If you find our work valuable, please like, subscribe and share. We rely on that to grow our subscriber base. This is real analysis by real analysts. Enjoy!

In this week’s KnowHow:

Economic expectations being reset

Liquidity remains supportive for equities

Growth and value now balanced

Managing for Peak Data

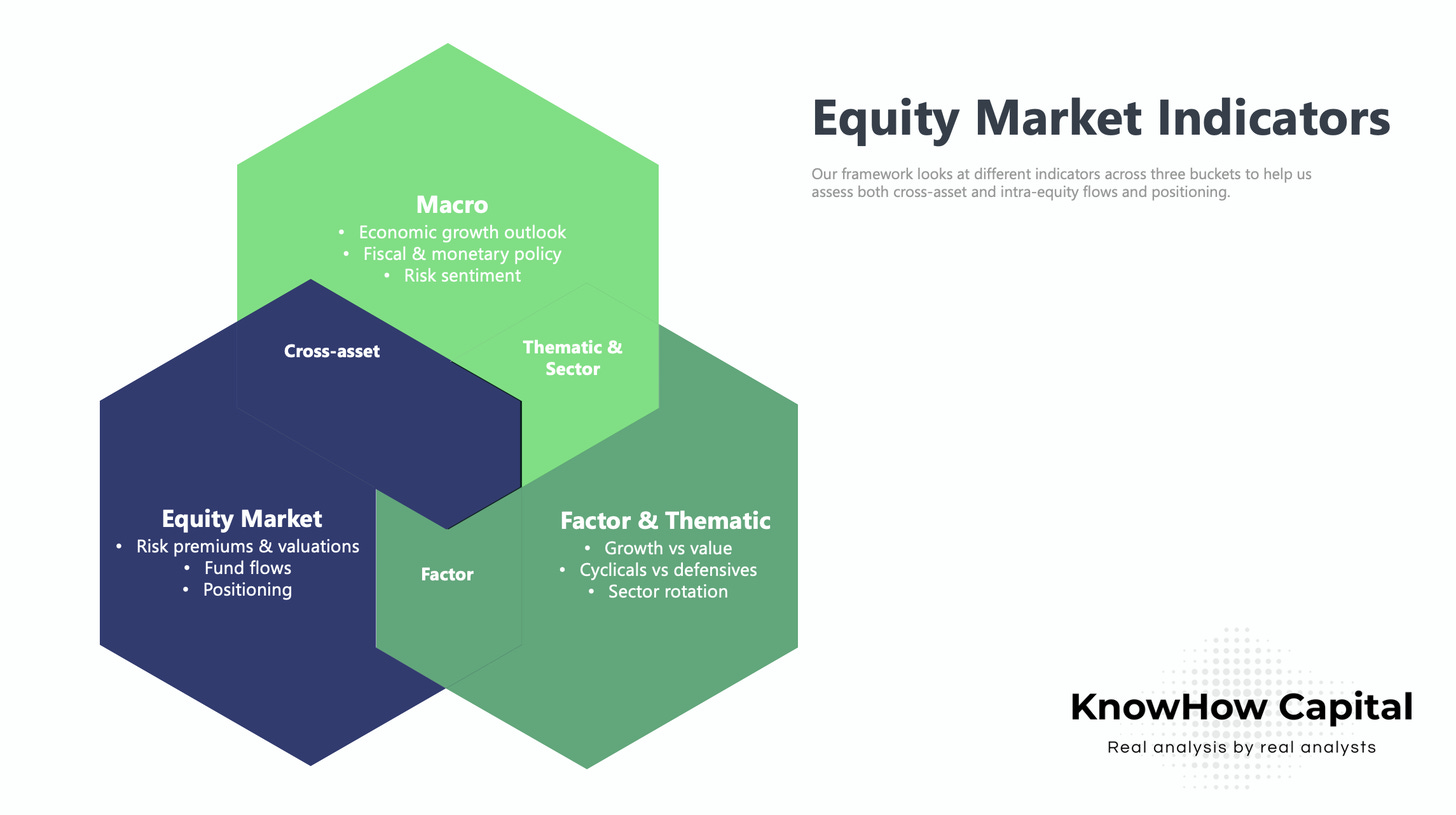

Markets have been choppy over the past week and as we head into earnings season, it is worth reflecting on and building an understanding of some of the tactical issues that are dictating the current price action. We’ve taken the opportunity to do a mid-month refresh of our Equity Market Indicators, to help condense it down to the key bits that we think investors should be focusing on. As a reminder, the framework we work off is below and focuses on assessing various datasets across three buckets of market indicators: Macro, Equity Market and Factors & Thematic.

The KnowHow Capital Portfolio is now live. Subscriber access only below.

Economic expectations being reset

Let’s start with the macro. Since peaking in late March, rates have been drifting lower. That drift has accelerated in the past couple of weeks.

Our view has been that a normalised 10yr should be somewhere around 2% but there are a couple of reasons why that is not the case: First, the pace of Treasury issuance, as Reuters have shown in this below chart, has been falling. At the same time, Fed purchases have remained at the $80bn/mth level along with strong demand from both US banks and international central banks. Demand for treasuries is exceeding supply but this will change as issuance picks up post government spending approvals and as a lower relative yield becomes less attractive for asset allocators.

Secondly, there has been a lot of macro data over the past two weeks. We would argue that the conclusion is basically this; whilst the surveys have been robust, ISM manufacturing and services etc, the hard data has been more underwhelming. Growth expectations are already high and as you will see in the below chart, the data is struggling to keep up. A lack of positive economic surprises in effect caps top-down earnings forecasts for stocks.

Until we see some clear line of sight on Fed tapering or the hard data improves materially, we are unlikely to see a shift in the current status quo.

What’s driving M&A and where are the upcoming opportunities? Subscriber access only below

Liquidity remains supportive for equities

What does all that then mean for equity markets? Well, if you start from a valuation standpoint, the only chart that matters is below… our calculation of the S&P Equity Market Risk Premium. Equities currently offer a return of around 3.5% above treasuries meaning they remain attractive. That dynamic continues to underpin valuation multiples.

In turn, that risk premium continues to drive inflows into equities as you will see from the below ICI chart. Whilst inflows are certainly not as strong as earlier in the year, they remain positive and we expect them to remain supportive until risk premiums reach pre-pandemic levels of sub 3%.

We have some mild concerns around positioning, particular from a retail perspective but again, there is nothing there that is too alarming for now.

Growth and value now balanced

For a few weeks now, we have been arguing for a growth rebound, note here. Our thesis has been that the growth into value rotation that has been driving markets since late Q3/Q4 had run too far. As economic data peaks, earnings momentum stalls particularly for cyclical and value stocks. That would in turn normalise the growth/value relationship. As you will see in the S&P Growth vs Value breadth chart below, that relationship has been normalising in the past few weeks and is now largely done.

Likewise, if you look at the 1yr relative performance of Growth vs Value, it too has mean reverted.

This was the pre-cursor to Phase 3, consolidation phase, of the market recovery that we have discussed in the past. Essentially, as we head into earnings season, positioning has now largely flattened and the market’s focus will shift to businesses that can upgrade earnings over the next couple of months.

Want to understand how to position your portfolio for Phase 3? Read our analysis below free.