If you value our work, please help us grow further by subscribing, sharing and Tweeting.

KnowHow Capital is sponsored by new company modelling platform Stellar Fusion. Dynamic company models built by real analysts to help you invest with knowledge. Sign up to get access on launch. Coming Soon!

For this piece we are taking a deep-dive into an important “social” theme in relation to the music industry. The dynamic between the industry and its artists has always been topical, but things are really hotting up right now. We’ll help to cut through the noise by contextualising the issue, and looking specifically at how it is playing out in the current era of streaming. We’ll then look in detail at the key music streaming giants - Spotify, Apple, Amazon, YouTube - assessing their role in creating the issue as well as what they are doing to address it.

The power dynamic between artists and the industry is a complex one from the outset. Artists are the industry’s clients and so there is a responsibility to service them, but as content producers they are also part of the supply chain. The latter means that, sadly, artists are often a dime a dozen and so can be brutally replaced. Regardless of where artists fall, the industry does have a “social” responsibility in terms of safeguarding and looking after their interests. While we hope this sense of responsibility is the main motivator for positive actions, there is also a strong business imperative - mistreatment could become a PR nightmare, especially when it comes to bigger artists. You definitely don’t want to mess with the BTS Army, and #FreeBritney campaigners are another reminder of the lengths fans will go to to protect the wellbeing of the artists they love.

“Tell me what's going on”, Marvin Gaye

The music industry is multifaceted, comprising a range of stakeholders and businesses, including music labels, streaming companies, venues, artists and fans - making it a complicated beast to look at. While tensions between artists and the industry have been well documented for a few years - think back to T-Swift removing her music from Spotify….although that was accompanied by a swift u-turn - the situation has been compounded by the Covid-19 pandemic. With the near complete loss of income from (in person) live music performances due to social distancing restrictions, the plight of artists has very much come to the fore. The last 18 months have seen artist groups mobilising to demand action (including hosting protests), as well as a high-profile UK Government Inquiry into the Economics of Streaming which has caused quite the stir!

“Oh, take me back to the start”, Coldplay

So, how did we get here?! The music industry has changed considerably over the last few decades. Technological advancements significantly changed music production and distribution, leading to these becoming largely digital. Steve Jobs, with his vision of putting 1000s of songs in consumers’ pockets, very much shepherded music into the new digital era.

While the evolution came with many positives, it gave rise to a privacy epidemic (starting in the 90s) which would go on to cripple the industry for the coming decades. This led to a significant loss in industry earnings, and it was only in 2015 that the recorded side of the music industry finally started to grow again. The revival was very much thanks to streaming companies, spearheaded by Daniel Ek of Spotify (and formerly of Napster) who managed to create a service that was optimised for the digital era and, importantly, provided consumers with a viable and attractive alternative to piracy.

Source: IFPI, Global Music Report 2020

The conundrum with streaming, however, is around pricing and what services can realistically charge. One of the main challenges is that, while copyright infringement authorities have clamped down and made it harder to access content illegally, many methods are still available meaning that the temptation to pirate is still ever present. There is also an abundance of content available for free via video sites such as YouTube, which has also become a go-to method for pirating. Data suggests that one in five (21%) music downloaders in the UK use video to MP3 converters to access music, and this (stream ripping) has now become the most common method of music piracy.

It isn’t all doom and gloom though! Given the context (pre-2015) and the current barriers to payment, what streaming companies have managed to achieve is a music marvel! They are essentially mesmerizing consumers with convenience and added value, and thus diverting their attention away from unsavory alternatives. Furthermore, not only is streaming breathing life back into the industry, it's a revival on steroids. Revenues from recorded music were $21.6 billion in 2020, and despite the pandemic, Goldman Sachs predicts that these will reach the projected $80+ billion by the close of this decade (i.e. 2030). Music streaming’s contribution to this pot of money is growing rapidly and is predicted to continue.

“Started from the bottom, now we’re here!”, Drake

While streaming is supercharging the industry, there is, of course, a “but”!

The crux of the issue is whether or not everyone is benefiting fairly from the resurgence of the industry, particularly artists. The digital era has essentially flipped the historic music model on its head. Previously, recorded music was the big money-maker, with consumers paying significantly higher prices for music (e.g. $0.99 for a single track download or $9.99+ for an album). Streaming royalties are notoriously confusing to understand but, essentially, a proportion of the revenue generated (through subscriptions and ads) is shared out to artists based on the total proportion of streams they get. The highest rate per-stream comes to $0.01 (Amazon Unlimited), which is some way away from revenues generated from music purchases in the good old (pre piracy) days.

