PLEASE READ: We have had a lot of feedback from subscribers over the past week and have decided to switch the Daily KnowHow to a free weekly product from next week along with charts of the week. We love writing the DKH but it takes time. We want the depth of our analysis to standout and to be able to showcase our stock and strategy research to our rapidly growing list of paid subscribers.

In today’s KnowHow…

The growth comeback

Are we about to see a wave of European carveouts?

Is Biden's Trickle-Up Economics Bound to Fail?

The Future of Financial Analysis?

What happened overnight…

Markets have steadied ahead of the inflation print today with US futures and European stocks little changed. Over in Asia and most regions rose on Thursday as the US/China talks helped sentiment. Unless we get some sort of massive surprise to the inflation number today, the recent move in treasuries and the equities ‘de-grossing’ suggests that today may be a non-event with the ‘transitory’ argument put forth by central bankers set to be maintained. One other thematic that is interesting us is the recent outperformance of the most shorted stocks in the market which feels like it could be set to continue. Finally, the ECB meet today. We previewed this last week but for us it looks as though the ECB will align itself with the Fed in keeping stimulus flowing for the time being.

Chart of the Day

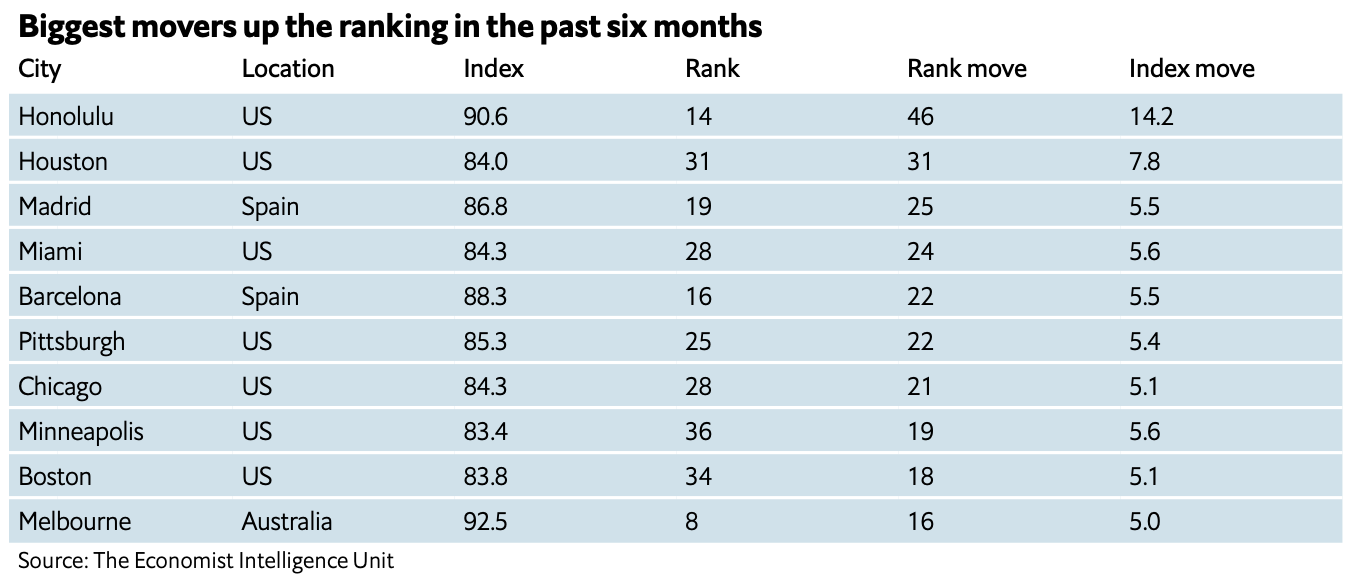

New Zealand and Australian cities often take the top spots in indices looking at the best places in the world to live. This year’s Economist Global Liveability Index is no different with Auckland, Osaka and Adelaide taking the top 3 spots. But, there is a trend below that which suggests US cities are climbing the rankings while European cities are dropping off. Below are the biggest climbers from the Economist’s latest publication.

Analysis

The growth comeback

A few weeks ago, we wrote that a big part of the Growth Reset (here) had now happened. Valuation spreads between growth and value had narrowed back to more reasonable levels and the inverse correlation of growth stocks to yield moves had started to ease. This chart below should give hyper-growth investors reason to breathe a sigh of relief. Cathie Wood’s ARKK fund has now outperformed the three major indices on a 1 month basis.

