If you find our work valuable, please like, subscribe and share. We rely on that to grow our subscriber base. This is real analysis by real analysts. Enjoy!

In today’s KnowHow…

Getting back to normal…

Who will activists turn on next?

ECB preview – what do the experts think?

Is the China tech crackdown ending?

What happened overnight…

All eyes are on the payrolls number today as we eagerly await any clues as to how much longer stimulus may be needed to support the American recovery. As a reminder, we previewed the payrolls earlier in the week and why this is so important given the April print. Plus, yesterday’s blowout ADP number, suggesting that almost 1mn new people were hired in May, sets us up for potentially a decent beat today also. Over in Asia and China’s markets weathered Uncle Joe’s order amending a ban on US investment in Chinese companies while in Europe markets are down small this morning having opened up. Outside equities and oil also swung from gains to losses but is still set for a second weekly advance while Elon once again moves the bitcoin price by posting his potential break-up.

Chart of the Day

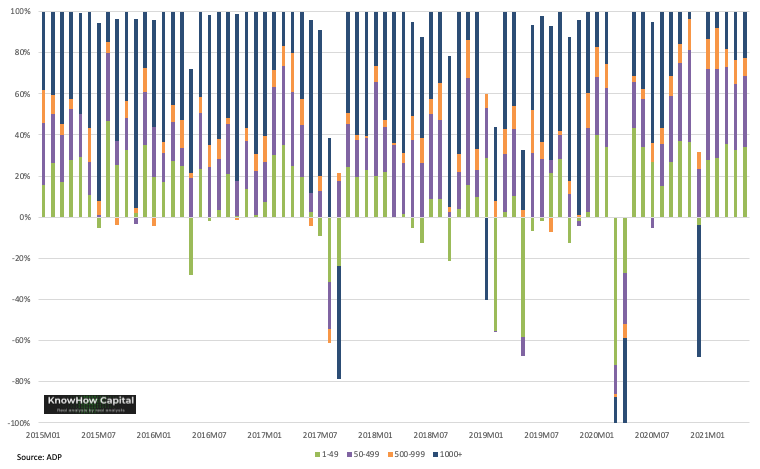

Ahead of the employment report today, and post yesterday’s ADP, we’ve been digging into the mix of jobs growth across small, medium and large businesses. That’s a pretty healthy trend for small businesses that should prove exciting in years to come.

Our Equity Market Indicators publication for May is now live (here). Subscribe to access it.

Analysis

Getting back to normal…

Morticia Addams once said that “normal is an illusion. What is normal for the spider is chaos for the fly”. That’s also true in investing. What is normal to you as an investor depends on your style, experience, time in the market.

If you are a born in 2020 Twitterati or Redditor, then 2021 has been a little tougher. However, the Van Eck Buzz index would suggest that perhaps some level of normality is returning to your investing life. At least in the past few weeks…

If you are a fundamental investor and have been looking on at the AMC share price this week, the very idea that anything is “normal” in this market is probably totally laughable to you.

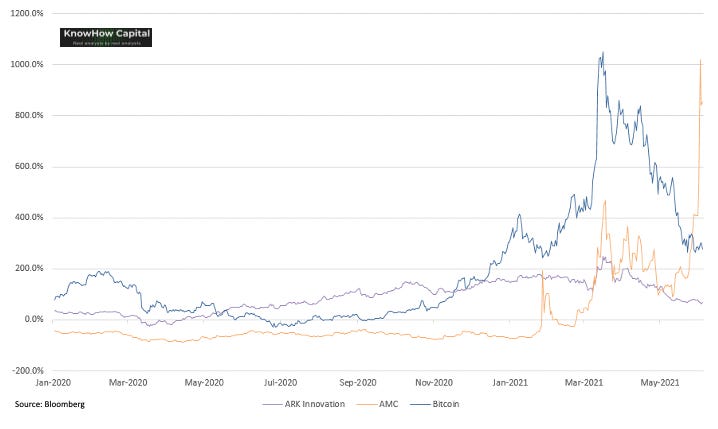

But, if you put aside what we have consistently referred to as the three bubbles in the above chart: hyper-growth, meme stocks and outside of equities, crypto, then actually, there is a little more normality returning under the bonnet.