Now, every industry evolves, especially in the digital age, and so teething problems are only natural. But while there had been grumblings in the past, the Covid-19 pandemic amplified these to the point where they could no longer be ignored. A large part of this was the loss of live music performances, which generate around $25billion+ in revenues each year. Artists had adapted their creative and marketing processes, turning live into their new money maker. However with this revenue stream essentially cut-off, many were struggling to make ends meet.

Artists have, of course, been impacted to different degrees. While the situation is sad for all, one perhaps doesn’t feel quite as sympathetic for the A-listers confined to their mansions, or hobbyists hoping to become overnight viral sensations. We perhaps need to be most worried about emerging and less high profile artists, especially with surveys showing that nearly three quarters (71%) of musicians and DJs report having lost more than 75% of their income during the pandemic.

The light has now also been shone on some other potentially controversial elements of the streaming model. Firstly, the labels are in bed with everyone! They negotiate with streaming companies on behalf of artists, but also need them to win to ensure that the industry as a whole (and their own revenue) continues to grow. Perhaps most controversially, the major labels (Universal Music Group, Sony and Warner) were given a financial stake in Spotify. Many are, therefore, beginning to question the rules of the game, as set by streaming companies and labels. The UK Government enquiry has even raised questions around antitrust.

Another point of contention is “Payola” potentially creeping into music streaming from radio. This is where an artist’s tracks are promoted (e.g. on curated or algorithmic playlists) without being disclosed, which could be the result of representatives incentivising platforms or the latter using it as a bargaining tool to pay lower royalty rates.

“I got new rules”, Dua Lipa

Now that we’ve set the scene, let’s get this party started! We’re looking in detail at the four major streaming giants - Spotify, Apple, Amazon and YouTube.

Individually and as a collective, these four have significant power when it comes to shaping the music industry for the foreseeable future. As we know, “With great power comes great responsibility”, so let’s see how it’s being used.

……………………………………………………….

