Your Daily KnowHow

The Bull Case for Equities | Uber Update

“Can we have a moment of silence for all those good hair days where no one important saw you”

What is in today’s daily?

In today’s ‘Your Daily KnowHow’ we revisit our constructive view on Uber, post their update this morning and the Grab / Didi news over the last week or so. It remains a key buy idea for us. Equity inflows in recent weeks have been raising a few eyebrows. We highlight why contrary to what many commentators will tell you, inflows remain the bull case for equities.

What did you miss overnight?

Asian markets closed down at the start of this week driven partly by the pressure on tech names post the Alibaba fine over the weekend. Japan also felt pressure as Tokyo went into a state of ‘quasi emergency’ in a bid to fight off the latest virus surge. Europe is relatively flat to down this morning with retailers and travel companies leading the declines in the Stoxx600. US futures are trading down slightly across the board following three weeks in a row of gains as investors look ahead to earnings season. We have mentioned previously that expectations look relatively high going into this earnings season so it is worth bearing that in mind. Finally, the US 10yr remained steady ahead of the latest round of auctions with the US selling 3, 10 and 30yr treasuries at the beginning of the week. Fed Chair, Jerome Powell’s CBS interview suggested a more positive view on the reopening of the economy in our view but he was also adamant that the Fed saw no reason to raise rates anytime soon.

The Bull Case for Equities

There has been a big focus on equity fund flows in the press over the weekend. In most cases, this commentary has been written with a negative slant suggesting that the record inflows into equity funds in recent weeks are indicative of an emerging bubble. The chart below shows how inflows have ramped up significantly in recent weeks, based on the ICI data.

However, this really only tells half the story. In fact, if you look at cumulative flows since 2013, equities have actually seen significantly outflows. Only in recent weeks has this tide actually started to reverse, albeit in size.

The broader question that investors and analysts need to answer is what is driving these inflows. Fundamentally, macro flows between bonds and equities are driven by the implied or expected return of one over the other ie. the equity risk premium. A higher equity risk premium suggests a higher expected return for equities relative to bonds.

We’ve used Aswath Damodaran’s calculations for equity risk premium in the chart below. These look at: i) the implied equities return based on dividends and, ii) the implied equities return based on forecast free cash flow. Given the reduced yield in equities in recent years, we believe the second model is a fairer reflection of the potential return of equities. As the chart suggests, equities continue to look very attractive relative to bonds.

The below chart is courtesy of Yardeni research and shows the latest Fed calculated equity risk premium up till the end of Q1.

The bottom line is this: equities remain very attractive versus bonds hence we are seeing record levels of inflows. For that to change, we would need to see: i) reduced earnings growth expectations or, ii) rising bond yields.

Uber Update - Strong Results, Re-opening Continues and Didi and Grab Supportive…

We wrote on 24th March why Uber was one of our top picks as the world reopens and with the stock up 10% since then (not including 4% pre-market today), it is worth updating given there are a few key points that could further support the shares in the near-term.

1. Strong Performance With Delivery Record Just Announced…

Uber has just announced that their delivery business set an all-time record, crossing a $52bn annualised Gross Bookings run-rate in March, growing more than 150% YoY. On top of this, the company’s Mobility business posted its best month since March 2020, crossing $30bn Gross Bookings run-rate. All this supports our positive thesis on the name with the company announcing it is on track to reach quarterly EBITDA profitability in 2021.

2. US Reopening Trade Continues To Outperform:

Whichever way we look at this, the US is now performing remarkable well vs RoW in the vaccination of its population and the subsequent reopening. The chart below compiled by BlackRock is one that we are continuously tracking to assess the sustainability of the reopening (on top of live mobility trends we spoke about in our previous analysis). Given the US >50% of Uber, this is clearly supportive for the reopening trade and Uber itself.

3. Grab and Didi Listings Supportive

Over the last two weeks reports have suggested that both Grab and Didi will become public companies in the near future. BBG commentary below:

Beijing-based Didi Chuxing has filed confidentially with the U.S. Securities and Exchange Commission for an initial public offering that could raise several billion dollars, according to people with knowledge of the matter. Its Southeast Asian peer Grab Holdings Inc. aims to announce a merger with a blank-check company in the U.S. as soon as this week in a deal valued at more than $34 billion, the people said.

