f you find our work valuable, please subscribe, share and give us a like. This is real analysis by real analysts. Enjoy!

In today’s KnowHow…

Tail risks

Belarus sanctions and potash / oil prices

We’re all off to the pub…

Airbnb – Moving with the Times

What happened overnight…

The Fed inflation comments have buoyed stocks overnight as US equity futures alongside European stocks all rose as Fed officials played down the risk of persistent inflation. The Stoxx 600 in Europe is poised to hit fresh record highs with the tech sector leading the way as Treasury yields ticked lower and the US dollar hit its lowest level since January (reminder last week we wrote on why the dollar could go even lower in the near-term). Finally, Oil retreated post the biggest two-day gain since March as investors confidence rose that demand will be able to accommodate any fresh flows from Iran should the nation’s nuclear deal be revived. We wrote on this last week too and why Iranian oil coming back online may not have as big a impact as many expect.

Chart of the Day

It is a year on since the death of George Floyd. A year in which race and inequality have become such a big issue in our daily lives. A lot will be written and discussed over the coming days around what level of progress has been made. Race is a deep-seated issue and needs addressing but we wanted to highlight this chart. History has shown time and time again that social unrest and income inequality are highly correlated. Fixing the problem must start from there.

Analysis

Tail risks…

There is a tendency amongst some investors, particularly growth investors, to argue that “tail risks” don’t matter if you keep investing in quality companies. To a degree, that is true. You can find various bits of analysis that show you that holding for long periods of time leads to performance. But, we’ve said this before and we’ll say it again… your average investor, or portfolio manager for that matter, is unlikely to be able to sit through big drawdowns and not react. Understanding your tail risks is therefore important.

A few years ago, PIMCO published a report arguing that excess liquidity and the interconnectedness of financial markets and global value chains meant that tail risks were fatter than normal i.e. higher standard deviation events were occurring with greater frequency than at other times during history. This feeds into some of the volatility analysis we have done in recent Daily KnowHows. An investor today has to accept greater volatility in their portfolio.

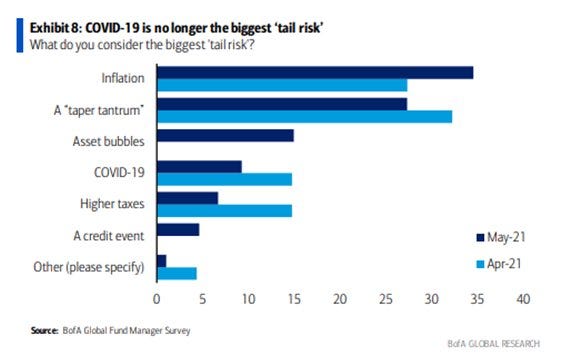

The team at Bank of America run a monthly survey asking their investors to highlight what they believe is the biggest “tail risk” for markets. This month’s survey is below. Concerns around inflation, asset bubbles and a potential credit event have risen versus April. Inflation and a potential “taper tantrum” as we approach H2 are the biggest tail risks.

But, we’ve been giving this some thought. Are these really “tail risks”? We know inflation volatility is a thing, we’ve experienced it through Q1/Q2 this year. And, much of the market is sitting back waiting for the “taper tantrum”. They are risks for sure and will drive volatility but what’s happened in Belarus this weekend, or the ongoing risks around Taiwan-China, another pandemic, even the Colonial Pipeline etc are the risks that could really surprise the market.