Spotify

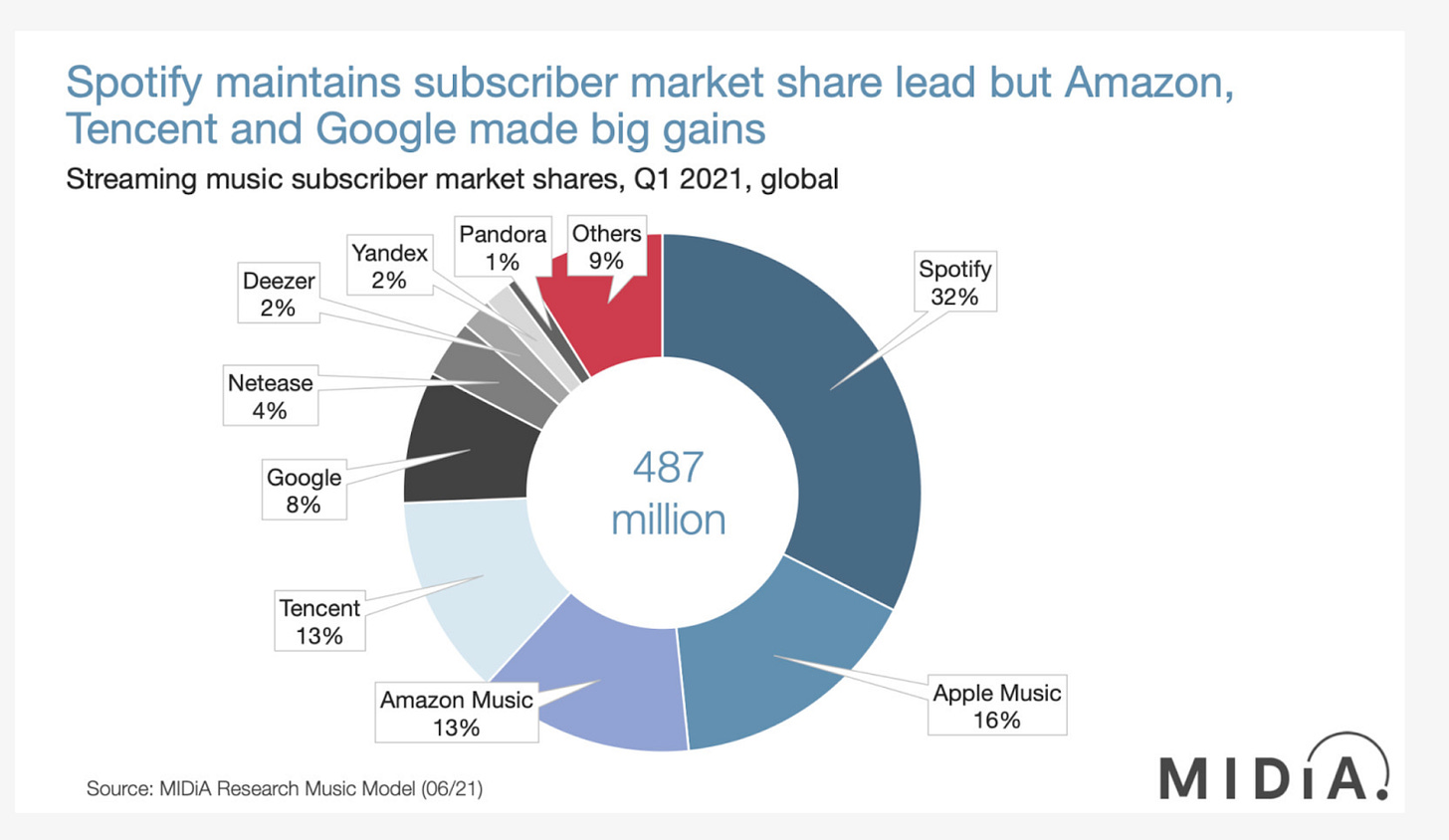

Spotify is definitely the prized pony, with the largest share of streaming subscribers globally by some way (32%). It has 345 million MAUs, 155m paid subscribers, and is now available in 92 markets. It also experienced significant growth in 2020, contributing 20% of recorded music revenue.

While business models across music streaming companies have more in common than they do apart (e.g. content, catalogue, maximum price point), Spotify has been one of the main targets for the frustrations of aggrieved artists. The Union of Musicians and Allied Workers staged protests at Spotify’s offices in March 2021. In fairness to Spotify, they responded with transparency, setting up the microsite Loud & Clear to offer more insight into their streaming model and how much artists are paid. Among other things, Spotify has stated that it pays approximately two-thirds of its overall revenue to music rights holders (e.g. labels). They did however then pass the buck firmly over to music rights holders, saying that this is where their involvement ends. More specifically, that rights holders decide how much money each artist gets, based on their agreements. Little was also said about Spotify’s actual relationship with labels, so this too remains somewhat of a mystery.

Spotify has been vocal about its ambition of building a platform that allows 1 million artists to make a living from their music. This is again another transparent claim and, importantly, a specific target that they can be measured against. While the proportion is increasing - in 2020, over 13,400 generated $50,000 or more per year from Spotify, up 80% from the proportion in 2017 (7,300) - the destination feels a long way away, and critics are not shy about pointing this out. Spotify has tried to provide insight into the roadmap, claiming that as the platform grows in terms of users and content, opportunities for artists will do the same. For example, enabling artists to create closer relationships with fans which, importantly, can be monetized through increased streams as well as driving traffic to other revenue channels (e.g. merchandise, ticket sales). The extent to which this strategy is proving effective will be something many (including us) will be keeping a close eye on in coming months.

In terms of supporting artists specifically during the Covid-19 pandemic, Spotify’s efforts have been somewhat mixed. Spotify’s COVID-19 Music Relief Project, consisting of matching donations, has collectively raised $10million to support individuals in the music community. They also created a crowdfunding ecosystem within the platform, allowing artists to add a “donate” button to their profile to receive financial support directly from fans. Although well intentioned, the latter has been somewhat controversial. Some artists felt that it was not only embarrassing for them to admit they were struggling, but that it also backfired on Spotify by highlighting that the industry was not supporting them.

One of the overarching key factors related to Spotify is its adoption of the “Freemium” model (i.e. offering a free ad-supported version along with a paid subscription). While Spotify doesn’t get quite as much flack as YouTube, it is subject to criticism for essentially devaluing music by providing it for free. This has made the brand an easy target for rivals, with Apple landing more than a few blows.

