A shocker from Netflix | How many AirTags can Apple sell? | SPACs, vaccines, inflation and more

Your DailyKnowHow

In today’s KnowHow…

A shocker from Netflix… here’s what it means for the stock

How many Apple AirTags are we actually buying?

Kicking SPACs when their down…

The COVID jabs are coming out punching - the proof is in the pudding

Inflation!? Who said inflation!?

What happened overnight…

Never a dull moment and with the S&P logging its first back to back daily decline since late March and the biggest daily decline in a month we had many questions on whether this was the beginning of the end. As a reminder we said last week a pullback was likely as given our sentiment indicator suggested so and we think this may be it. Interesting to see that while Asia followed suit, Europe is holding up remarkably well with ASML once again highlighting why it is Europe’s best tech company. Over int he US and Netflix (more below) is weighing heavily on the Nasdaq pre-market while the USD rose for the second day in a row and yields in the last hour have bounced off their 5-week lows.

Chart of the Day

The chart below is from the Wall Street Journal. More than 50% of Chile’s adult population have now received their first dose of a vaccine, predominantly from China’s Sinovac. And yet, cases continue to rise. This will raise alarm bells in many of the countries that are issuing the Sinovac vaccine but is also hardly surprising given the concerns raised through the trials. This pandemic isn’t going away any time soon from a global perspective.

Analysis

That’s a shocker from Netflix

If for a second you had started to think that this was going to be a smooth earnings season, Netflix’s earnings last night should give cause for a serious reassessment. There will be a lot to navigate over the next few weeks with all the pandemic noise, valuations that have run hard and what will obviously be some pretty tough comps through H1 for the pandemic winners. But, even in that context, Netflix’s numbers versus what the shares are pricing in were pretty ugly. Earnings and revenues were better than the market had expected and the company has announced a $5bn buyback but the market cares about new subscribers and that’s where this has got messy.

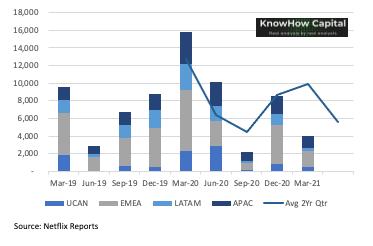

Have a look at our chart below. Netflix added 4m net new subscribers in Q1. Given the pull forward of subs in Q1’20 which the company highlighted itself, we prefer to look at this on a 2yr average basis. At a 10m 2-yr avg run rate, that’s still pretty impressive. In Q2, the company has guided to 1m net new subscribers. Again, if you look at the 2-yr avg run rate, that’s also fine given the company expects subscriber growth to pick up in H2.

Longer-term, we can debate what is the right addressable opportunity for Netflix. But, as per Reed Hastings’ comment on yesterday’s conference call, the company clearly thinks it’s subscriber runway is still very big.

“we're going to be super hungry to double from there going forward, too. So outside of China, I think pay television peaked about 800 million households. So lots of room -- and that was several years ago that it peaked, lots of room to grow”

So what’s the problem and why is this such a shocker for the shares? Netflix has two levers for revenue growth in our view:

US pricing - ARPU has grown around 25% over the past two years following the most recent price increases. The positive is that churn has also remained low which suggests there is still plenty of room to push US pricing further. But, this won’t happen this year and will be a gradual increase over time. Internationally however, whilst Europe has seen price increases, we think there is less room at least over the next couple of years. On a blended basis across the group, we think it is reasonable to assume 4-5% growth from pricing over the next 2-3yrs.

International subscribers - Netflix is now at almost 75m subscribers in the US. That is already a decent share of the near 130m US households. The international market is really the driver of growth from here. The opportunity is large but these markets are more competitive with local language players and the content is harder to scale in our view. If you look at the chart below, even on a 2yr avg basis, we think the market will cautiously assume 5% ish growth from subs over the next few years

Taking the two together, we expect investors to cautiously rebase their Netflix growth expectations over the next couple of years from the current 15-20% range in current estimates, close to the 10-15% revenue growth range.

Now, bringing this back to valuation and this is where the real problem arises. The stock is valued on a 20% growth rate, not 10-15%. We prefer to look at valuation using a longer-term DCF but as a sense check, we always come back to the EV/Gross Profit vs. growth CAGR framework below. Pre the results, Netflix was trading at 21x EV/Gross Profit 2021. As per the below chart, this implies a 20% growth CAGR, broader inline with current consensus expectations. A fall in expectations to our suggested range would imply a 15x EV/Gross Profit multiple, closer to where the FAAMG group currently trades.

How many Apple AirTags are we actually buying?