Uber has stakes in both companies and the crystallisation of value should be supportive for Uber. In many analysts models, the lack of transparency means that the value placed on these investments are often a discount to fair value. While it is difficult to work out the opportunity, Didi Chuxing filed confidentially for a U.S. IPO that would value it at $70 billion to $100 billion, Bloomberg News reported Friday.

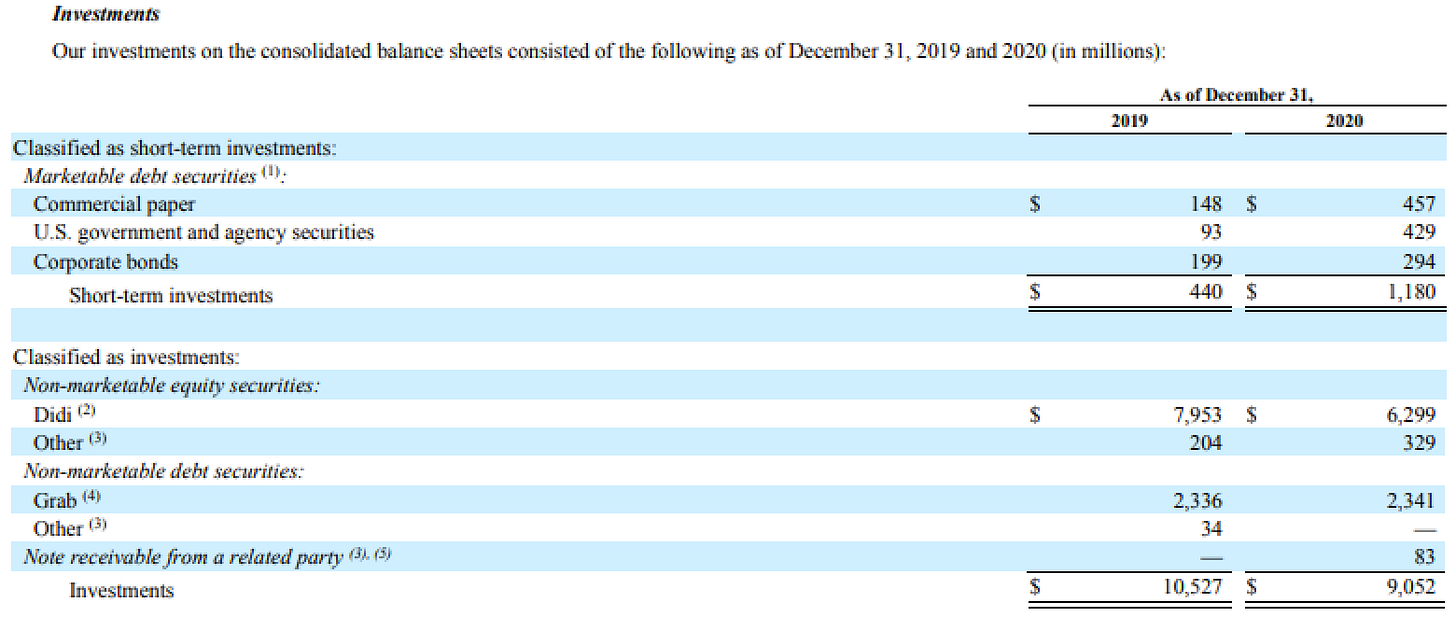

While the exact size of their stake is difficult to work out given reporting, Uber had a 15.4% stake in Didi and a 23.2% stake in Grab as of Sept. 30, 2018. (The have since sold down stakes including 8% of their holding of Didi in 2020 for a combined $500m). At its year end 2020, the respective stakes were valued at $6.3 billion for Didi and $2.34 billion for Grab (see below). What is important to note is that if Didi can get even anywhere near the $100bn cited, Ubers stake will be worth significantly more than the $6.3bn they and the market currently has in there numbers. The same is to be said for Ubers stake in Grab.

Conclusion: The strong update this morning is very positive and supports our thesis. on top of this, while the Grab and Didi news are not central to our thesis, they are no doubt still supportive and with the US continuing to perform strongly out of lockdown, Uber remains a key holding of ours.