In today’s KnowHow…

Analysis: And that’s why valuation matters

Fed warns of peril for asset prices

Hotel bookings on the up but…

Jamie D wants to see some deets

SEC to investigate the gamification of investing

What happened overnight…

It seems that nothing can get in the way of the Dr Copper freight train with the metal soaring to an all-time record overnight. Outside that, the focus today is on the US jobs data with stocks heading higher in anticipation of a strong report that will cap off a series of strong economic reports this week. Elsewhere spot iron ore broke $200 a ton for the first time while Brent crude hovered around $68. European markets are strong overall with a cyclical tilt driven by commodities. And futures on the whole up marginally this morning with yields behaving well. Look out for how some of the high growth names that bounced hard after earnings behave on the open.

Chart of the Day

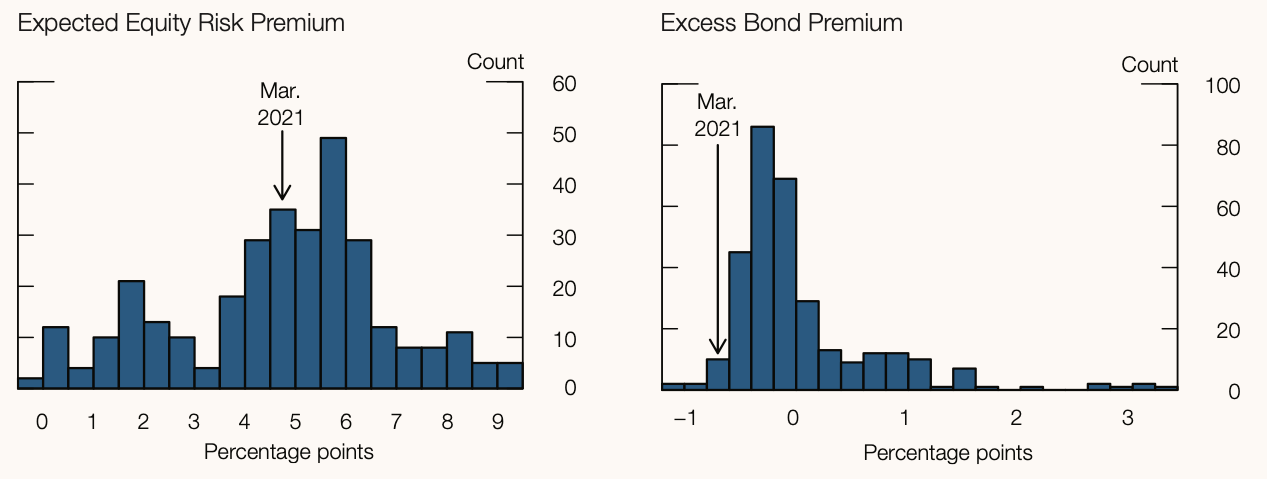

There’s more on the Fed’s Financial Stability Report further down. But, when you’re thinking about risk appetite and frankly emerging bubbles, this is the chart you need to get your head around. The Equity Risk Premium, effectively the return offered to equity investors over safe assets, has pulled back in the last couple of months but remains a source of potential inflows for the broader equity market. Not so the bond market.

Analysis

And that’s why valuation matters

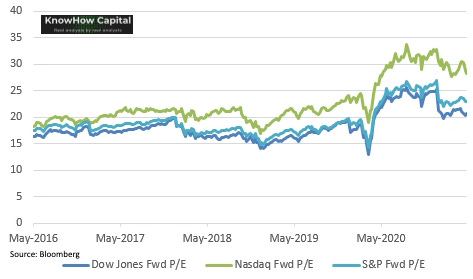

If all you did this year was check-in now and again on how the headline equity indices were performing, you would have missed what has become the mother of all valuation tantrums. Yesterday it accelerated even further. The ARKK ETF, a decent gauge of high growth and retail participation in our view, is now down 13% YTD having been up 25%. Major indices, including the tech heavy Nasdaq, were all up yesterday.

All this should tell you two things: valuation and positioning matters. Excessive retail participation in high growth along with unsupported valuations and a rising rate cycle have left them dangerously exposed. Our analysis of retail positioning is here. Today, we want to touch on how we’re thinking about valuation.

A case study through Pinterest

Let’s demonstrate this through Pinterest. We’re big fans of Pinterest and have written about the long-term opportunity. But, this analysis applies to a number of high growth stocks.

