in the medium-long term, we see weakness in the USD persisting in the near-term.

That Pin hasn’t popped

Pinterest shares were down nearly 10% on Friday following some large sell-downs in both the morning and late evening sessions. Selling activity such as this is particularly concerning for investors in the wake of the Archegos saga.

We will of course be looking at volume and activity closely today to assess follow through but in situations like this, it is important to understand the bigger picture drivers of the shares. We published a detailed Twitter thread on Friday and if this is a stock you’re interested in, please take a look. Block sell downs tend to be temporary and despite our concerns that the Pinterest share price had risen too far ahead of earnings, we think the long-term opportunity remains exciting.