While the topic is complex, ad-supported revenues do contribute significantly to the overall revenue generated from music streaming. Spotify is also growing its paid users at a high rate, suggesting that the free version is not cannibalising its offering. And as the service expands to new markets, where the price of subscriptions tend to be lower, ad-supported revenues will likely play an increasingly important role in growing the financial pot for everyone.

Source: IFPI, Global Music Report 2020

While the default for many is to question the intentions of tech giants such as the ones we are looking at here, the truth is that their ability to win financially in music streaming alone is somewhat capped. As described above, the industry is in recovery and only beginning to grow again, after technological changes and pirates majorly rocked the boat. While vertically integrated services such as Apple and Amazon can afford for music to be a loss leader, Spotify, which has historically had all of its eggs in one basket, is less able to do so. However, Spotify’s bullish adoption of other forms of audio (podcasts and live) is allowing it to diversify its content and become less reliant on music. Having these formats, with less complex licencing and often owned by Spotify, means there is greater profit to be had. Hopefully this will mean that Spotify can afford to pay an even higher proportion of music revenues out to artists, but it will also give it a stronger position in negotiations with the industry. To what extent Spotify remains loyal to its first love (music) is another thing we will be watching closely.

……………………………………………………….

Apple

Next up, Apple - the second biggest streaming service. Although, with a 16% share of global streaming subscribers, along with fellow rivals is well behind Spotify (32%).

Apple does however stand out in a few ways. Firstly, relative to its competitors, Apple is an OG in the music game and has demonstrated its commitment to supporting the industry over the years. Originally this was in the form of iTunes which offered some welcome relief, and then Apple Music when streaming emerged as the more sustainable long-term model. Apple therefore does seem in it for the long-term. Secondly, perhaps easier for Apple given its vertical integration, Apple Music’s revenue model is paid subscription only. They have taken a strong stance against offering music for free, and been quite vocal in their criticisms about services that do.

Inlight of protests and the current context of scrutiny towards streaming services, Apple has also come out this year (in June 2021) and attempted to be transparent about its actions, along with taking a few additional swings against its competitors. More specifically, Apple has flagged that it pays the same headline rate (52%) to artists on major labels as well as independent labels (something not all services do). The company has also categorically stated that Payola is in no way part of its model.

Apple is also showing innovation with inclusion of live and on-demand radio within its streaming platform. Whether it be through increased exposure or even having their own shows, it is putting artists at the heart of the service. Of course, these privileges are reserved for the creme-del-la-creme (e.g. Elton John) but nonetheless, it is a point of difference. Furthermore, Apple is continuing its legacy of being multi-format, and by including radio within the paid streaming offering, could help to attract a wider consumer base (i.e. those who would not pay for streaming alone).

As promising and (potentially) well intentioned as the Apple Music offering is, the truth remains that Apple has been lagging behind Spotify for some time now. And it doesn’t seem as though the gap is going to close any time soon. In order for Apple to fulfil its potential in a way that benefits more artists, it will need to start pushing on. There is, however, another way that Apple can start to gain ground on its competitors. While it may not be Queen B in the music streaming world, one must not forget that Apple is a tech Juggernaut with a lot of control in the wider music streaming ecosystem. The beef with Spotify is one to watch, as the two lock horns over app store fees and the compatibility of the existing Spotify app on the new Apple M1 chip. Hopefully all such negotiations between streaming giants are resolved in a way that helps the industry continue to thrive, as this will ultimately benefit everyone - most importantly artists.

……………………………………………………….

Amazon

Before digging into the details, let’s make sure we’re all on the same page re the various ways to access music via Amazon. This could take a minute! Unlike Apple, Amazon has historically had a free tier (Amazon Music Free) and also offered music bundled in with other services (Amazon Music Prime). Both are however restricted in terms of content, so if you’re after a more comprehensive selection, then it’s Amazon Music Unlimited or, for the super fancy, Amazon Music HD.

Like others, Amazon is also still very much lagging behind Spotify in terms of its share of music subscribers globally (13%). But it is stepping up in terms of its speed of growth, in large part due to strong engagement in emerging markets. This would suggest that the future is looking bright and it could start giving at least Apple a closer run for its money soon.

