“Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair”

What is in today’s daily?

We have some thoughts on the NVIDIA news yesterday and why this may not be as bad for Intel as some of the market fears. We still like Intel here and would use the weakness yesterday to add. Secondly, we have some thoughts on what we are looking at to understand when the Fed will begin to taper with our sense that the Fed’s hand may be forced sooner than the market expects.

What did you miss overnight?

Bond yields continued to climb in the morning session as traders awaited the CPI print in the US (thoughts below). Asian markets gained on Tuesday driven by the Hang Seng and specifically Alibaba as it added to the gains it made on Monday. Banks and Autos drove the gains in Japan. Outside that, Australian business conditions rose to a record high last month. Over in Europe and markets have edged higher driven by travel and hospitality names. Bitcoin jumped to an all-time high before Coinbase goes public (we wrote on this on Friday) and Grab has announced that it is to list in a record $40bn SPAC deal. We wrote why this was another positive for Uber yesterday too.

What we’re reading…

Vladimir Putin tests US with more Russian troops on Ukraine border

This New Mercedes ‘Tesla Fighter’ Could Be Game Changing, Says Deutsche Bank

Ex-BOJ Member Sakurai Sees No Rate Cuts Without Fresh Crisis

Why the Nvidia news may not be as bad for Intel as many worry?

Yesterday Nvidia announced that it was attempting its own ARM Server CPU’s to complement its GPU offerings in a second move into the space the company has attempted post Project Denver, which was not successful. The company believe that, when tightly coupled with NVIDIA GPUs, a Grace CPU-based system will deliver 10x faster performance than today’s state-of-the-art NVIDIA DGX™-based systems, which run on x86 CPUs.

Why is this important for Intel?

NVIDIA’s new processor is its first data center CPU, challenging Intel in a market which it dominates with more than 90% market share. As a result, Intel traded off 4% amid worries from investors about competition in the space while NVIDIA shares were up 5%. The market is clearly excited about the prospects for NVIDIA as a three-chip company:

“Coupled with the GPU and DPU, Grace gives us the third foundational technology for computing, and the ability to re-architect the data center to advance AI. NVIDIA is now a three-chip company,” Nvidia CEO Jensen Huang said in a statement.

Why are we cautious on ‘Grace’?

We remain cautious on this move for a few reasons.

· Firstly, while management noted that this move will enhance both the breadth and depth of their products available to customers, the duly noted that it was hard to estimate what the revenue opportunity may be when the product launches in early 2023.

· Secondly, Grace is a very complicated addition to the NVIDIA portfolio in terms of competition. This comes at a time where there are already worries about the competitive nature of the ARM deal. Management did comment yesterday that conversations were ongoing with the regulator and they still expected the deal to close in 2022.

· Thirdly, we have seen this before from the likes of Microsoft and Qualcomm and while technology has moved on, the consumer take-up was muted with many customers sticking with Intel. We worry that there will be similar issues for NVIDIA especially as they have already tried this before.

· Finally, the actual readacross to Intel is muted as Arm-based processors still have limitations in processing power. Yes there will be some uses (e.g data centre) but these are still low single digit percentages of total server workloads.

Conclusion:

There have been worries about competition for Intel but for now, we see the sell-off yesterday as unwarranted. We will write some full analysis Intel in due course but in short we still like the name given: the new CEO’s strong recent hires, the strong Q1 is likely to continue, their move into the Foundry excites us and the recent executive order from president Biden to address vulnerabilities in the semiconductor supply chain is supportive for the name.

Is the Fed ready to taper?

If you hadn’t given the possibility of the Fed tapering over the coming months some thought, Fed St. Louis President, James Bullard’s comments overnight should get you thinking about it. Bullard is one of the more dovish Fed members but he outlined in his comments that the Fed could begin thinking about tapering i.e. reducing its asset purchases, by the time the US hits 75-80% vaccination rate. That probably gets you to some time in Q3.

