Please give us a like on Substack if you find our work valuable. It helps us enormously!

In today’s KnowHow…

The US Dollar has further to fall

The Waymo spin-out

Your country needs you to take a job

European Financial Stability report highlights credit risks

What happened overnight…

Stocks are mixed on Thursday with investors juggling the threat of reduced stimulus against some further signs of economic progress in the recovery. In the US, S&P futures signalled a fourth day of loses with Cisco weighing on the index after its profit forecast missed estimated. Over in Europe and equities pared gains to trade mostly higher with defensives and tech sectors leading the way. Oil is now hitting three-week lows, having gained earlier, while yields fell as the US dollar weakened (more on why we expect this to continue below). Finally, the cyrpto roller-coaster stabilised slightly after a c30% plunge yesterday then rallied 30%. Even post this, Bitcoin remains below that $40,000 mark.

Chart of the Day

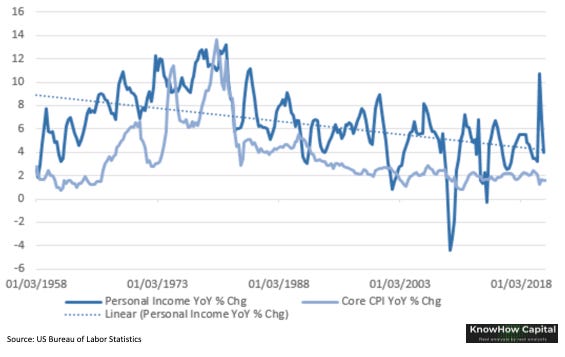

Ever wondered why we bang on about the Fed and inflation all the time… well, it’s kind of your biggest investing risk over the next year. We got you…

Analysis

The US Dollar has further to fall

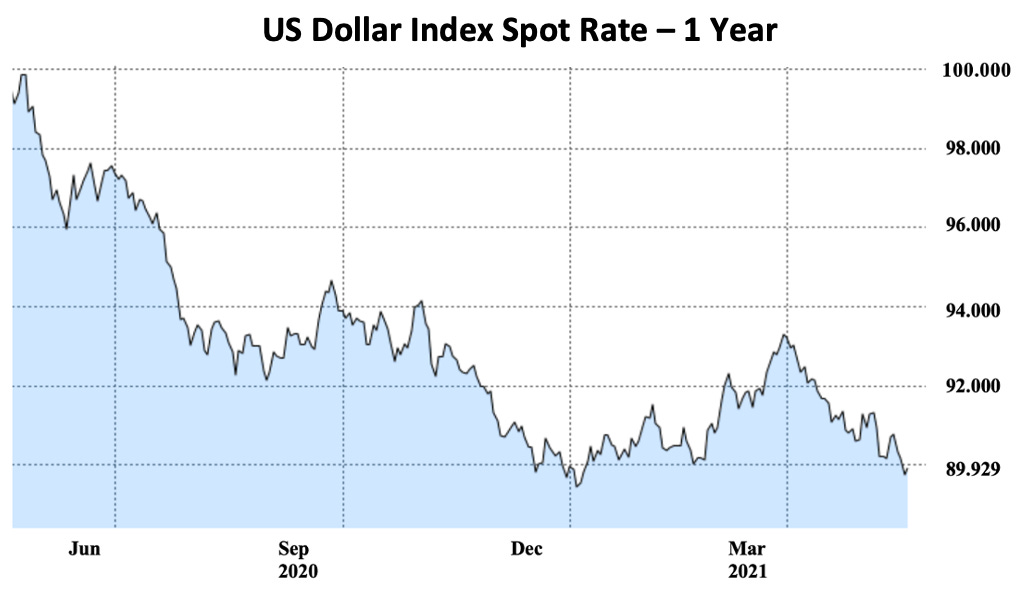

Just over a month ago we suggested that the USD could fall further. That has played out. But we think there is further to go. The chart here contextualises where we are now, with the US dollar back to the lows we saw as we came into the year…

Why do we care? It depends on what’s driving the price action of course. But a weaker dollar suggests a more accommodative Fed policy stance relative to the economies. Not always the case, but the chart below illustrates that over the past 13 years, the S&P500 and the US dollar index have held a negative correlation (-0.47) and sometimes this correlation is far deeper.

So, why do we think there is further to go?

Firstly, positioning. As you can see, the net futures exposure is little changed since we last wrote. That remains supportive for a weaker dollar. If positioning switched materially to short, there would be potential upside risks near-term.

Is the Fed stance shifting?

