“Why do they call it rush hour, when nothing moves?”

Welcome to Your FIRST Daily KnowHow… we’re kicking this off, a little later than originally planned, with the aim of bringing thoughtful daily analysis on things that are effecting your portfolios and investments. Our aim is not to be a run-of-the-mill daily of which there are plenty out there. We’ll keep building on the product and would love your feedback and ideas… please share with friends and colleagues.

So let’s kick off…

The inflation backdrop

The debate around inflation continues to brew in the background and got a fair amount of attention yesterday. A few comments in Jamie Dimon’s annual letter yesterday that are worth taking on board:

The QE and deficit-spending response to the COVID-19 pandemic is of a completely different magnitude and without some of the offsetting drags that trailed the Great Recession.

I have little doubt that with excess savings, new stimulus savings, huge deficit spending, more QE, a new potential infrastructure bill, a successful vaccine and euphoria around the end of the pandemic, the U.S. economy will likely boom. This boom could easily run into 2023 because all the spending could extend well into 2023.

Conversely, in this boom scenario it’s hard to justify the price of U.S. debt (most people consider the 10-year bond as the key reference point for U.S. debt). This is because of two factors: first, the huge supply of debt that needs to be absorbed; and second, the not-unreasonable possibility that an increase in inflation will not be just temporary.

This chart below also gives some context around that first point on COVID-19 recession vs the Great Recession and why, at the very least, the probability of structural inflation feeding in the economy has likely grown.

Whatever your long-term view is on inflation, this debate will continue to brew throughout the year. Comps are easy, supply chains are being impacted and there are pockets of pent-up demand post re-opening that are driving input prices higher. This matters for portfolios for a couple of reasons: i) inflation expectations will impact the Fed’s path for rates but also more technically, discount rates and therefore valuations. Hence, all the recent excitement around the US 10yr yields, and ii) it will start to hit company profitability particularly if businesses can’t pass through cost pressures.

However, the key long-term question is on the sustainability of inflation. Have a look at this ISM based chart below. Customer inventories dropped post Great Recession in the same way as they are doing today and prices paid, inevitably rise given the supply chain shock. This is normal during recessions when activity picks back up and can last some time.

The Fed’s minutes yesterday again made clear it’s view that it doesn’t see long-term inflation as an issue at this juncture.

In early March, the University of Michigan Surveys of Consumers preliminary measure for the next 5 to 10 years was the same as in the previous two months, while in February, the 3-year-ahead meas- ure of inflation expectations produced by the Federal Reserve Bank of New York was essentially unchanged from its January level. The Survey of Professional Fore- casters measure of PCE price inflation over the next 10 years edged up in the first quarter, returning to its pre- pandemic level. A staff index of common inflation ex- pectations, which summarizes the co-movement of a wide variety of inflation expectations measures, was at about the same level in the fourth quarter of last year as in the third quarter.

Earnings kicking off next week

We’ll be getting into the swing of earnings from next week and from Wednesday it will start to get busy. A couple of points we wanted to share ahead of that:

Expectations being driven by industrials

Have a look at the chart below showing the estimated quarter-on-quarter change in EPS estimates for the Nasdaq, S&P and Dow. Unsurprisingly, the pick up in estimates in Q1 is being driven by industrial businesses as we come out of the pandemic. However, it is clearly just a Q1 effect currently and estimates growth is far more muted in the next few quarters. Two things to think about here, we think: i) is there scope for a cyclical EPS recovery that lasts longer than just a couple of quarters. This ties in to the inflation and economic recovery point above, ii) is there a potential re-opening benefit in tech, particularly cloud for large businesses, that the market isn’t yet appreciating. More thoughts on this over the coming weeks.

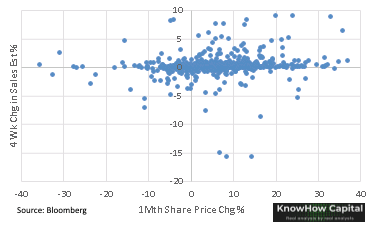

Managing portfolio risks into earnings season

Trying to risk manage through earnings season is never an exact science. But, we wanted to share this chart particularly given the share price reaction in some growth stocks… CHWY a clear example of this. As a rule, companies that sit in the bottom right quadrant, i.e. where share prices have kept rallying but estimates are getting cut, is where we would highlight the biggest near-term risks. We’ll try to dig into some of those names a little further in tomorrow’s note.