Apple’s launch of the AirTag created quite a bit of excitement yesterday. Will the KnowHow team be Tagging up as soon as possible? Naturally. But, what does it actually mean for the share price. Lets break this down…

How many people have iPhones? In total, there are around 1bn people with iPhones globally. We think it is fair to assume that each of these is potentially an AirTagger

How many Tags are we likely to buy? This is the real question. We’ve thought long and hard about this and surveyed the team. We’d like one for our keys and possibly a backpack. Do we really need it for anything else? We don’t think so. Apple clearly thinks people need more… but really?

How often are we replacing these? Well, it turns out they aren’t very easy to lose. It's kind of a one-off purchase.

How much does it cost? Apple will sell you one for $30 but you can have four for $99… boom!

Putting it all together, we think you can make a case for a $60bn to $100bn one-off opportunity for Apple’s AirTag. Given Apple’s $2tr market cap, that’s a 2-4% impact on the shares. Drop in the ocean really… right, time to look for another tag.

What we’re reading

Kicking SPACs when their down…

We touched on the potential worries for SPACs earlier in the week so we thoughts it was interesting to see that Paul Marshall, co-founder of Marshall Wace, is ringing alarm bells on the space too. In his newsletter to investors Marshall suggested that the life cycle of SPACs is riddled with ‘perverse incentives’ for investors, sponsors and companies using the shortcut route to come to market.

“The SPAC phenomenon will end badly and leave many casualties,” Marshall said, while disclosing that the firm has more than $1 billion of gross exposure to SPACs in its flagship $21 billion Eureka hedge fund. The warning follows a stampede to list SPACs -- more than 300 raised in excess of $100 billion this year alone -- that’s sparked scrutiny and regulatory overhang.

"We have increasing exposure on the short side as the SPACs go ex-deal and the low caliber of the deals, and even the potential for bezzle, becomes apparent," he told Bloomberg. "Bezzle" refers to the period in which an embezzler has stolen money without the victim realizing yet.

The party may have indeed peaked. The U.S. Securities and Exchange Commission last week set forth new guidance that warrants, which are issued to early investors in SPACs deals, might not be considered equity instruments and may instead be liabilities for accounting purposes. The regulator had also warned listing candidates that structuring as a SPAC isn’t a way to avoid disclosing key information to investors.

If you would like more details on our thoughts on the space then have a read here.

The jabs are coming out punching - the proof is in the pudding

A bit of good news for a Wednesday morning. While new cases hit a record last week, with 5.2m people around the world getting infected, according to data from Johns Hopkins University, the flurry of depressing headlines cannot disguise one thing: it is now clear that the vaccines are working.

An FT analysis of data from five countries — each facing very different scenarios — finds that rates of infections, hospitalisation and death have traced a lower path among the older, most vaccinated age groups than among the younger, who are least likely to have received the jab. Rather than just rehash what the article is saying, we have picked out 3 charts that really stood out for us:

1. UK Cases, hospital admissions and deaths as a percentage of winter peak, by age group has decreased

2. Cases, ICU occupancy and deaths are climbing fast among Chile’s younger population, but are stable or falling among the mostly vaccinated elderly

3. Countries are seeking to fully reopen while keeping cases in decline – target zones:

Inflation!? Who said inflation?

Inflation has been a big topic for us over the last few weeks (see thoughts here). We are worried about the impact that inflation may have on yields over the course of 2021 and while the market seems to understand that big inflation prints in the coming months are likely, sustained beats across DM countries is a worry for us.

With this in mind, we are interested to see that while inflation did pick up in March to 0.7% in March after dipping to just 0.4% in February, this was actually below the average forecast of 0.8% in a Reuters poll of economists, according to official figures published on Wednesday.

Fuel prices in March showed their biggest annual increase since January 2020. Clothing and footwear prices rose by 1.6% on the month after store closures caused by lockdown rules had caused discounting in February, the biggest increase since 2017 for the time of year. Clothing and footwear prices were still 3.9% lower than a year before, and food prices were 1.4% down.

It is also worth having a read of the below from EY ITEM Club’s Howard Archer. He predicts that prices will pick-up in the near term, but could then fade - and be flat year-on-year by early 2022:

“Following the Chancellor’s introduction of more supportive measures in the Budget, including the mortgage guarantee scheme and extension of the Stamp Duty threshold increase, the EY ITEM Club now expects the housing market to show vigour in the near term and a modest firming of prices. The market will also likely be helped by the extension of the furlough scheme to the end of September and the fact that unemployment is not likely to rise as much as expected at the outset of the pandemic. However, the EY ITEM Club is doubtful that this will be sustained for long as the strengthening of the housing market has been outsized relative to economic fundamentals.

The EY ITEM Club suspects house prices will be flat year-on-year by early 2022. Some quarters of falling prices likely at the end of 2021 and early on in 2022 as the Stamp Duty benefit ends, unemployment rises and there is a waning of pent-up demand. Housing market activity may also be affected from the latter months of 2021 by growing expectations that interest rates could start to rise before long.”