Following on from this, it is worth noting what happened yesterday. The US dollar initially ticked higher off the back of the Fed Minutes where some saw taper talk starting at upcoming meetings. The full text said:

‘A number of participants suggested that if the economy continued to make rapid progress toward the Committee’s foals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases’

We believe investors should look through these comments though. As a reminder, the Fed minutes yesterday covered the April meeting that came post the news that we saw 1million of job gains. Since then, the most recent NFPs significantly disappointed and recent data will prevent the Fed from signalling taper until Jackson hole at the earliest in August.

Where Are We Now?

The move in yields has been relatively muted over the last month. Inflation remains the big near-term worry for investors, however the Fed has continuously reiterated that it will maintain its ultra-accommodative stance as it sees the inflationary pressures are transitory. The data will drive volatility clearly, but we see limited room for the 10yr yield to move materially above 2%. That means, real rates will remain anchored. On top of this, there is plenty of US dollar liquidity set to flow into the market courtesy of the TGA over the next few months (see here for a detailed explanation of this). This will likely be positive risk assets and negative the US dollar.

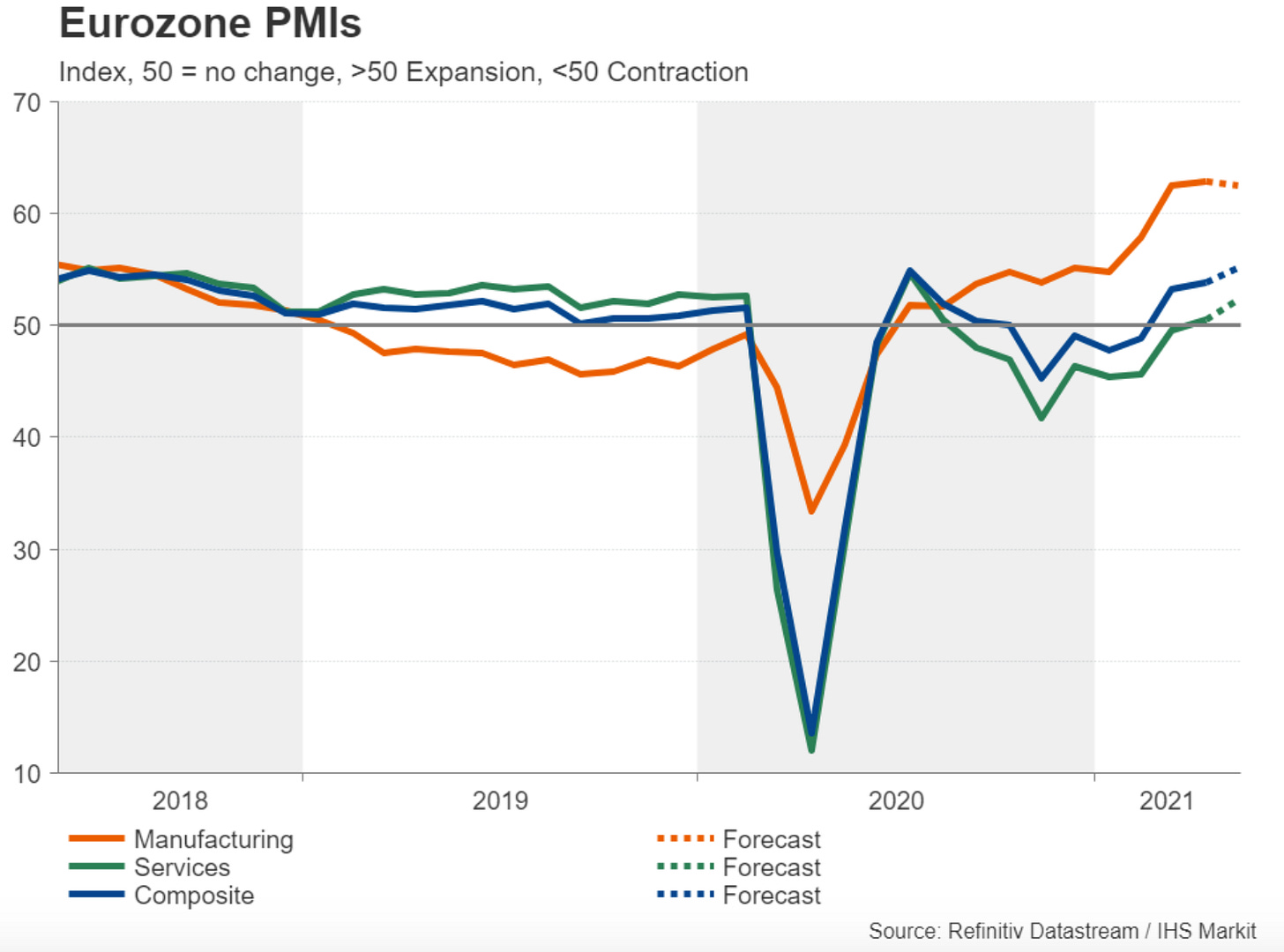

Europe is getting its act together

On top of the above, the European PMI prints tomorrow could also act as a bearish indicator for the US dollar. The services sector registered its first expansion in 8 months in April and should see further improvement (see forecast below). This should continue to drive the data momentum back towards Europe and countries outside of the US as they play catch-up. As a result, the fast turnaround in the Eurozone’s economic fortunes has re-energized euro bulls after a tough first quarter.

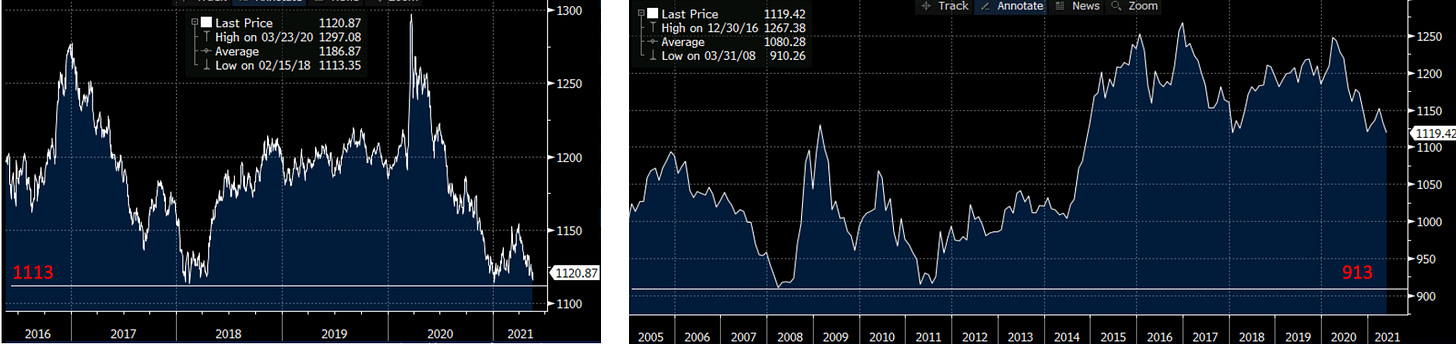

Nearing key support levels

Looking at this all from a technical standpoint, we track the BBDXY (Bloomberg Dollar Spot Index) and it is close to some very key support levels of 1113 (2021 lows) and 1112 (2018 lows). The next support level if we go through this is all the way down at 913 last seen back in 2011 and 2008… again a potentially bearish sign for the US dollar in the near-term.

Conclusion:

European data should continue to drive the data divide between the US and Europe. Add in the US dollar liquidity set to flow into the market, a more muted yield environment and a potentially bearish US dollar technical backdrop, should all lead to further weakness in our view.

