Like what you’re reading? Then please give us a “like” on Substack. It helps promote our work. This is real analysis by real analysts. Enjoy!

In today’s KnowHow…

Where is the retail froth?

The Name’s Bezos, Jeff Bezos…

‘I love this one!’: how social media cliques fuel trading in penny stocks

China's Baidu posts 25% rise quarterly revenue on ad, cloud boost

What happened overnight…

US futures are all in the green today, with the Nasdaq leading the way, as investors optimism seem to outweigh concerns of a pick-up in virus cases in Asia. Over to Europe and it is a sea of green, recovering yesterday’s loses, with Price Momentum names driving the outperformance. The US dollar continues to whimper and has fallen to a four-month low, while the US 10-year was steady as we await the minutes from the Fed’s last meeting on Wednesday. On the single stock side, the Amazon/MGM news is the main headline (more below) and it is also worth noting Baidu’s beat in China, driven by ads and a cloud boost that will intensify debates around the US / Asian war on cloud (again more below).

Chart of the Day

We’re Facebook bulls… no hiding that. Yes there is a reg and Apple overhang that has potentially handicapped valuation, plus some further optionality in WhatsApp Money and Oculus. But we think the advertising runway is still substantial and offline advertising is accelerating to online post pandemic. Our friends at Sanford Bernstein have published some great analysis showing exactly that opportunity.

Analysis

Where is the retail froth?

We’re entering the summer lull. Earnings are largely out of the way and yesterday at least, there were signs that volume is also starting to drop off. Forget what happened in 2020, this is typically a period where liquidity is key and you get some extreme pockets of volatility. ‘Tis not the time to get trigger happy friends.

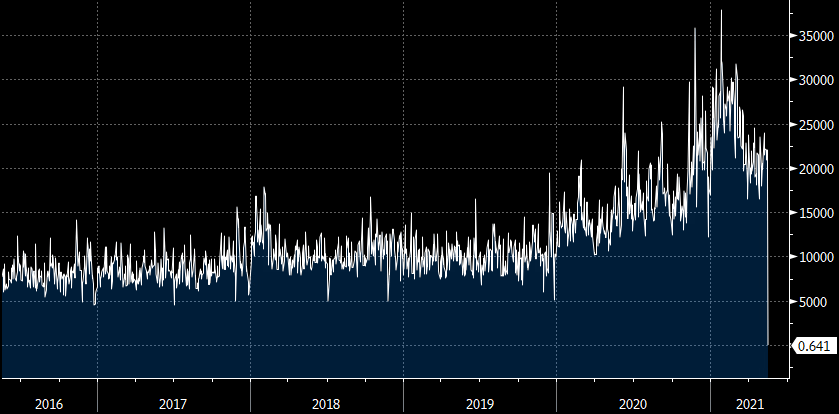

There is of course another dynamic at play here, different to pre-pandemic periods, and that is the retail investor. We discussed recently why it was important to measure retail investor activity (here). The Bank of International Settlements have also written on this recently, it’s worth a read, and the chart below is from their report. Retail flows are far more concentrated than the broader market and inevitably that adds to single-stock volatility.

The big question now is how sustainable this level of activity is. i.e. has the pandemic, government cash injections, time availability etc led to a structural shift in retail investor activity or will this unwind post-pandemic? We don’t have the answer and most likely, the truth lies in between the two.

There are a couple of things worth tracking:

App downloads for investing had a pop post the Gamestop saga but have eased back again

We also like to look at call option activity. That too is showing signs of slowing.

Of course, all this could just be tied to the summer lull and the real picture will only be revealed later in the year when we track the higher comps. But, what we’re very focused on at KnowHow is trying to understand the stocks that are most exposed to a potential summer or positioning unwind. We’ll publish our list of red flag stocks this evening.

What we’re reading

The Name’s Bezos, Jeff Bezos…

It is only Tuesday and it’s already been a very busy week in the world of Media. We spoke on Discovery and WarnerMedia yesterday, and their merger, as traditional media groups race to build more scale to compete with big technology companies in an entertainment business ruled by online streaming. The news overnight is that Amazon is in talks to acquire MGM, the film studio behind the James Bond franchise, for about $9bn, according to people familiar with the matter. The interesting angle for us is what other media names may await? Up until not, three big names: MGM, Sony Pictures Entertainment (S.P.E.) and Lionsgate, have all had suitors in recent years, yet all three have remained on the block...apparently, until now. These names have two things in common: (1) None have a robust streaming presence domestically. (2) All three own valuable film and TV libraries with thousands of Intellectual Property (I.P.) opportunities for adaptation, reimagining and exploitation.

‘I love this one!’: how social media cliques fuel trading in penny stocks

We all know what happened when Twitter and Reddit got hold of GameStop but the big read in the FT looks at the penny stock side of the market and the huge impact someone can have on penny stocks if they start pitching them to their followers. The example given in the article was a plug from the twitter account called Alexander Delarge for a little-known penny stock called MedX Holdings, a “brands and acquisitions” business looking at the emerging cannabis industry. The message appeared shortly before the end of the US trading day to his 61,000 followers and within minutes the price of MedX had soared 30 per cent. The trading volume went from 4m shares a day to 38m the day before the tweet and 47m the next day which has led many to ask who knew about the tweet before. After a bit of digging, the FT stumbled across screenshots of several small private discussion forums showing some traders tipping off others that Delarge’s “alert” message was coming, in the hours before it landed.

This is nothing new, MedX is just one of hundreds of so-called penny stocks which have seen their own frenzied, social media-driven speculation this year. The FT investigation found dozens more stocks that in recent months showed sudden surges in trading, followed by lulls, often encouraged by social media accounts with cultish followings, including Delarge’s and within the article the FT details a number of other tweets that Delarge has made with no proof to support his comments…

China's Baidu posts 25% rise quarterly revenue on ad, cloud boost

This was one of the key themes we heard from when the US reporting names posted their Q1 results, so it is interesting to see a very similar theme playing out over in Asia. China's Baidu Inc reported a 25% rise in quarterly revenue on Tuesday, powered by advertising on its core search and video-streaming platforms. The Beijing-based company's aggressive push into cloud services, artificial intelligence, autonomous driving and smart transport technology has helped grow its non-advertising revenue and offset competition to its core search platform from Alibaba and ByteDan. Baidu's streaming affiliate, iQIYI posted a 25% increase in advertising revenue and subscribers grew by 3.6 million in the quarter to a total of 105.3 million, helped by more original productions.

Outside these results, this report just published is a very good insight into how cloud is set to become the new frontlinebetween Asia and the West. While China is behind the US, it is taking share and ss of April 2021, Canalys reports that the worldwide cloud market grew 35% this quarter to $41.8 billion. AWS has 32% of the market, followed by Azure at 19%, Google at 7%, Alibaba Cloud close behind.