Of course, yields have also pulled back in that time. That inevitably has helped. Plus, some strategists would argue that this is nothing more than a dead-cat bounce ahead of the upcoming taper tantrum. Still, there are fundamental factors at play here that suggest to us that growth could be making a comeback as we head into the consolidation phase of this recovery.

In the below analysis, we have broken out US stocks into four quartiles of growth tiers. Our growth tiers are not just based on forward sales estimates but also include past growth, as well as capital and R&D investment.

Growth starting to outperform again

You will see from the below chart that Tier 1 growth, despite underperforming the S&P by almost 20% YTD, is now up on a 1mth basis. Tier 2 growth, which we still maintain offers fair better value for growth investors has performed even better.

But, it is more than just the price action that offers reason for optimism. The fundamentals are also starting to align.

Fundamentals now more supportive

Below, we have analysed our tiers based on consensus forecasts over the past 3 months and over the past 4 weeks. Cyclical stocks have clearly seen a strong rebound in sales and earnings estimates given the re-opening. However, in the past 4 weeks, there are some signs that perhaps that is starting to stall. We would expect that to be the case as the macro data peaks in Q2/Q3.

From a valuation perspective, we think there is a similar trend now at play as analysts start to bake in their higher growth assumptions for both cyclicals and growth stocks. The below chart, looking at the valuation premium on EV/Sales for each tier vs its 2yr average, would suggest that the most expensive parts of the market right now are actually lower growth/more cyclical stocks.

But remaining selective

Does all this mean it is now time to pile in to hypergrowth stocks? No, we don’t think so. If we breakout both Tiers 1 and 2 by stock on the analysis above, there is still a large spread of valuation ranges. Plus, we are mindful of what we expect to be a very volatile Q3 as tapering discussions pick-up. But, the above analysis makes us more cautious on cyclical stocks and suggests there are opportunities to add in growth where we see good value.

What else interests us

Are we about to see a wave of European carveouts?

What do you get when you put together a number of large, often inefficient conglomerates, and a sea of hungry sharks’ flush with investor cash looking pursuing deals at breakneck speed? Well, one of JPM’s top bankers advising private equity firms in Europe says the region is primed for one of its busiest-ever periods of corporate carveouts, as companies seek to bolster capital and cut non-core businesses while valuations remain high. Klaus Hessberger, co-head of strategic investors and financial sponsors in Europe, the Middle East and Africa believes we could see more than 40 sizeable carveouts in Europe over the next 12-18 months. This view was backed up by a report from EY last month where they stated that about 77% of European firms anticipate accelerating their divestment plans due to the impact of Covid-19. While the chart below is the US a similar story, if not higher, is expected in Europe. We are looking to do some analysis on the companies we think are most likely to see a benefit from carve-outs so if you would like to receive this let us know.

Is Biden's Trickle-Up Economics Bound to Fail?

Our Dear Joe is betting on trickle-up economic policies for the US after decades of trickle-down policies. Experts are sceptical with this new era in US economic policy making, as some judge this strategy to be short-sighted and might lead to more stagnation than a Reaganomics agenda in the long run. The proposition is to expand government spending to 25% of the GDP from 20% before the pandemic through a massive redistribution of wealth from higher income earners to middle and lower income-earning Americans. If you’re not familiar with that concept, think about Robin Hood. However, there are three reasons this can be dangerous: (1) It may be inflationary and unsustainable. (2) It may mean less money for investment. (3) It may result in a decrease in productivity. The article is well worth a read. In short, it is better to grow the pie than redistribute it, but let’s not get it twisted, trickle-down economics is also flawed and Reagan’s administration has helped lead the US to reach an all-time high level of wealth and income inequality in the US as well as a decrease in innovation and productivity even though standards of living have increased since the 1980s.

The Future of Financial Analysis?

When it comes to information such as Quarterly Reports and Annual Reports, one generally associates them with being long and hard to read. From our experience, it can take several hours for one or two people to just start to deeply analyse a company’s 10-K and it is almost impossible to analyse all of the information. With this in mind, start-ups and mature financial firms are turning to technology to gain the advantage. “Natural language processing” or NLPis an increasingly popular field of artificial intelligence that involves teaching machines how to read and understand the intricacies of human language. NLP allows tracts of previously recondite non-numeric “unstructured” data to be systematically harvested and analysed at dizzying speeds. This ranges from being able to pick up on certain key phrases within textual information to being able to organize and analyse certain data points within a text. It’s not just reports, this AI will likely be expanded to include TV interviews and management calls among many other forms of media. Just looking at the chart below, it shows just how rapidly companies are looking to expand its use by making this rewarding Al become commonplace in many settings. If you would like to read more about this then we’d recommend reading this paper published last month.