Below is the EV/Sales multiple for Pinterest. A company’s valuation multiple, on various metrics, will come down to a number of different factors both macro and micro. But, in essence, the trend is your gauge for how the market is viewing expectations for sales or earnings of that company. High multiple = high expectations, low multiple = low expectations.

In this second chart, we have overlaid that EV/Sales multiple with the change in analyst sales estimates over the next 12mths. Paying a high multiple for a stock following already high growth in sales estimates without any clear insight on the sales trend is when you start getting into valuation bubble territory. We like high growth, but we don’t like to play here.

But what’s the right valuation

The question then becomes, what is the right price to pay for Pinterest. As you can see above, the stock has now seen its multiple contract back to the post-IPO average. That looks to us far more reasonable.

There is also a wider market factor to take into account. Rates have fallen, there is more liquidity and the equity market risk premium i.e. attractiveness vs govt bonds or risk free assets is higher than pre-pandemic. It isn’t just high growth stocks that have seen a rise in valuation multiples. Across the major indices, valuations on a Forward PE basis have risen between 15-25% post pandemic.

Is that the bottom?

For high growth businesses such as Pinterest, we think you can start making the case that valuation is now finally starting to look attractive. Yesterday’s after-hours price action in other high growth names such as DataDog, Roku and Peloton may suggest the market is also coming round to that view.

What we’re reading

Fed warns of peril for asset prices…

The Fed semi-annual Financial Stability Report, may just be something you want to flick through sitting in the sun over a cold brew out on the patio. Some good charts every serious investor should be on top of but it is certainly not the most riveting reading. So, here’s the KnowHow take-away. The Fed sees a rising appetite for risk across a variety of asset markets is stretching valuations and creating vulnerabilities in the U.S. financial system. Indicators pointing to elevated risk appetite in equity markets in early 2021 include the episodes of high trading volumes and price volatility for so-called meme stocks. Elevated equity issuance through SPACs also suggests a higher-than-typical appetite for risk among equity investors. We would also flag our retail analysis from Wednesday’s KnowHow.

March sees a pick-up in hotel bookings…

Mobility data is something we track very closely, and current trends are supportive for the likes of Uber and their riding business despite the market’s tantrum around this week’s earnings (see our analysis here). Something else we are closely watching is holiday data and when traveling may begin to show a noticeable recovery. InterContinental Hotels, owner of the Holiday Inn and Crowne Plaza hotel chains, told the market this morning that it has seen a “notable pick-up” in demand from March, boosted by the Spring Break in the US and improving conditions in its Asian markets.

The company stated that occupancy in the three months to the end of March had averaged 40 per cent across its hotels, but had increased towards the end of the quarter. Revenue per available room — the industry’s preferred metric — was down 53 per cent in January compared to 2019 but improved to 47 per cent below 2019 levels in March. Another site worth tracking is the weekly US Occupancy data from STR and as you can it has levelled off in the last few weeks. These businesses are still in the mire and we’re still some way from a full recovery.

Jamie D wants to see some deets

It’s not like Jamie Dimon to shy away from a debate. The JP Morgan CEO has strong views and doesn’t hold back punches… we like that. His interview with the Investment Company Institute’s general membership meeting was no different. Jamie wants to see deets from the policy makers. It’s all well and good throwing money at the problem but he wants real targets for building roads, funding college degrees and creating jobs if they embark on a massive spending spree to bolster the economy.

“On highways, how many miles are you going to build, how much is it going to cost, when’s it going to get done, who’s responsible?” he said. On education, he doesn’t think that “free community college” is precise enough. “How many kids are going to graduate; how many kids are going to have a job at $65,000 a year?”

Just throwing money, it doesn’t work…. Try telling that to the Fed.

SEC to investigate the gamification of investing…

A few weeks ago, we wrote about the heightened scrutiny SPACs may face as Gary Gensler takes over at the SEC, so it was interesting to see his comments yesterday that regulators were scrutinizing the marriage of social media and online trading that caused gyrations in shares of GameStop Corp. this year. Gensler said applications that “gamify” trading—by using appealing visual graphics to reward a user’s decision to trade—might encourage frequent trading that results in worse outcomes for investors. Gensler also said the SEC would study regulatory changes in response to the March blowup of Archegos Capital Management.