If you find our work valuable, please like, subscribe and share. We rely on that to grow our subscriber base. This is real analysis by real analysts. Enjoy!

In today’s KnowHow…

Investing is getting harder than you think

Foreigners are heading back to Chinese stocks

Record low inventories supporting German IFO

M&A keeps on coming

What happened overnight…

It’s another green day as US futures and global markets are once again in positive territory as more central-bank officials (Fed Vice Chair Clarida and ECB member Panetta) suggested that inflationary pressures were transitory. Over in Europe and the Stoxx 600 headed for a fifth day of gains, the longest streak this year, with travel and leisure names leading the way. MSCI APAC also headed for a fifth day, aided by gains in Hong Kong and China, with the onshore yuan hitting a three-year high (more below). Outside equites and the Chinese banking regulator has asked lenders to stop selling financial products linked to commodity futures to individual investors, according to a Reuters report.

Chart of the Day

China’s NDRC is pushing for less speculation and far more price stability in commodities as part of its next 5yr plan. That’s not surprising given the size of the China import problem across all commodities from grains to metals to energy. We wrote about this last week in our note (here). Authorities want to ensure that they have built up sufficient supply and reserves of commodities to prevent price volatility and of course inflation. Does that really create a commodity super cycle? remains to be seen in our view.

Analysis

Investing is getting harder than you think

We’ve had a couple of goes recently at smashing down some favourite investor misconceptions. What particularly irks us is this idea that you can ignore all around you as well as valuation and if you hold certain stocks for long enough, you will have made a fortune. The theory is very nice but in practise there are so many factors that come into play not least of all, your own personal situation or remit. Plus, picking winners is not easy.

60% of stocks have generated negative wealth through history

In 2016, Professor Hendrik Bessembinder wrote a paper for Arizona State University looking at the total wealth creation the stock market had delivered relative to Treasury Bills since 1926. This was his conclusion in his updated paper last year…

“Summing the outcomes across firms indicates that Shareholder Wealth Creation totalled $47.38 trillion as of end of 2019. Of the same firms, 11,036 firms (42.17% of the total) created positive wealth for their shareholders over their full lifetimes, while 15,132 firms (57.83% of the total) reduced shareholder wealth, as compared to the Treasury bill benchmark”

That tells you that for almost 60% of stocks, investors have generated negative returns. But, it gets better. 80% of that wealth creation has been from just 83 stocks. The Top 50 stocks list from the paper is below. Some household favourites on there for sure.

As many losers as there are winners in recent years

The reality is that if you look through history, there have almost always been as many winners in the stock market as there are losers despite short-term periods of stronger breadth.

Profitability being concentrated towards fewer companies

The question is whether the software revolution and technology can drive faster profitability for a greater number of companies as stock price performance post-pandemic would suggest. McKinsey refers to this as “The Great Acceleration” as innovation drives a step change in economic profit. But again, there is a nuance. The winners are winning a greater share of the prize and as scale kicks in there are even less winners than before.

There are of course caveats to this analysis. We are currently seeing record levels of equity issuance. The pool of stock market companies that are at the forefront of innovation in their fields is therefore growing. For those that succeed, the prize is big. But, contrary to the valuation the market is assigning many of these businesses, history would suggest very few will actually be big winners. “Buy and hold” is a nice mantra but picking what you buy is much harder than what those people would tell you.

What we’re reading

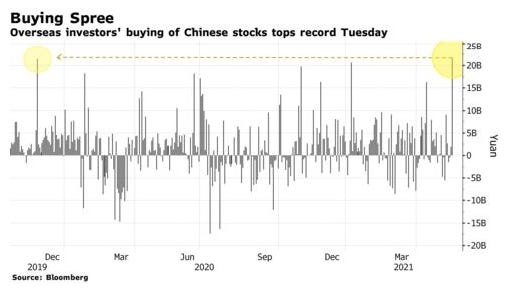

Foreigners are heading back to Chinese stocks

It is interesting to see that we saw record foreign purchases of Chinese stocks on Tuesday. China’s equity benchmark rallied by the most since July as investors piled into stocks amid attempts by policymakers to contain commodity prices. The yuan also advanced to its strongest since 2018. Some investors have said that the strong buying of foreign investors in A-shares via the trading links has a lot to do with the stronger yuan as there have been expectations that China may allow the yuan to strengthen a bit to counter the import inflation. As a result, the CSI 300 Index closed 3.2% higher at its strongest since early March, driven by gains in consumer staples equities. In terms of the scale of the overseas buying, the chart below highlights that investors net purchased 21.7-billion-yuan ($3.4 billion) worth of A shares via links with Hong Kong on Tuesday, the most ever. This, we think, is an interesting signal as is does reassure investors that many of the long-term institutional investors are willing to buy some of the heavyweight stocks at current levels given sentiment has stabilised.

Record low inventories supporting German IFO

The headlines out of Germany were very positive yesterday as Germany’s industrial production leading indicator, the IFO index, increased to its highest level in two years and came in at 99.2 in May, from 96.6 in April (see chart below). Both the current assessment and the expectations component increased significantly, with expectations surging to the highest level since January 2011. Something that is certainly worth noting though is that Germany is at record-low levels of inventories of finished goods as a result of the pandemic driven demand overhang. Companies are trying to address these with investment and hiring but this is another inflationary signal that we will be tracking closely as production ramps up rapidly post re-opening.

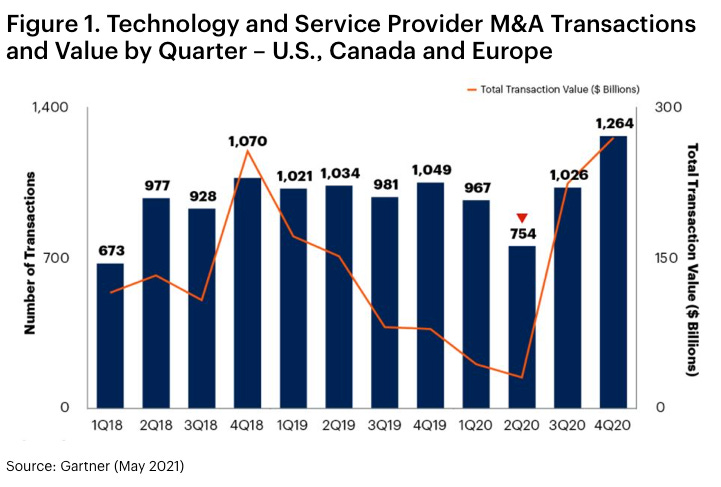

M&A keeps on coming

Another day and another M&A announcement. As an FYI, we are in the middle of some analysis looking at who else could be an M&A target so keep your eyes peeled for this. Today, we got the announcements that inhaler developer Vectura and private hospital operator Spire Healthcare have both been approached in the UK. Ramsay Health Care of Australia has proposed to buy Spire for around £1bn, or £2bn at enterprise value. The 240p per share offer is a 24.4% premium over the final closing price and a 55.8% premium over the March 5th value that Ramsay first approached. Vectura has agreed a deal with private-equity group Carlyle for £985m. Under the terms of the offer, shareholders will receive a cash dividend of 136p plus a dividend of 19p per share. This corresponds to a 32% premium on Tuesday’s ex-dividend closing price. On a side-note, this article from Gartner is also interesting as it suggests, for the tech space at least, the global M&A may likely exceed previous highs recorded in 2018 by next year.