We mentioned yesterday (here) that markets typically experience three phases in the first 12-18mths after a crisis. The final phase is consolidation when valuations have reached a new normal and earnings expectations have recovered. At that point, you should see performance of all the major factors start to converge. The above chart seems to suggest that is starting to play out.

What else interests us

Who will activists turn on next?

In Anjani Trivedi’s opinion piece last night, she suggests that post the Exxon activist success, hedge funds should turn their heads to the auto industry. Yes we all hear about how well some companies are doing fighting climate change but she points to two companies who seem to be hiding behind the flimsy veil of ambitious targets and big spending on electrification, with no disclosure or real strategy to cut carbon emissions. The two she points too are Ford and General Motors. According to its 2021 proxy statement, General Motors’ board recommended knocking down the one shareholder proposal that could have held its executives accountable for some climate change-related goals through compensation. For Ford, the cancellation of the plans to build an all-new electric vehicle with Rivian Automotive were cancelled and in its annual filing, Ford noted that regulations aimed at cutting emissions, increasing fuel efficiency “and other factors that accelerate the transition to electrified vehicles, may increase the cost of vehicles by more than the perceived benefit to consumers and dampen margins.” They don't seem all that incentivized to make a deep push, and haven't made capital allocation particularly efficient or transparent. No one knows where the climate transition will head in the longer-term but for investors, perhaps a more aggressive tactic is needed for some auto companies.

ECB preview – what do the experts think?

We touched on our thoughts into the ECB earlier on in the week and what this could mean for markets. With that in mind, it is interesting to see that a survey of economists expects the ECB to extend its phase of faster bond-buying through the summer to ensure the economic rebound after coronavirus lockdowns morphs into a sustained recovery. The majority expects the ECB to keep purchasing about 20 billion euros ($24.4 billion) worth of debt a week until September before slowing down. Most expect the 1.85 trillion-euro pandemic program to finish in March 2022, as currently planned. “The ECB can use the fact that we are heading into the quieter summer months to justify a slightly slower pace,” said Bas van Geffen, an economist at Rabobank. “That said, it may still be a bit of a hard sell to the market, requiring e.g. dovish rhetoric on medium-term inflation, even though the short-term economic outlook is improving.”

Is the China tech crackdown ending?

We have been long-term bulls of the tech majors in China for a while, but the tech crackdown has held us back over the last 6 months since the Ant IPO was pulled. For us, that was a step-change in how the Chinese government viewed some of the tech giants, specifically Alibaba. Since then, there has been almost weekly negative news flow in the space. As a result, even though valuations for the likes of Alibaba and Tencent are very attractive at the moment, we are still on the side lines waiting for the crackdown pressures to abate. With this in mind, it is very interesting to read that Hyomi Jie at Fidelity International, suggest that Beijing’s antitrust crackdown on homegrown tech giants may be coming to an end. Her China consumer equity funds oversee $7.3 billion in assets and one has beaten 96% of peers in the past year. We would caveat her views given she may benefit from the crackdown ending but she argues that while probes of billionaire Jack Ma’s Alibaba and Ant Group Co. took three to four months, a second batch of investigations into firms such as Tencent and Meituan may proceed more quickly, indicating that the regulatory cycle could be wrapping up as key players in the industry have agreed on what needs to be done.

On the valuation debate, Alibaba is trading at around 20 times its 12-month earnings estimates, compared with its five-year average of 25 times. Tencent’s multiple has fallen back to its average since 2016 of around 31 times. That compares with 35 times for the Hang Seng Tech Index.