“What do dogs do on their day off? Can’t lie around – that’s their job!”

What is in today’s daily?

As we approach Tesla’s earnings on 26th April, we show you why margins and costs should increasingly become the driver for the shares. And, SPACs are turning into a bit of a mess… why it could get a lot worse before it gets better.

Chart of the Day

Whether it is Twitter or Google, Dogecoin is the most searched term today anywhere. The “meme” coin is the new Gamestop. “ahoooo”… hold on… is that the sound this doge makes?

If Tesla was just a car company

As we approach Tesla’s Q1 earnings release on 26th April, we’ve been trying to flex a few modelling assumptions to see what’s currently implied in the share price. There is always, and unsurprising so, a major focus on Tesla’s delivery volumes. What will EV penetration be by 2030, what will Tesla’s share of that market and opportunity be?

If Tesla was just another car company, you would assume some reasonable long term operating margin for a vehicle producer and value the business on that basis. For reference, have a look below at the operating margins of VW’s range of brands. It’s a wide range but you could assume that an electric vehicle producer, and a low cost one at that, should be able to get towards the top-end of that range ex servicing.

What’s implied in the current share price?

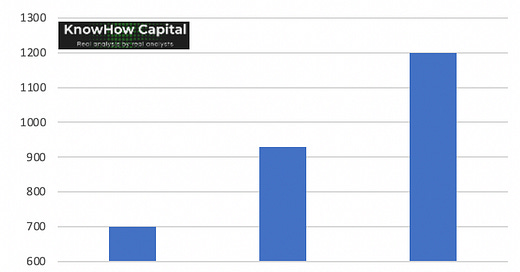

To get to the current share price, assuming a stable 12% operating margin long-term (not quite like for like vs above but let’s go with it for the purposes of our analysis), we think you need a volume trajectory roughly as below.

Of course, that’s not unachievable at all considering EV volumes and Tesla’s own market share have both consistently surprised positively versus most forecasts. And, it is broadly inline with the company’s own goal of delivering 50% CAGR growth.

But, Tesla is not just another car company. It is an innovator and the lowest cost operator in what is still a frontier and developing technology. Volumes will of course matter but given how well the shares have responded to deliveries over the past year, we believe that the greater sensitivity to valuation and consensus estimates will come from margins. Below is the chart the company produced at its battery day in September.

If successful, we think it can have a 500bps impact on operating margins coupled with absorption of R&D and selling and administrative costs... possibly even more. And it’s important to appreciate the sensitivity of that to valuation. Assuming a further 10% CAGR in volumes at the same operating margin gets us to a share price of $930/sh. But, holding volumes at our previous level and assuming a 500bps increase in operating margins actually gets us to $1200/sh. As Tesla ramps up volumes over the coming quarters, we believe gross margins and battery costs as well as stabilising fixed costs will increasingly become the driver for the shares.

A SPACing mess

The recent clearance of Gary Gensler to lead the SEC has refocussed the market on a potential crackdown post a series of difficulties this year including the collapse of Archegos Capital Management and the Gamestop fallout. One area of the market that is also under increased scrutiny is the SPAC space with agency officials warning in recent weeks that offerings are getting riskier for retail investors.

What is the background?

With over 350 SPACs in the US alone YTD, we have already seen more SPACs this year than in any calendar year between 2003 and 2019. To put this into context, 79% of this year’s IPOs by number and 69% by value have been SPACs. If you would like to understand more exactly about how SPACs differ to IPO’s then this is a very succinct summary from last October and the chart at the bottom of this paragraph hopefully also explains how they work.

What is the worry?

The pipeline of SPAC public offerings has now seen a large overhang as the US regulator this week issued new guidance changing the way accounting rules apply to a key element of the blank-check company. The accounting considerations mark the latest effort by the SEC to clamp down on the white-hot SPAC market. For months, the regulator has been raising red flags that investors aren’t being fully informed of potential risks associated with blank-check companies in addition to commenting on accounting standards of SPACs. The below summarises the statement well:

In a statement late Monday, SEC officials urged those involved in SPACs to pay attention to the accounting implications of their transactions. They said that a recent analysis of the market had shown a fact pattern in transactions in which “warrants should be classified as a liability measured at fair value, with changes in fair value each period reported in earnings.”

“The evaluation of the accounting for contracts in an entity’s own equity, such as warrants issued by a SPAC, requires careful consideration of the specific facts and circumstances for each entity and each contract,” the officials said in the statement.

It is also worth noting the legal risk are rising. The number of lawsuits filed in New York State against SPACs are on the rise, according to an analysis by law firm Akin Gump. It found that 35 suits have been filed between September of last year through the end of March and that they generally allege that SPAC directors provided inadequate disclosures about the companies they intended to merge with.

Why could this be important?

The risks to the market in our opinion are twofold. (1) on the banks themselves, (2) On the wider market, especially retail investors.

1. Banks are now relying on SPAC’s more than ever. This has been highlighted in the US Banks Q1 results this week with many citing the SPAC boom as reason for their outperformance in Q1. Having seen blowout results in Q1, we have had a number of questions on whether this could be the peak for banks in terms of SPAC and ECM revenue but also the resulting impact on trading revenues.

2. Wider market / retail investors: Cracks had already started to form in the SPAC market, as evidenced by the rise and fall in the share price of Churchill Capital Corp. VI, which announced a merger with electric car manufacturer Lucid Motors in February. Having priced at $15 (50% premium on the SPAC’s initial IPO), the price of the shares in the merged company rallied to over $64 before falling to $20 subsequently. On top of this, all but one of the 15 SPACs that started trading towards the end of March started trading below their initial public offering (IPO) price of $10 per unit on their first day of trading. Much like the Gamestop frenzy, there are serious concerns about the readacross to the wider market if these cracks continue to grow and especially on retail investors given the size of the retail involvement in SPACs.

Conclusion:

While SPACs are a relatively new phenomenon, in a market that is at all-time highs having run too far too soon over the last few weeks in our opinion (see here), we are keeping a very close eye out at the ongoing SPAC developments given the sheer amount of capital that is currently tied up in SPACs.