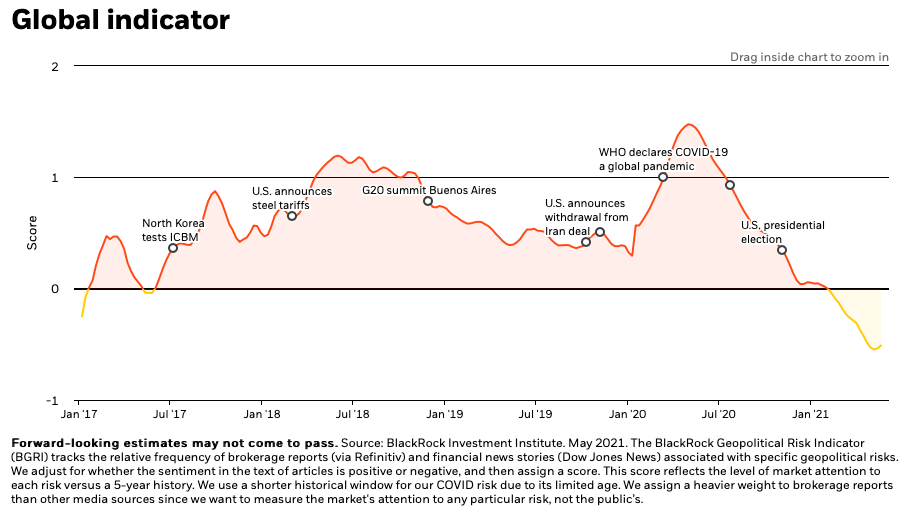

In their recently refreshed Global Risk Indicator, BlackRock have 10 tail risks which they believe could catch markets by surprise. These include technology decoupling, COVID-19 resurgence, cyberattacks and US-China tensions. They then use a combination of words analysis in company and brokers reports along with news articles to assess the extent to which the market is paying attention to them. All pretty clever really. Their chart below would suggest a high degree of complacency around tail risks.

What we’re reading

Belarus sanctions and potash / oil prices

We have all seen the headlines, but we think there is something that the market isn’t taking notice of just yet. Last night Brussels agreed to ramp up sanctions against Belarus and ban its state airline from EU airports after the Minsk regime triggered global uproar by intercepting a Ryanair flight carrying an opposition activist. European leaders agreed to “targeted” economic measures and with that are expected to be aimed at companies and oligarchs accused of financing the 27-year rule of President Alexander Lukashenko, we think we may see sanctions on lucrative oil and potash sectors, crucial providers of revenue for Lukashenko’s regime. Calls overnight have been for "European countries to join the U.S. in sanctions against Belneftekhim and sanction Belaruskali. Belneftekhim is Belarus's state oil company. Belaruskali is one of the world's largest producers of potash. With potash tightness already in the market due to Indian supply, we think this could further tighten the market, raising the price further (see below) and support producers such as ICL or K+S in the near-term.

We’re all off to the pub…

We have long suggested that the pent-up demand for the pubs and restaurants space would be significant (one of the reasons we like Uber so much) and initial analysis in the UK of non-official data shows that after months of lockdown, the populations of England, Scotland and Wales flocked back to their favourite bars and eateries as they opened inside from May 17, boosting bookings and sales to above pre-pandemic levels. UK consumer spending between Monday and Wednesday last week rose 10 per cent on the levels recorded for the same days in 2019, before the pandemic hit. This was the strongest reading of any week since coronavirus restrictions were put in place in the UK last March, according to figures from Fable Data, which tracks banks transactions. On top of this, Restaurant bookings were 65 per cent higher on Friday and Saturday last week than the same days in 2019, according to data from Open Table and mobility and short-term lets are all increasing. While we are not there yet, this is certainly some more good news for the Economy.

Airbnb – Moving with the Times…

As we leave lockdown and travelling returns (see article above that highlights short-term rents recovering – chart below too) it is interesting to see that Airbnb is making several changes to their service to help with this popularity surge in two main ways.

1. Providing More Help for Its Guests. The service just unveiled the new “I’m flexible” feature which allows guests that are more likely to be more lenient on where and when they travel to be awarded with more options for rental homes, a feature that is likely to increase its user base. Other notable changes include a clearer cancellation policy as well as providing guests with more options for things to do within their surrounding area.

2. Providing More Help for Its Hosts. Airbnb is helping its hosts by making the process to become one easier and quicker as well as providing new videos on how to be better at hosting guests from existing hosts. Going further, the ability to price your rental home quicker, a better-built messaging service, and new online classes for hosts are just a few other ways Airbnb is changing for the better.

The company has adapted to make sure that not only its users are able to get to more destinations, but that hosts are there to provide them with what they want with the recent demand for travel. While there are many more features and the dates of when all of these features will release will vary, Airbnb has proven itself to be a company that follows what is going on extremely closely and can change with the times very well.