What we’re reading

The Waymo spin-out

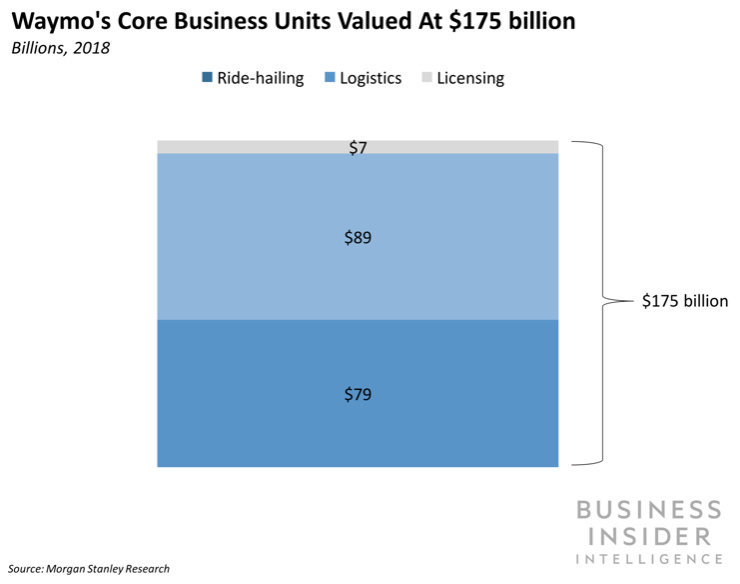

It’s been a tough few months for Waymo, Alphabet’s autonomous vehicle project. Since February, six executives have either left or jumped ship including CEO, John Krafcik. There’s been delays, bad press and the tech is still tough. A recent Youtube video by a Waymo passenger got a ton of attention after the vehicle got confused by roadside cones and then eventually drove away from the roadside assistance. Getting autonomous to work seamlessly is tough and skeptics have argued for a long time that it will prove incredibly expensive with returns still a long way away. Well, Waymo is looking at ways to get its hands on its next batch of cash. Last year, the group raised $2.25bn for the first time outside of Alphabet at a $30bn valuation. They now appear to be looking at a $4bn raise with a potential IPO not far down the road. Still, that $175bn valuation the geniuses at Morgan Stanley came up with a few years ago would seem some way off.

Your country needs you to take a job

Wage growth equals inflation. That has been the message from the Fed and we have highlighted the below chart on a few occasions. Of course, we can get temporary fluctuations in inflation driven by supply bottlenecks as we’re seeing in the latest data. But, long-term, wage growth underpins inflation expectations and history would suggest that’s not been an easy gig. Now, there is potentially a shift taking place. Amazon, Walmart and McDonald’s have all announced recent attempts to raise wages. Add-in the fact that several key sectors are struggling to recruit the right talent and you may well start to drive wage growth. Maybe… just maybe.

It’s also not just a US debate. In the UK, XpertHR’s latest survey suggests wage growth in April has started to pick up across the 1600 firms that it surveys. In the EU, economists are also pointing out that one of the biggest challenges to the EU Recovery Plan may well be finding the rights skilled workers. The pandemic has reversed a lot of the movement of labour over the past decade and it will take time to repair. There are a lot of theories on where wage inflation is going. But, be mindful that the hard data at the moment is still iffy.

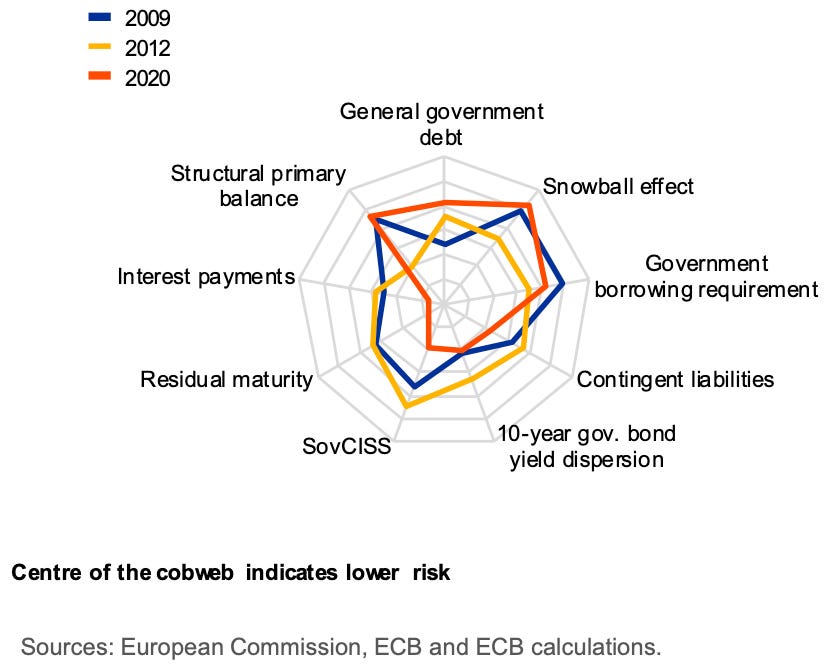

European Financial Stability report highlights credit risks

We dug into the Fed report a couple of weeks back and concluded that despite a few pockets of market concern, they were generally quite relaxed about financial stability and didn’t see any major risks. The EU published its latest report yesterday and the text is more cautious. Below is the key text that will leave some investors slightly jittery.

Policy measures helped corporate insolvencies to fall to historic lows during the pandemic . However, as this support is gradually removed, considerably higher insolvency rates than before the pandemic cannot be ruled out, especially in certain euro area countries. This in turn could weigh on sovereigns and banks which provided support to corporates during the pandemic.

Should we expect corporate insolvencies to rise? Yes. A number of industries have been effected by the pandemic, particularly retail, travel, leisure and real estate. What the world looks like post-pandemic is still unclear. And, the EU is right to alert financial institutions and investors to the potential risks. But, in our view, the key risks associated with bankruptcies are to banks and potential contagion in an illiquid market. As the EU points out itself, the banks remain very well capitalised.

Good chart below of where they see the biggest risks versus previous cycles. Inevitably, it will be government debt a la 2012.