Importantly, Amazon doing better could be good news for artists, given that it pays the highest royalty rates out of music streaming companies. Perhaps partly as a result of this, Amazon has also managed to steer relatively clear of controversy in relation to paying artists. It has also been less vocal publicly, relative to others, about what it’s doing to address concerns around music streaming royalties.

Overall, Amazon seems to be flying under the radar somewhat when it comes to music. While music has been part of the offering, it may not have been a priority but this could be set to change. With its subscriber numbers increasing and the current attention on streaming companies, we’re keen to see how Amazon responds in coming months. Will it lead from the front and leverage its position as the streaming company that pays artists the most, or will it change tact when there is more at stake?!

……………………………………………………….

YouTube

And then there was one - YouTube! If you like controversy, then you’re in for a treat - we’ve saved the best till last.

Mind the gap - the hole YouTube has created in the music ecosystem!

Over the last few years, YouTube has been in some hot water around devaluing music, and thereby undermining the industry-revving efforts of other music streaming services. A prominent issue has been around the “value gap” created due to YouTube not paying licensing fees in the same way other streaming services do. While high profile artists have the opportunity to earn significantly (and directly) through advertising revenue on YouTube, for the majority (and other industry stakeholders such as labels) the model is suboptimal.

As laid out earlier, YouTube also offers consumers alternative (often illegal) methods of music access, which can be significant barriers to the adoption of paid streaming subscriptions. Copyright infringement is another issue. This is largely due to “safe harbour’ policies for platforms with user generated content, meaning they do not face the same licencing laws - copyrighted content only has to be removed once the platform has been informed.

YouTube does, however, have YouTube Music, a bespoke music streaming service that functions more like its rivals in terms of licencing, content and interface. It also operates the more classic music streaming “Freemium” model, although an added draw is also getting access to friction free (e.g. adless) YouTube through the paid subscription. But, YouTube’s bespoke music subscription is one of the streaming world’s best kept secrets - take-up is low (8% of global subscribers). Although, in good news, data suggests that it is beginning to grow, especially among young consumers and those in emerging markets.

One of the biggest conundrums with YouTube is that it is a powerful musical beast and so must be treated with caution. In terms of user engagement, 47% of music streaming globally takes place via video platforms, of which YouTube is the predominant one (IFPI 2019). Also, we would all of course be devastated if music was no longer available via YouTube - where would we go for dancing cat videos, classic live performances or obscure versions of songs you can’t find anywhere else. Watching whatever you want on YouTube, whenever you want, has essentially become a human right!

While the situation is complex, in relation to the current context of streaming royalties and artists, YouTube’s model is in many ways the most problematic out of our streaming giants. This does, however, mean that it has great potential to have a positive impact. Importantly, YouTube does seem to be making positive strides, looking into helping artists monetise their content better, as well as growing its specific music platform (YouTube Music). Now that things are heating up even more, we expect them to step such efforts up further.

……………………………………………………….

“Although we've come to the end of the road, Still I can't let go”, Boys II Men

And breathe - we’ve come to the end of this rather complex tale. Before we go, we’d like to leave you with some final thoughts and pointers on what to keep your eye on.

In summary, it’s important for all involved that music streaming continues to thrive, as it’s the industry’s ticket out of the gloom of the previous few decades. However, as things stand, artists in particular are struggling and more needs to be done to address this.

Given pressure being put on by artists and authorities, we expect to see streaming services taking more active steps in the coming months or else they will find themselves facing more criticism:

As the superstar of the industry, Spotify may get away with making fewer fundamental changes, such as paying higher per stream rates. The by-products of its continued growth and focus on helping artists create new revenue streams could, however, be positive.

More competition between Amazon and Apple for second place could have positive repercussions. Both have promising offerings in relation to artists, such as paying higher per stream rates, the benefits of which will be felt more as they grow. This will also begin to increase the pressure on Spotify to do more.

YouTube has the most different and, frankly, controversial model out of the four. Despite scrutiny, it has managed to get by relatively unscathed thus far. But something feels different this time, and so we’re hopeful that it will be more proactive in its response.

Thankfully, with the pandemic easing and the return of live performances, the situation for artists will start to improve. And while the last 18 months have been painful, they have provided a much needed inflection point for the industry, one that will hopefully mean artists are better off in the long run.