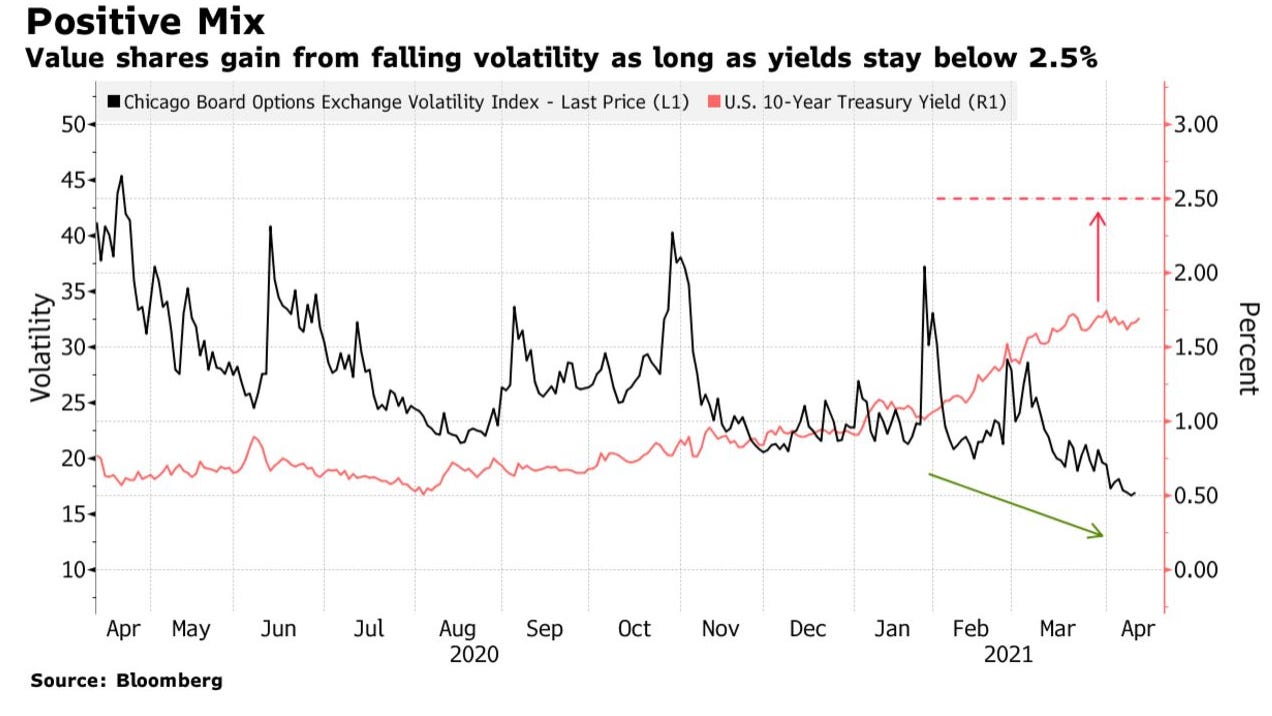

However, while we think tapering will be another volatility event in the market, it is important to note that the overall policy backdrop still remain supportive.

“It’s too early to talk about changing monetary policy. We want to stay with our very easy monetary policy while we are still in the pandemic tunnel. If we get to the end of the tunnel, it will be time to start assessing where we want to go next.”

There are a few things we are focussing on to assess the broader backdrop for equities

(1) Inflation: We have spoken about inflation a few times over the last few weeks and why it is so important (thoughts here). Today, we have the US CPI print for March where analyst expectations suggest we should see a step-up in inflation to 2.5%. Our worries are that this print and the next few prints have the potential to beat expectations and must therefore be taken into account when building your portfolios.

To borrow our comments from last week, this matters for two reasons: i) inflation expectations will impact the Fed’s path for rates but also more technically, discount rates and therefore valuations. Hence, all the recent excitement around the US 10yr yields, ii) it will start to hit company profitability particularly if businesses can’t pass through cost pressures.

(2) Treasury Yields: closely linked to the above, any substantial surprises in inflation will likely push yields higher closer to 2% in the 10yr that many in the market are focusing on. While the Fed continues to push back that the inflation prints over the next few months will be distorted, we worry that the subsequent impact on yields will be hard to continue to ignore. Inevitably, inflation will remain a key trigger for volatility through the year. As you can see below, the US- 10 year breakeven rate (difference between 10-year Treasury Bond and Treasury Inflation-Protected Securities) has now hit 2012 highs.

(3) Growth and Hiring: We will focus on this point more at a later date but it is worth mentioning now in the context of Powell’s speech over the weekend. While it was a bit of a non-event, again we saw comments about what to look for going forward given the US is at an ‘inflection point’ with stronger growth and hiring ahead thanks to rising vaccinations and powerful policy support.